Bandwidth (BAND) Q3 Earnings Beat on Healthy Top-Line Growth

Bandwidth Inc. BAND reported modest third-quarter 2021 results, wherein both the bottom line and the top line surpassed their respective Zacks Consensus Estimate. New customer additions, robust cross-selling momentum, differentiated global platform, and reinforced customer relationships favored the Raleigh, NC-based company’s quarterly performance.

Bottom Line

On a GAAP basis, net loss in the September quarter was $6.9 million or a loss of 28 cents per share compared with a net loss of $2.3 million or a loss of 10 cents per share in the prior-year quarter. The wider GAAP loss despite top-line growth was primarily attributable to higher operating expenses.

Non-GAAP net income remained relatively flat at $6.5 million or 25 cents per share. The bottom line beat the Zacks Consensus Estimate of 9 cents.

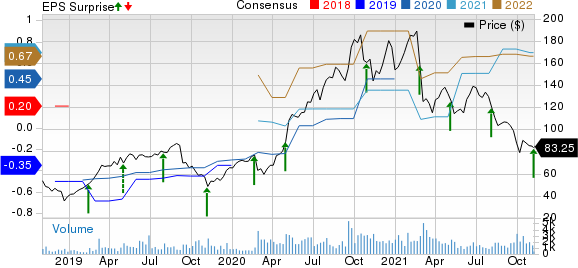

Bandwidth Inc. Price, Consensus and EPS Surprise

Bandwidth Inc. price-consensus-eps-surprise-chart | Bandwidth Inc. Quote

Revenues

Quarterly total revenues were $130.6 million, up 54% year over year and well above the expectations of $123.6-$124.6 million. This includes Communications Platform-as-a-Service (CPaaS) revenues of $107.4 million (up 45.5% year over year), surpassing expectations of $106.1-$107.1 million. The higher revenues were primarily attributable to healthy demand trends driven by a customized networking infrastructure. The growth was further bolstered by an augmented global footprint and broad-based demand across all services. The top line surpassed the consensus estimate of $126 million.

However, revenues were hurt by the DDoS attack due to lost transaction volume and impact on network services. This malicious attempt to disrupt normal traffic is likely to reduce CPaaS revenues for 2021 by $9-$12 million. Despite the setbacks, the company has been able to restore normalcy and mitigate risks for customers for top-line growth as exemplified by its ability to exceed third-quarter revenue guidance.

The higher CPaaS revenues, which accounted for 82.2% of total revenues, were primarily driven by sustained broad-based growth as enterprise customers are increasingly migrating toward Bandwidth’s global platform to fulfill their communication requirements. Bandwidth had 3,173 active CPaaS customers as of Sep 30, 2021, up 57.5% year over year. This includes the contribution from Voxbone. The dollar-based net retention rate was 108% compared with 131% in the prior-year quarter. Adjusted CPaaS gross profit jumped to $57.7 million from $36.7 million with respective margins of 54% and 50%, owing to high margin international business.

Other Details

Total operating expenses were $57.3 million compared with $37.4 million in the prior-year quarter. Operating income came in at $0.9 million compared with $1.9 million in the year-ago quarter.

Adjusted gross profit in the quarter improved to $63.4 million from $41.6 million with margins of 49% each. Adjusted EBITDA totaled $14.2 million compared with $9.3 million in the year-ago quarter.

Cash Flow & Liquidity

In the first nine months of 2021, Bandwidth generated $23.7 million of net cash from operating activities compared with $11.3 million in the year-ago period. As of Sep 30, 2021, this enterprise software developer had $321.8 million in cash and cash equivalents with $109.1 million of total current liabilities.

Q4 & 2021 Guidance

Bandwidth has provided guidance for the fourth quarter and updated the same for 2021. For the ongoing quarter, total revenues are expected in the range of $115.7-$120.7 million. CPaaS revenues are estimated in the band of $94.5-$99.5 million. Adjusted loss is anticipated to be 11-15 cents per share.

For 2021, total revenues are anticipated in the range of $480.5-$485.5 million, down from $484.8-$486.8 million expected earlier. CPaaS revenues are projected in the band of $407-$412 million compared with prior expectations of $418.4-$420.4 million. Adjusted earnings are estimated in the range of 74-78 cents per share, up from the previous range of 71-75 cents.

Zacks Rank & Stocks to Consider

Bandwidth currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader industry are Clearfield, Inc. CLFD, sporting a Zacks Rank #1 (Strong Buy), and Arista Networks, Inc. ANET and SeaChange International, Inc. SEAC, both carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Clearfield delivered an earnings surprise of 49%, on average, in the trailing four quarters.

Arista has a long-term earnings growth expectation of 16.7%. It delivered an earnings surprise of 6%, on average, in the trailing four quarters.

SeaChange has a long-term earnings growth expectation of 10%. It delivered an earnings surprise of 28.9%, on average, in the trailing four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SeaChange International, Inc. (SEAC) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Clearfield, Inc. (CLFD) : Free Stock Analysis Report

Bandwidth Inc. (BAND) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance