Australian Dollar Rallies as RBA Minutes Reduce Rate Cut Bets

DailyFX.com -

Talking Points

Australian Dollar rallies against its major counterparts

RBA minutes confirm a wait-and-see policy approach

Bond yield gains suggest ebbing rate cut expectations

Showcase your trading skills against your peers in FXCM’s $10,000 Monthly Challenge here.

The Australian Dollar rallied against its major peers after June’s RBA meeting minutes crossed the wires. Heading into the document’s release, the markets were pricing in at least one rate cut from the central bank over the next 12 months. The most recent monetary policy announcement saw the Reserve Bank of Australia leaving rates unchanged to a level deemed consistent with CPI and sustainable growth returning to target over time.

This means that the markets were looking for clues in the minutes about whether or not the RBA has really taken on a holding pattern. In the document, the central bank reiterated that June’s rate decision was consistent with sustainable growth and CPI returning to target over time. They expect inflation to remain low for some time. Members noted that an appreciating Australian Dollar could complicate the country’s adjustment to its terms of trades.

Australian 2-year government bond yields rallied alongside Aussie gains after the minutes report was released. This suggests that the markets likely interpreted the document as broadly hawkish, or meaning that the central bank will cut rates later rather than sooner. Overnight index swaps are still pricing in at least one 25bps reduction in RBA’s main lending rate over the next year.

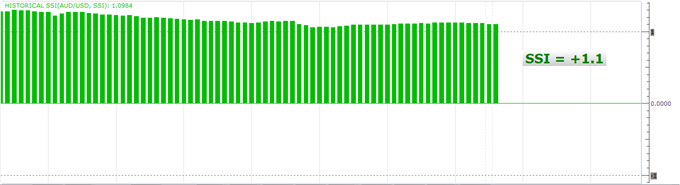

Meanwhile, the DailyFX Speculative Sentiment Index (SSI) is showing a reading of 1.1 following the announcement, meaning that for every trader short the AUD/USD, there are 1.1 on the long side. The SSI is a contrarian indicator, implying further AUD/USD weakness ahead.

Want to learn more about the DailyFX SSI indicator? Click here to watch a tutorial.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance