Baker Hughes (BKR) Gets Order to Supply MRCs for NFS Project

Baker Hughes Company BKR has been ordered to supply two main refrigerant compressors (“MRCs”) for the North Field South (“NFS”) project from QatarEnergy.

The MRCs are part of two liquefied natural gas (“LNG”) mega trains, with 16 million tons per annum (“Mtpa”) of additional capacity. The order will be booked in the first quarter of 2023.

In 2020, Baker Hughes was awarded a contract for North Field East expansion project. The latest order will bring the overall LNG mega trains, driven by Baker Hughes’ energy solutions, to 12.

Each MRC train will comprise three Frame 9E DLN Ultra Low NOx gas turbines and six centrifugal compressors across two LNG mega trains for a total scope of supply of six gas turbines to drive 12 centrifugal compressors.

Baker Hughes will conduct the packaging, manufacturing and testing of the gas turbine/compressor trains at its Gas Technology facilities in Italy. The company will leverage its service site in Ras Laffan, Qatar, for maintenance and technical assistance services.

The NFS project is the planned second phase expansion of Qatar’s North Field, which is the largest single non-associated gas field globally. Once fully completed, the second expansion phase will increase Qatar’s LNG production capacity from 110 Mtpa to 126 Mtpa by 2027.

Raising awareness regarding the adverse effects of carbon emissions led to the increasing use of clean energy sources. Due to its clean burning nature, natural gas is a popular choice of clean fuel to generate electricity. As it is difficult to transport large volumes of natural gas, LNG use is a perfect solution.

As an LNG technology leader, Baker Hughes commits to supporting the sector to capture, transfer and transform gas in a way that meets rising energy demand and reduces emissions. The project will help position Qatar as a leading supplier of LNG and help unlock more global capacity.

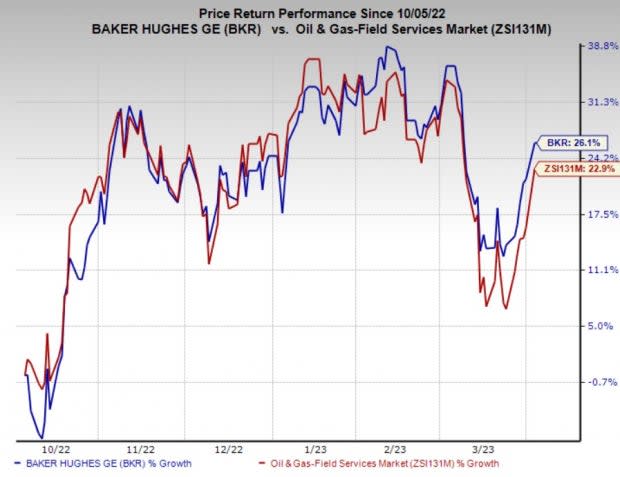

Price Performance

Shares of BKR have outperformed the industry in the past six months. The stock has gained 26.1% compared to the industry’s 22.9% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Baker Hughes currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cactus, Inc. WHD reported fourth-quarter adjusted earnings of 57 cents per share, beating the Zacks Consensus Estimate of 51 cents. Strong quarterly earnings were primarily driven by increased drilling activity by customers, offset partially by higher total expenses.

At the fourth-quarter end, Cactus had cash and cash equivalents of $344.5 million, which can provide it with immense financial flexibility. Cactus had no bank debt outstanding as of Dec 31, 2022.

Liberty Energy Inc.’s LBRT fourth-quarter 2022 earnings per share of 82 cents handily beat the Zacks Consensus Estimate of 71 cents. The outperformance reflects the impacts of strong execution and increased service pricing.

As part of its shareholder return policy, LBRT repurchased $125 million of its stock at an average price of $15.29 a piece since July and reinstated a quarterly cash dividend of 5 cents per share in the fourth quarter.

Marathon Petroleum Corporation’s MPC adjusted earnings per share of $6.65 comfortably beat the Zacks Consensus Estimate of $5.54. The bottom line was favorably impacted by the stronger-than-expected performance of its key Refining & Marketing segment.

In the fourth quarter, MPC repurchased $1.8 billion of shares and another $700 million worth of shares from the start of this year till Jan 27. Marathon Petroleum, which gave an additional $5 billion share repurchase approval, currently has a remaining authorization of $7.6 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

Baker Hughes Company (BKR) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report

Cactus, Inc. (WHD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance