How Badly Will Coronavirus Impact Delta's (DAL) Q1 Earnings?

Delta Air Lines, Inc. DAL is scheduled to report first-quarter 2020 results on Apr 22, before the market opens.

With the coronavirus outbreak dealing a severe blow to the company, the Zacks Consensus Estimate for first-quarter earnings has been revised downward significantly over the past 60 days.

Let’s delve into the details.

With large-scale capacity cuts (mainly in February and March) amid plummeting air-travel demand and government travel restrictions, the carrier’s passengers revenues (accounting for approximately 90% of the top line) are expected to have declined considerably, thereby impacting overall results. Notably, the Zacks Consensus Estimate for first-quarter passenger revenues indicates a 6.3% fall from the figure reported in fourth-quarter 2019. Additionally, the consensus mark implies a 2.9% dip in total revenues for the soon-to-be-reported quarter.

Moreover, weak cargo demand due to global supply-chain disruptions as a result of the coronavirus pandemic is expected to reflect on cargo revenues. Apart from soft demand, massive flight cuts might have weighed on Delta’s cargo revenues by reducing cargo carrying capacity as the airline transports freight in the bellies of passenger aircraft. Consequently, the Zacks Consensus Estimate for cargo revenues suggests a 6.4% decrease from the number reported in fourth-quarter 2019.

With fuel expenses comprising a major chunk of total airline expenditures, low fuel prices are likely to have aided the bottom line, thus partly offsetting the adversity arising from substantial revenues loss. The Zacks Consensus Estimate for average fuel price per gallon (adjusted) hints at a 3.5% decrease from the sequential quarter’s reported figure.

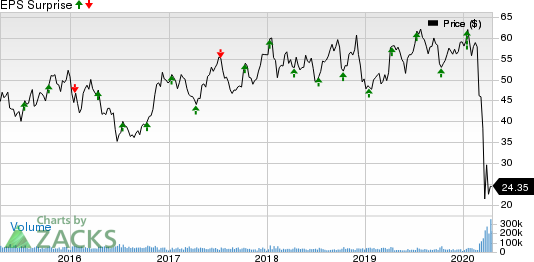

Delta Air Lines, Inc. Price and EPS Surprise

Delta Air Lines, Inc. price-eps-surprise | Delta Air Lines, Inc. Quote

Earnings Whispers

The proven Zacks model does not conclusively predict an earnings beat for Delta this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that is not the case here as elaborated below. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings ESP: Delta has an Earnings ESP of -37.65% as the Most Accurate Estimate is pegged at a loss of 70 cents, wider than the Zacks Consensus Estimate of a loss of 51 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Delta carries a Zacks Rank #3.

Highlights of Q4 Earnings

In the last reported quarter, the company delivered a positive earnings surprise of 21.4%. The bottom line also improved 30.8% on a year-over-year basis, mainly owing to low fuel costs. Operating revenues too edged past the Zacks Consensus Estimate and increased 6.5%, backed by higher passenger revenues.

Stocks to Consider

Investors interested in the broader Transportation sector may consider Scorpio Tankers Inc. STNG, Landstar System, Inc. LSTR and Ensco plc VAL as these stocks possess the right combination of elements to beat on earnings this reporting cycle.

Scorpio Tankers has an Earnings ESP of +12.30% and a Zacks Rank of 3.

Landstar has an Earnings ESP of +0.44% and is a #3Ranked player. The company will release first-quarter earnings numbers on Apr 22.

Ensco has an Earnings ESP of +0.63% and is Zacks #3Ranked.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ensco plc (VAL) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

Landstar System, Inc. (LSTR) : Free Stock Analysis Report

Scorpio Tankers Inc. (STNG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance