Australian Dollar Correction Could Be Over if Risk Trends Permit

Fundamental Forecast for Australian Dollar: Neutral

Risk-off as Global PMIs Send Aussie and Euro Lower, Dollar and Yen Up

US Dollar Retreat Likely to Continue on Firming Risk Appetite

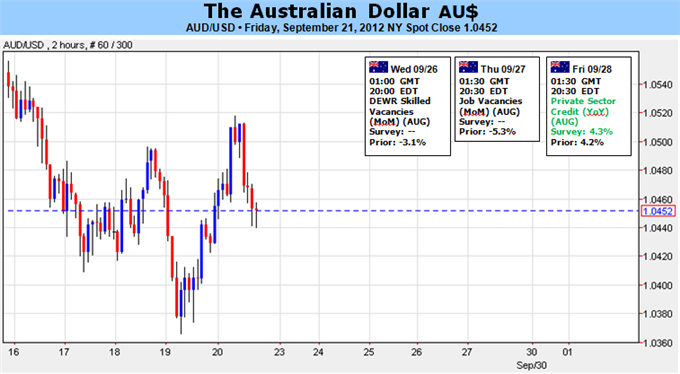

The Australian Dollar had a mediocre week, shedding -1.17% against the top performer, the Japanese Yen, while gaining +0.26% against the worst performer, the Euro. The AUDUSD dropped back by -0.89% as price action was largely dictated by two main themes: a US Dollar rebound; and deteriorating sentiment on China.

With respect to the first point, it looks like the initial reaction to the Federal Reserve’s unlimited quantitative easing program was largely priced in, and an overextended market from a technical perspective warranted a pullback. In terms of the second, data was mediocre at best out of China, but commodity prices tied to Chinese growth – Copper and Iron Ore – were relatively steady. We believe that base metals will be a strong guide for the Australian Dollar (considering that Iron Ore is Australia’s top commodity export), and as long as they remain strong, with the Fed priming the liquidity pump, the Australian Dollar could strengthen going forward. However, this may not be that week, we now hold a neutral outlook for the Aussie until global risk trends pick up.

In terms of data out of Australia this week, there’s not much by way of the economic docket that could really provoke a breakout from its current trend: weak in the short-term, but strong in the medium- and long-term. There is one data release that is of interest, however. On Friday, the Private Sector Credit report for August will be released. According to a Bloomberg News Survey, credit grew at a pace of +0.3% on a monthly-basis, from +0.2% m/m in July. On a yearly-basis, credit growth was up by +4.3% in August from +4.2% y/y in the prior month. If Private Sector Credit is improving as predicted, the Australian Dollar could see a boost.

Looking at the calendar going into the first week of October, we note that there’s a Reserve Bank of Australia Rate Decision coming up on October 2. We thus suspect this will start to drive the Australian Dollar by mid-week. According to the Credit Suisse Overnight Index Swaps, there is a 62.0% chance of a 25.0-basis point rate cut, with 90.0-bps priced out over the next 12-months. Earlier this week, there was a 70.0% chance of a 25.0-bps rate cut, up from a 40.0% chance last Friday. These rate expectations ahead of the RBA are important to watch: if they show a greater likelihood of a rate cut, the Australian Dollar will depreciate. Given the psychology surrounding the Australian Dollar and China right now, any positive signs out of either country could provide some much needed relief; and if US equity markets rally again, so too will the Aussie. –CV

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance