Azul (AZUL) to Report Q1 Earnings: What's in the Offing?

Azul S.A. AZUL is slated to report first-quarter 2020 financial numbers on May 14, before market open.

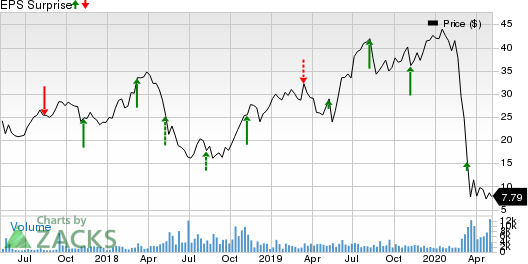

Azul has an impressive track record with respect to earnings per share. The carrier’s bottom line outperformed the Zacks Consensus Estimate in all of the last four quarters. It has a trailing four-quarter positive earnings surprise of 100%, on average.

However, the Zacks Consensus Estimate for first-quarter loss has been revised downward to 50 cents from earnings of 20 cents in the past 60 days.

Let’s discuss the factors that are likely to get reflected on the upcoming quarterly results.

AZUL SA Price and EPS Surprise

AZUL SA price-eps-surprise | AZUL SA Quote

Factors at Play

Thanks to the COVID-19 pandemic, lower passenger revenues (accounting for most of the top line numbers) are likely to have hurt the company’s revenues in the to-be-reported quarter. Load factor (% of seats filled by passengers) is also likely to have declined on lower traffic demand. However, cargo revenues are likely to have increased in the first quarter, courtesy of the significance of cargo services (air transportation of health care materials, including medicine, masks, and hospital equipment) in the fight against the pandemic. the Zacks Consensus Estimate for current quarter revenues is pegged at 763.19 million, which indicates year-over-year growth of 11.11%.

Further, lower fuel costs are likely to have supported the bottom line in the quarter to be reported. Also, depreciation of the Brazilian currency is likely to have had a negative impact on the company’s first-quarter performance.

What Does the Zacks Model Say?

Our proven model does not predict an earnings beat for Azul this time around. This is because a stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings ESP: Azul has an Earnings ESP of 0.00% since both the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at a loss of 50 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Azul carries a Zacks Rank #3, currently.

Highlights of Q4 Earnings

In the last reported quarter, Azul’s earnings (excluding 94 cents from non-recurring items) of 95 cents per share surpassed the Zacks Consensus Estimate of 90 cents. Moreover, quarterly earnings increased more than 100% on a year-over-year basis. Quarterly revenues of $790.3 million beat the consensus mark of $735.2 billion and increased 21.3% on a year-over-year basis.

Stocks to Consider

Investors may consider Grid Dynamics Holdings, Inc. GDYN, Covetrus, Inc. CVET and Datadog, Inc. DDOG as these stocks have the right combination of elements to beat on earnings in this reporting cycle.

Grid Dynamics has an Earnings ESP of +9.09% and a Zacks Rank #2. . The company will report first-quarter 2020 earnings on May 11.

Covetru has an Earnings ESP of +41.67% and a Zacks Rank #3. The company will report first-quarter 2020 earnings on May 14.

Datadog has an Earnings ESP of +100.00% and a Zacks Rank #3. The company will report first-quarter 2020 earnings on May 11.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AZUL SA (AZUL) : Free Stock Analysis Report

ChaSerg Technology Acquisition Corp (GDYN) : Free Stock Analysis Report

Covetrus Inc (CVET) : Free Stock Analysis Report

Datadog Inc (DDOG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance