The Awkward Coincidence Of Temasek’s SMRT Buyout: A Win For Singaporeans & Shareholders?

In the past weeks, national transport operator SMRT has been at the centre of a couple of significant corporate actions. These moves appear, at least on paper, to be a major positive for the company and its shareholders.

Let’s recap what has happened.

# 1 LTA offers S$1.06 billion for SMRT’s operating assets

This has been a discussion that has gone on for more than 4 years.

Ever since the trains started breaking down in 2011, the general consensus has been that getting a profit maximising entity (and make no mistake, SMRT, being a public listed company is one) to ensure the continuous reliability of the public transport infrastructure was not a good idea.

The idea proposed was that the government, through LTA, should take over from SMRT and be responsible for the railway infrastructure and trains in Singapore.

# 2 Temasek Holdings offers S$1.2 billion To Buy Out Remaining SMRT Ownership

Temasek Holdings, an investment company owned by the Singapore Government, currently owns 54% of SMRT.

In other words, one can confidently say that the Government indirectly owns SMRT, even though the company is a public listed entity.

Temasek has made a conditional offer of $1.68 per share to buy out the remaining 46% of shares that it does not own. In total, this would cost them about S$1.2 billion.

Unlike a general offer, where Temasek would offer $1.68 for any shareholders who wants to sell, this deal is a “Scheme Of Arrangement”. For any offer to be made, existing shareholders, excluding Temasek, would need to have a majority voting for it. If the deal goes through, Temasek would own 100% of SMRT.

Think of it as an en-bloc deal. Temasek either gets all the remaining SMRT shares, or none of it.

Read More: Temasek Holdings and GIC – And The Management Of Our Monies

Why Selling Its Operating Assets To The Government Is A Good Move

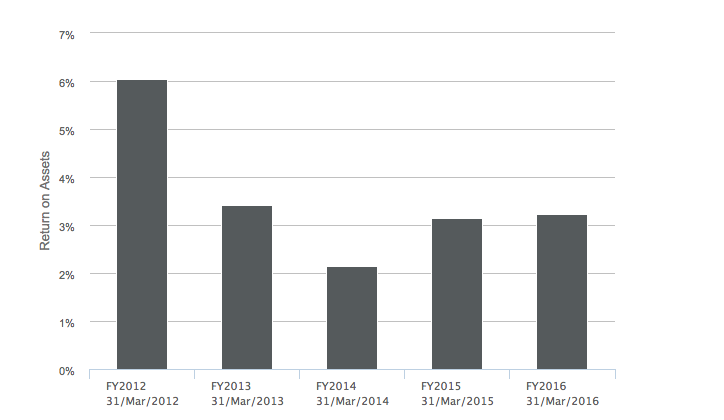

Since the breakdowns started occurring in 2011, SMRT has been having difficulty in maintaining the nice, fat profits it used to enjoy. Here is a chart about SMRT we took from SGX’s StockFacts.

Source: StockFacts

SMRT went from making 6% or more on their return on assets in 2012 to just slightly more than 3% per year in subsequent years (and only 2.1% in 2014).

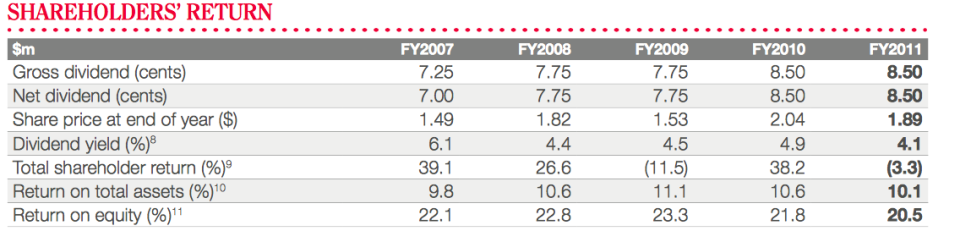

To put the numbers into perspective, take a look at the return of assets that SMRT was earning prior to 2012.

As you can see, return on total assets was about 10% in the earlier years.

The idea is simple. SMRT used to be a great company to own because they were able to generate high profits from the assets they own. These days, that isn’t really true.

Hence the offer to offload their operating assets to LTA at book value is a very good deal for the company.

Fair For Singaporeans?

There is a bitter pill to be swallowed here. On one hand, it almost feels like Singaporeans are getting the raw end of the deal here.

In its earlier years, SMRT was an extremely profitable company paying out hundreds of millions in dividend each year. In fact, one can make the argument that the dividend paid out by SMRT since the early 2000s could easily have amounted to enough money to buy out the entire infrastructure that LTA is buying today.

Now that the operating and maintenance costs are expected to increase in future years, it does seem unfair that the government is taking over (at book value) and bearing the costs, while profits in earlier years were enjoyed by SMRT.

That said, we think it’s the right decision. The upkeep of important infrastructure in the country should be under the responsibility of the government, rather than a private entity with government connection.

Why Is Temasek Looking To Buy Out SMRT?

The timing of the offer is not a coincidence. Given the changing circumstances of the transport industry, there are many reasons why Temasek, being an investment company of the government, would want to own it entirely.

A Profit Maximising Move:

In 2014, SMRT CEO Desmond Kuek said that SMRT’s business outlook would improve after it sells its rail asset to the government.

With the proposal now coming to fruition, it would seem that SMRT’s future business, amidst some uncertainty, would stand to gain.

This could be a nice play on Temasek’s part to gain complete control of a still private company operating in a monopolistic environment. We expect the company to fare better in the future with the sale of assets. Otherwise, why would the SMRT management moot the idea in the first place?

Keeping Things Private:

This buyout would take SMRT off the Singapore Exchange. With that, the company would have a lot more control over its business operations without having to be accountable to its shareholders, or the general public.

Its only shareholder would be Temasek, which is basically a proxy for the Singapore government.

This would make it easier for the company to transit and move towards a different operating model in the future. Also, it would prevent any unnecessary backlash from public shareholders on the decisions it makes.

Christopher Tan from the Straits Times made an interesting observation about how both Temasek and SMRT appears to be trying to “talk down the valuation of SMRT”, which is puzzling, given that its management has been talking about how this would be a positive move for the longest time.

Read More: Why Uber & GrabTaxi Are The Best Things That Have Happened To Singapore’s Transport

Our Take – A Good Lateral Move That Should Have Happened Years Ago

Apart from some inconsistency in statements, which we will attribute to politics, we think this is generally a good move for all parties.

For current investors, the offer from Temasek represents a 15% premium over its 52-week average price.

For SMRT, this deal was what they have been seeking for over the past years. Aside from the $1 billion they would get, the offloading of operating assets would reduce their expenses, and make SMRT a pure operator without having to worry about maintenance.

For Singaporeans, with the government having full control over the important operating assets of our public transport infrastructure, we now have an organisation that is completely responsible for anything that goes wrong.

We no longer have to contend with the blame being pushed from the ministry to SMRT, and from one CEO to another, each time a major train breakdown occurs.

It comes at a price to us, the taxpayers, but it is the right move, though arguably overdue.

DollarsAndSense.sg is a website that aims to provide interesting, bite-sized financial articles which are relevant to the average Singaporean. Subscribe to our free e-newsletter to receive exclusive content not available on our website. Follow us as well on Instagram @DNSsingapore to get your daily dose of finance knowledge through photos.

Top Image Credit: DollarsAndSense.sg

The post The Awkward Coincidence Of Temasek’s SMRT Buyout: A Win For Singaporeans & Shareholders? appeared first on DollarsAndSense.sg.

Yahoo Finance

Yahoo Finance