AutoNation (AN) Beats Q1 Earnings Estimates, Boosts Buyback

AutoNation, Inc. AN reported first-quarter 2024 adjusted earnings of $4.49 per share, which decreased 25.7% year over year but topped the Zacks Consensus Estimate of $4.45. This outperformance can be primarily attributed to higher-than-expected gross profit from the sale of new vehicles and wholesale used vehicles. In the reported quarter, revenues amounted to $6.48 billion, falling short of the Zacks Consensus Estimate of $6.49 billion but increasing from $6.39 billion in the first quarter of 2023.

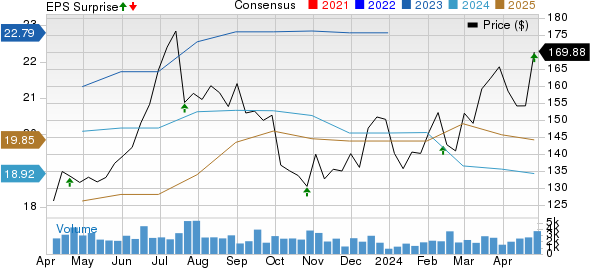

AutoNation, Inc. Price, Consensus and EPS Surprise

AutoNation, Inc. price-consensus-eps-surprise-chart | AutoNation, Inc. Quote

Key Takeaways

In the reported quarter, new vehicle revenues were up 1.6% year over year to $2.9 billion and were in line with our estimate. New vehicle retail units sold totaled 57,842 units (up 5.2% year over year), topping our projection of 57,137 units. The average selling price (ASP) per new vehicle unit retailed was $50,780 (down 4.6% year over year), missing our estimate of $52,115. Gross profit from the segment came in at $195.9 million, declining 31.7% year over year but topping our estimate of $174.5 million.

Retail used-vehicle revenues contracted 2.7% from the year-ago figure to $1.83 billion and missed our projection of $1.85 billion. Used vehicle retail units sold totaled 66,163 units (down 1.7% year over year), missing our projection of 68,005 units. ASP per used vehicle unit retailed came in at $26,735 (down 4.2% year over year) and lagged our projection of $27,211. Gross profit from the segment came in at $101.8 million, down 28.8% and lagging our projection of $119.2 million.

Revenues from wholesale used vehicles were up 9.3% to $162.3 million and topped our estimate of $147 million. Gross profit declined 15% to $9.7 million but significantly topped our estimate of $3.6 million.

Net revenues in the finance and insurance business amounted to $334.7 million, which increased 0.7% from the year-ago quarter but missed our projection of $377 million. Gross profit was $334.7 million, up 0.7 and missed our estimate of $377 million.

Revenues from the parts and service business rose 7.6% to $1.17 billion, in line with our estimate. Gross profit from this segment came in at $555.8 million, rising 8.7% year over year and marginally beating our estimate of $554.7 million.

Segmental Details

Revenues from the Domestic segment declined 4.1% year over year to $1.75 billion and missed our projection of $1.82 billion. The segment’s income declined 37% to $75 million, missing our estimate of $83.2 million.

Revenues from the Import segment rose 10.6% from the prior-year quarter to $1.97 billion and slightly missed our forecast of $1.93 billion. The segment’s income contracted 19.7% to $128.8 but was in line with our model estimate.

The Premium Luxury segment sales inched down 2.8% to $2.41 billion, marginally missing our projection of $2.47 billion. The segmental income declined 24.3% year over year to $171.6 million in the reported quarter but topped our estimate of $169.7 million.

Financial Tidbits

AutoNation’s cash and cash equivalents were $60.3 million as of Mar 31, 2024. The company’s liquidity was $1.7 billion, including $60 million in cash and nearly $1.6 billion available under its revolving credit facility.

The firm’s inventory was valued at $3 billion. At the end of the first quarter, non-vehicle debt was $3.87 billion. Capital expenditure in the quarter was $93.7 million.

During the first quarter of 2023, AutoNation repurchased 0.2 million shares of common stock for an aggregate purchase price of $39 million. Since the beginning of the year through Apr 24, the company had bought back 1.6 million shares for $250 million. To boost investors’ confidence, AN has authorized an additional $1 billion shares under it repurchase program. As of Apr 24, it had $1.1 billion remaining under its share repurchase program.

Zacks Rank & Key Picks

AN currently carries a Zacks Rank #4 (Sell).

A few top-ranked players in the auto space include PACCAR PCAR, Dorman Products DORM and Allison Transmission ALSN. While PCAR and DORM sport a Zacks Rank #1 (Strong Buy) each, ALSN carries a Zacks Rank #2 (Buy) currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for PCAR’s 2024 and 2025 EPS has moved up by 8 cents and 10 cents, respectively, in the past 30 days. The trucking giant surpassed earnings estimates in the trailing four quarters, with the average surprise being 17.07%.

The Zacks Consensus Estimate for DORM’s 2024 sales and earnings suggests year-over-year growth of 3.8% and 22.25%, respectively. EPS estimates for 2024 and 2025 have improved by 34 cents and 44 cents, respectively, in the past 60 days.

The Zacks Consensus Estimate for ALSN’s 2024 sales and earnings suggests year-over-year growth of 2.5% and 4%, respectively. The consensus estimate for 2024 and 2025 has improved by 7 cents and 33 cents, respectively, in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

AutoNation, Inc. (AN) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

Dorman Products, Inc. (DORM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance