How Badly Will Coronavirus Impact Murphy USA (MUSA) Q2 Earnings?

Murphy USA Inc. MUSA is scheduled to release second-quarter 2020 results on Tuesday Jul 21, before the opening bell.

The Zacks Consensus Estimate for the to-be-reported quarter’s earnings is $4.31 per share and for revenues is $2.57 billion.

Against this backdrop, let’s delve into the factors that might have impacted the company’s performance in the June quarter.

Factors at Play

Murphy USA boasts a unique high-volume low-cost business model, which helps it retain high profitability even in the fiercely competitive retail environment. The company, which sells more than four billion gallons of retail fuel annually, owns more than 90% of its gasoline stations. This allows Murphy USA to keep its operating expenses low. The proximity of Murphy USA’s fuel stations to Walmart WMT supercenters enables the company to leverage the strong and consistent traffic that these stores attract, thereby driving the above-average fuel sales volume. Further, this is expected to have lent the company’s portfolio a solid competitive edge.

In the last reported quarter, Murphy USA’s revenues of $687.5 million from merchandise sales rose 13.4% year over year, a trend that most likely continued in the second quarter as well. Precisely, the Zacks Consensus Estimate for second-quarter merchandise sales revenues stands at $696 million, indicating a 5.6% rise from the year-ago reported figure of $659 million.

Notwithstanding Murphy USA’s stellar first-quarter performance, the coronavirus outbreak and efforts to stop the contagion’s spread are likely to pose significant challenges to its business. Importantly, this motor fuel retailer is already facing lower customer demand since mid-March while store wise average retail fuel volumes on APSM basis are currently trending below the earlier 2020 projection of 250-255 thousand gallons. This, in turn, prompted the El Dorado, AR-based company to scrap its retail fuel volume expectation for this year. But Murphy USA is still maintaining its guidance for organic growth, fuel break-even, corporate costs and capital spending.

What Does Our Model Say?

Our proven Zacks model predicts an earnings beat for Murphy USA this season. The right combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of a positive surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Murphy USA has an Earnings ESP of +14.85%.

Zacks Rank: Murphy USA currently carries a Zacks Rank #3, which increases the predictive power of ESP.

Highlights of Q1 Earnings

In the last reported quarter, Murphy USA posted earnings per share of $2.92, beating the Zacks Consensus Estimate of $2.80 and also significantly improving from the year-earlier quarter’s bottom line of 16 cents.

This outperformance was attributed to a strong retail margin of 26.9 cents per gallon, which soared 220% year over year and also came ahead of the Zacks Consensus Estimate of 9.7 cents.

Additionally, Murphy USA’s operating revenues of $3.2 billion inched up 2.2% year over year and beat the Zacks Consensus Estimate by $142.7 million on higher merchandise sales as well.

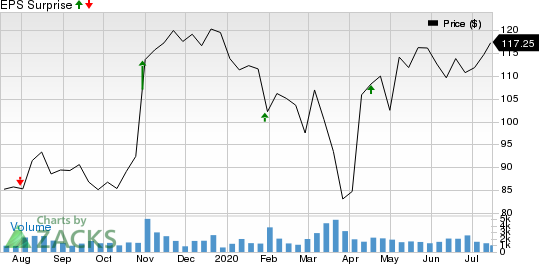

As far as its earnings surprises are concerned, Murphy USA’s bottom line beat the Zacks Consensus Estimate in three of the trailing four quarters and missed the mark on one occasion, the average positive surprise being 16.61%. This is depicted in the graph below:

Murphy USA Inc. Price and EPS Surprise

Murphy USA Inc. price-eps-surprise | Murphy USA Inc. Quote

Stocks to Consider

Here are some other firms worth considering from the energy space on the basis of our model, which shows that these have the right combination of elements to beat on earnings this season:

Halliburton Company HAL has an Earnings ESP of +19.33% and a Zacks Rank of 3, currently. The company is scheduled to release earnings on Jul 20.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Suncor Energy Inc. SU has an Earnings ESP of +20.59% and is Zacks #3 Ranked at present. The firm is scheduled to release earnings on Jul 22.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Halliburton Company (HAL) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Suncor Energy Inc. (SU) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance