Bank of America (BAC) Loses 30% in 1H: Is It Worth a Look?

After a poor end to the first half of the year in more than five decades, investors are wary about entering the markets as all three major indexes recorded second consecutive quarterly declines. 2022 commenced with a rise in COVID-19 cases due to the Omicron variant. Thereafter, the ongoing Russia-Ukraine conflict, 40-year high inflation and aggressive monetary policy stance by the central banks globally have stoked the fears of recession within the next six-nine months.

These factors led to declines in all the 11 major S&P 500 sectors except for energy. The Financial Services sector, which fell 18.8%, is among the five worst-performing sectors. Amid such a dismal scenario, investors must look out for stocks that are fundamentally well placed and will continue to thrive once the current headwinds cool off. Today we will be discussing one of the largest banks in the United States — Bank of America BAC.

The stock has lost 30% in the first half of 2022, which is more than the S&P 500’s decline of 20.3% and other major banks like JPMorgan’s JPM 28.9% and Citigroup’s C 23.8%. In fact, this Zacks Rank #3 (Hold) stock touched a 52-week low of $30.64 in the last day’s trading. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Bank of America is well-poised to benefit immensely from higher interest rates. The company’s balance sheet is highly asset sensitive and rising rates will support top-line growth. In fact, management has provided a very optimistic outlook for net interest income (NII) this year.

Provided that loans grow modestly and rates in the forward curve materialize, management projects NII in the second quarter of 2022 to increase by more than $650 million over the prior-quarter level. Subsequently, NII is likely to improve significantly on a sequential basis in each of the remaining two quarters of the year.

For 2022, the company anticipates operating expenses to approximate that of the 2021 level. This is quite contrary to what JPMorgan and Citigroup managements have projected for expenses this year. JPM expects a nearly 8% rise in operating expenses, while C anticipates a 5-6% increase.

Now, let’s discuss other factors which show that Bank of America stock is worth keeping an eye on despite the recent sell-off.

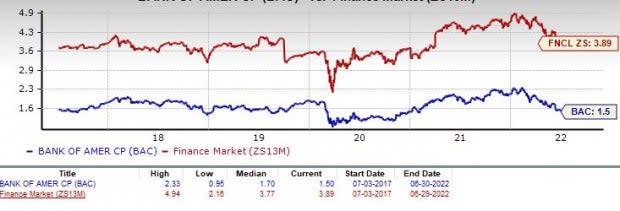

Attractive Valuation: At $31.13 per share, Bank of America is currently trading at a price/tangible book value of 1.50X, way below the Zacks Finance sector average of 3.89X. Thus, the company’s beaten-down stock price and attractive valuation might be a good entry point for investors.

Price-to-Tangible Book Ratio (TTM)

Image Source: Zacks Investment Research

Robust Fundamental Growth Drivers: Bank of America continues to align its banking center network according to customer needs. These initiatives, along with the success of Zelle and Erica, have enabled it to improve digital offerings and cross-sell several products, including mortgages, auto loans and credit cards. The acquisition of Axia Technologies strengthened its healthcare payments business.

BAC remains focused on acquiring the industry's best deposit franchise and strengthening the loan portfolio. Despite a challenging operating environment, deposits and loan balances have remained solid over the past several years. Though loan demand had remained subdued since the pandemic, the same is witnessing a decent increase of late. As of Mar 31, 2022, total loans and leases grew 10% year over year to $993.1 billion.

Prudent cost management continues to support the bank’s financials. Its expense-saving plan — Project New BAC (launched in 2011) — helped improve the overall efficiency. Over the last several quarters, Bank of America has incurred on an average $14 billion in expenses, despite undertaking strategic growth initiatives. This indicates the company’s continued expense discipline, operational excellence improvements and digital transformation benefits.

Improved Capital Deployments: Following the clearance of the 2022 stress test, BAC intends to hike the quarterly dividend by 5% to 22 cents per share, beginning in the third quarter of 2022. Prior to this, the company had announced a 17% hike to its quarterly dividend in July 2021.

In October 2021, the company's share repurchase plan of $25 billion was renewed. As of Mar 31, 2022, $16.9 billion buyback authorization remained. Last year, Bank of America returned $31.7 billion to shareholders in the form of buybacks and dividend payouts. Given the strong balance sheet and earnings strength, the company will be able to sustain enhanced capital deployment plans.

Favorable Estimate Revision & Surprise History: Analysts seem bullish on the stock. Over the past two months, the Zacks Consensus Estimate for earnings has moved marginally north for 2022. Its projected long-term earnings per share growth rate is 7%.

Bank of America has an impressive earnings surprise history. The company outpaced estimates in each of the trailing four quarters, the average earnings surprise being 16.66%.

Parting Views

Considering Bank of America’s growth prospects, upbeat 2022 outlook and robust fundamentals, investors must watch out for the stock for long-term gains. The company’s efforts to improve revenues, strong balance sheet and liquidity positions and expansion into new markets will keep on supporting its financials.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of America Corporation (BAC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance