Bank of America Corp Sees Notable Reduction in Daily Journal Corp's Portfolio

Charlie Munger's Investment Moves in Q1 2024 Highlighted by Banking Sector Adjustments

Charlie Munger, the esteemed Vice Chairman of Berkshire Hathaway and Chairman of Wesco Financial, is renowned for his investment acumen and influence on Warren Buffett (Trades, Portfolio)'s approach to value investing. Munger's investment vehicle, Daily Journal Corp (Trades, Portfolio), has disclosed its 13F filing for the first quarter of 2024, offering a glimpse into the strategic decisions made during this period. Munger's investment philosophy, often described as seeking high-quality businesses for the long term, is reflected in the latest portfolio adjustments, particularly within the banking sector.

Key Position Reduces

Daily Journal Corp (Trades, Portfolio) has made notable reductions in its holdings, with Bank of America Corp (NYSE:BAC) and Wells Fargo & Co (NYSE:WFC) experiencing significant cuts:

Reduced Bank of America Corp (NYSE:BAC) by 300,000 shares, resulting in a -13.04% decrease in shares and a -5.46% impact on the portfolio. The stock traded at an average price of $34.33 during the quarter and has returned 10.00% over the past 3 months and 10.42% year-to-date.

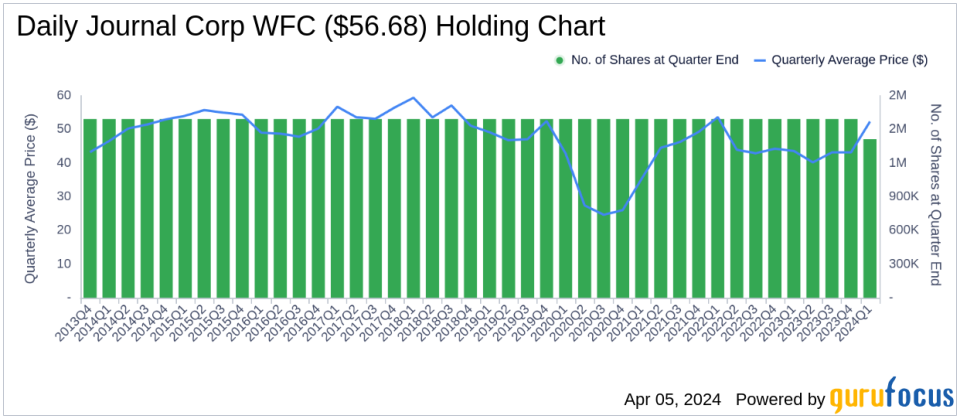

Reduced Wells Fargo & Co (NYSE:WFC) by 178,800 shares, resulting in a -11.23% reduction in shares and a -4.75% impact on the portfolio. The stock traded at an average price of $52.32 during the quarter and has returned 15.88% over the past 3 months and 16.02% year-to-date.

Portfolio Overview

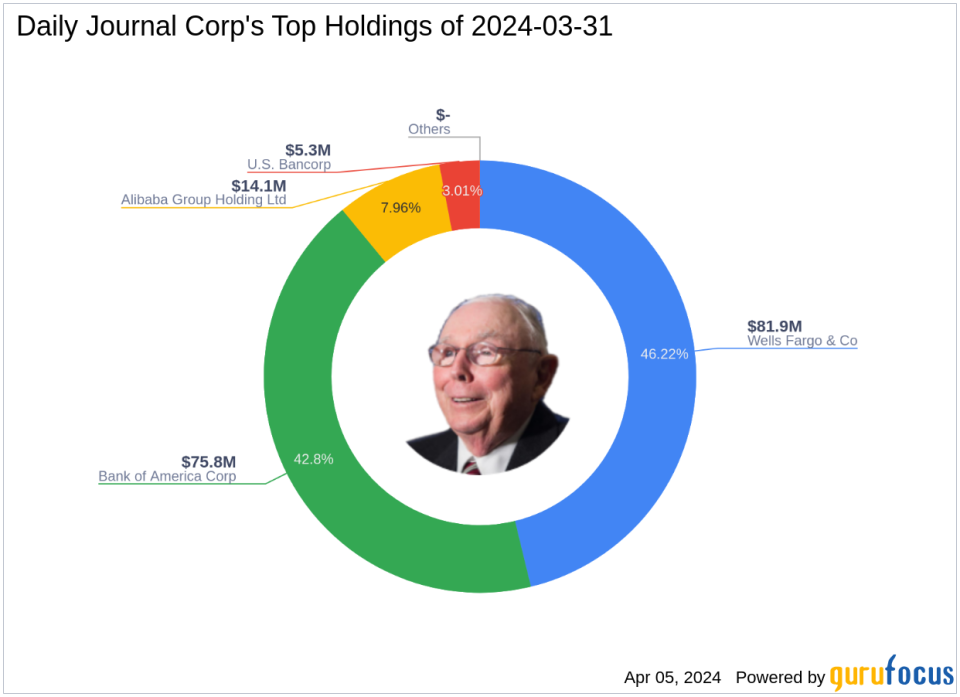

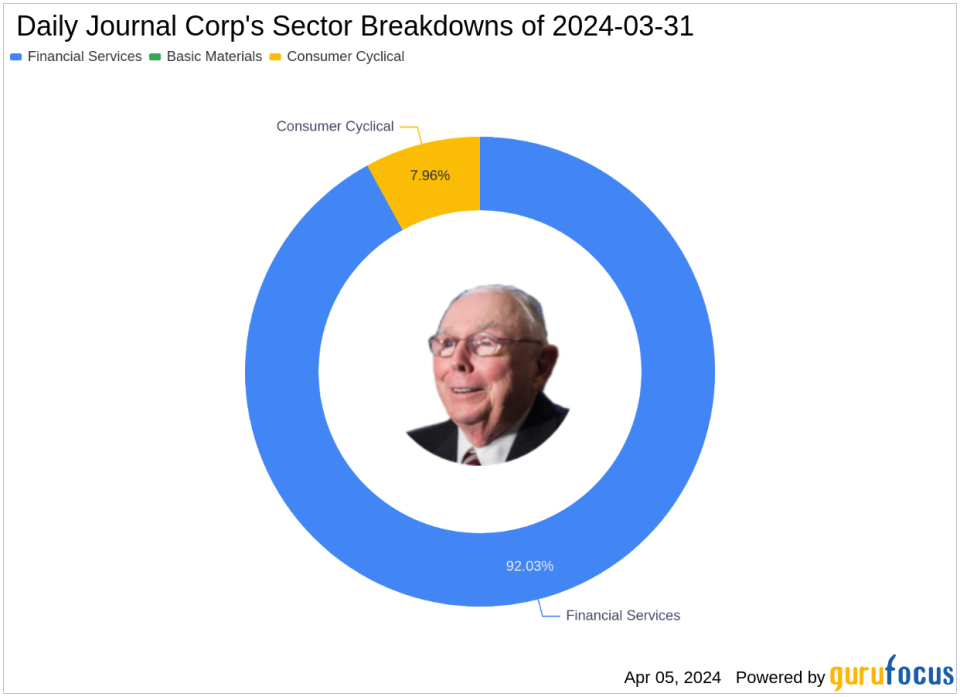

As of the first quarter of 2024, Daily Journal Corp (Trades, Portfolio)'s portfolio is composed of 4 stocks, with a significant concentration in the Financial Services and Consumer Cyclical sectors. The top holdings include 46.22% in Wells Fargo & Co (NYSE:WFC), 42.8% in Bank of America Corp (NYSE:BAC), 7.96% in Alibaba Group Holding Ltd (NYSE:BABA), and 3.01% in U.S. Bancorp (NYSE:USB). This strategic allocation underscores Munger's confidence in the financial industry, despite the recent trimming of positions in key banking stocks.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance