Baker Hughes (BKR) to Develop DAC Technology With HIF Global

Baker Hughes Company BKR signed an agreement with synthetic fuel maker HIF Global to develop technology for direct air capture (“DAC”) of carbon dioxide (CO2).

In April 2022, Baker Hughes had acquired the Mosaic DAC technology to upgrade its carbon capture, utilization and storage (“CCUS”) portfolio. The companies plan to examine Baker Hughes’ Mosaic Materials technology to enhance DAC deployment at a commercial scale.

Energy companies are actively investing in DAC technology to address global warming. The DAC technology uses metal-organic framework materials, which can be used to separate CO2 from the atmosphere.

HIF Global has two sites where it expects to deploy the DAC technology. One of the facilities is located in Chile, while the other is in Texas. The facility in Chile produces green hydrogen from wind power and water. It then combines the hydrogen with recycled CO2 to develop eFuels.

EFuels, also known as synthetic fuel, are produced by combining CO2 obtained from the atmosphere with hydrogen. The fuel can be used in existing vehicles without any modifications. HIF Global expects feasible deployment of Baker Hughes’ technology at the sites.

The agreement enhances HIF Global’s plan to capture 25 million tons of CO2 per year. The company will use the captured CO2 to combine it with green hydrogen to produce 150,000 barrels per day of eFuels. This will help decarbonize more than 5 million vehicles in service today.

Oil and gas companies are getting actively involved in CCUS projects as it offers a transition pathway for the rapid and effective reduction of CO2 emissions beyond what can be achieved by alternative methods like electrification and renewable fuels. Thus, the use of carbon capture and storage in reducing industrial emissions offers an excellent opportunity.

Baker Hughes has more than 20 years of experience in CCUS technologies. The company’s portfolio involves pre-FEED and FEED consultation, project design, capture and purification, fit-for-purpose CO2 compression technology, well design and construction for storage, carbon transportation and injection, and monitoring and site stewardship. BKR aims to achieve net-zero carbon emissions by 2050.

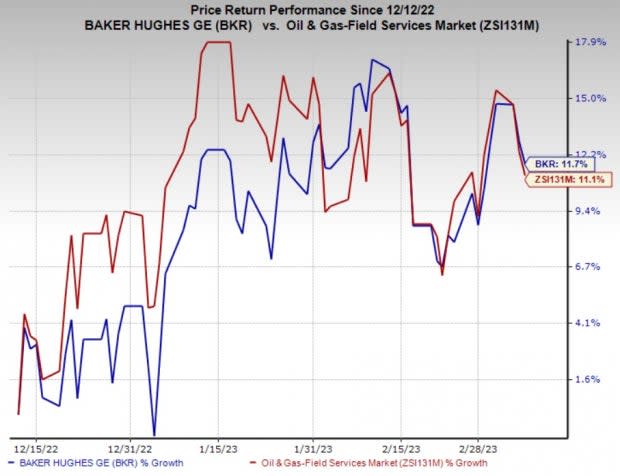

Price Performance

Shares of BKR have outperformed the industry in the past three months. The stock has gained 11.7% compared to the industry’s 11.1% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Baker Hughes currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Antero Midstream Corporation AM reported fourth-quarter 2022 adjusted earnings per share of 20 cents, beating the Zacks Consensus Estimate of 17 cents. The strong quarterly results were primarily driven by higher freshwater delivery volumes and increased average freshwater distribution fees.

For 2023, Antero Midstream expects a net income of $340-$380 million, indicating an increase from the $326.2 million reported in 2022.

PBF Energy Inc.’s PBF fourth-quarter 2022 earnings of $4.41 per share missed the Zacks Consensus Estimate of earnings of $4.95. Quarterly earnings were primarily driven by lower contributions from the Logistics segment, and higher costs and expenses.

For 2023, PBF Energy’s total refining system throughput is expected to be 935,000-995,000 barrels per day. For the first quarter, the company anticipates throughput volumes of 845,000-905,000 barrels per day.

Murphy USA Inc.’s MUSA fourth-quarter 2022 earnings per share of $5.21 missed the Zacks Consensus Estimate of $6.16. The underperformance can be attributed to lower-than-expected petroleum product sales.

Murphy USA projects a 2023 fuel volume of 240-245 thousand gallons on an APSM basis. Further, Murphy USA’s 2023 guidance includes up to 45 new stores, up to 30 raze-and-rebuilds, and $795-$815 million in merchandise margin contribution.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Antero Midstream Corporation (AM) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

PBF Energy Inc. (PBF) : Free Stock Analysis Report

Baker Hughes Company (BKR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance