Australia cuts interest rates to 1.75 percent

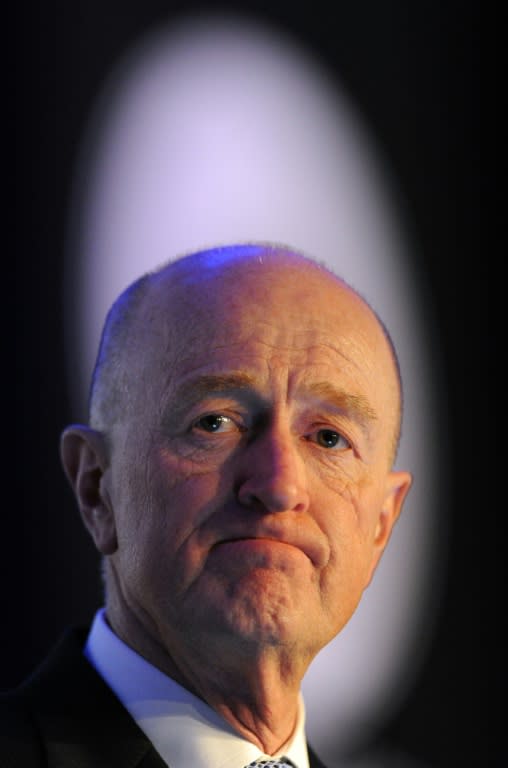

Australia's central bank cut interest rates by 25 basis points to a historic low of 1.75 percent on Tuesday following lower than expected inflation, sending the currency down. The Reserve Bank of Australia (RBA) had remained on hold for the past year, having already cut borrowing costs to try to spur growth as the economy exits an unprecedented mining boom. Governor Glenn Stevens said the board now considered another cut appropriate following "information showing inflationary pressures are lower than expected". "The board judged that prospects for sustainable growth in the economy, with inflation returning to target over time, would be improved by easing monetary policy at this meeting," he added. While the stock market closed up more than 2.1 percent after the announcement, the Australian dollar fell sharply -- dropping more than one percent to 75.84 US cents. "The RBA's decision to cut rates will keep a lid on further appreciation in the Australian dollar, and increases the likelihood that we have seen a peak for the currency," ANZ Research said in a note. ANZ added that "the bank is likely to follow up with another rate cut in the near term". In his statement, Stevens said inflation had been quite low for some time but recent data were "unexpectedly low". Inflationary data released late last month showed that consumer prices fell in January-March for the first time since 2008, during the global financial crisis. For the year to March, inflation came in at just 1.3 percent, well down from the 1.7 percent over the year to December. "While the quarterly data contain some temporary factors, these results, together with ongoing very subdued growth in labour costs and very low cost pressures elsewhere in the world, point to a lower outlook for inflation than previously forecast," Stevens said. The RBA, which targets an underlying inflation rate of 2.0-3.0 percent, noted that the economy appeared to be rebalancing following the mining investment boom. "GDP growth picked up over 2015, particularly in the second half of the year, and the labour market improved," Stevens said. "Indications are that growth is continuing in 2016, though probably at a more moderate pace." Australia, which for almost 25 years has avoided falling into recession, posted a better than expected GDP reading of 3.0 percent last year, while the jobless rate slipped to 5.7 percent in March -- the lowest in two-and-a-half years. But the economy still faces an uncertain period ahead as growth slows in its largest trading partner China and Stevens noted uncertainty about the global economic outlook. Westpac's Bill Evans said that while Tuesday's cut came as a surprise, the decision would not have been taken without a "realistic expectation" that a further cut was likely, possibly in August. The chief economist at AMP Capital, Shane Oliver, agreed that another cut to take the cash rate to 1.5 percent was likely. "For investors relying on bank interest, the decision by the RBA to cut the cash rate again will push deposit rates further down to levels not seen since the 1950s," he added. The RBA's decision came just hours before Treasurer Scott Morrison delivers his annual budget, which will attempt to stimulate jobs and growth and boost the conservative government before an election expected on July 2.

Yahoo Finance

Yahoo Finance