Atlassian (TEAM) to Report Q3 Earnings: What to Expect?

Atlassian TEAM is set to report third-quarter fiscal 2020 results on Apr 30.

For the fiscal third quarter, Atlassian projects revenues of $395-$399 million (mid-point $397 million). The Zacks Consensus Estimate for revenues is pegged at $395.7 million, suggesting growth of 27.9% from the year-ago reported figure.

The company anticipates non-IFRS earnings of approximately 20 cents per share. The Zacks Consensus Estimate is also pegged at 20 cents per share, indicating a year-over-year decline of 4.8%.

Notably, the company’s earnings surpassed estimates in the trailing four quarters, the average positive surprise being 23.9%.

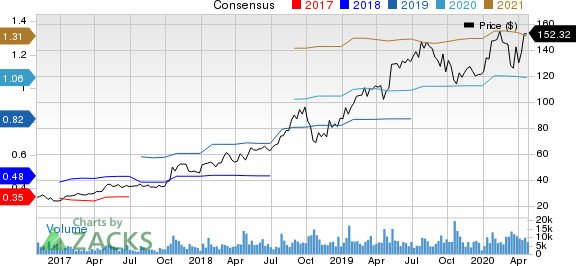

Atlassian Corporation PLC Price and Consensus

Atlassian Corporation PLC price-consensus-chart | Atlassian Corporation PLC Quote

Let’s see how things have shaped up for the upcoming announcement.

Factors at Play

Atlassian’s fiscal third-quarter performance is expected to have benefited from the rising demand for remote working tools amid the coronavirus-led global lockdown.

The growing adoption of the company’s cloud-based solutions and massive digitalization of work from organizations, big or small, is likely to have driven its quarterly performance. Increasing demand for the company’s cloud products from new customers as well as the existing clients using on-premises products is a tailwind.

Healthy demand for core products like Jira and Confluence, coupled with the rising uptake of new products like Jira Service Desk, Jira Ops and Bitbucket, is expected to have been a key growth driver. Improvement in product quality and performance, multiple product launches and increased pricing are anticipated to have boosted quarterly revenues

Robust growth in subscription revenues, aided by the higher uptake of the company’s cloud-service offerings, is expected to reflect on the company’s to-be-reported results as a consistent key catalyst.

What Our Model Says

Our proven model does not predict an earnings beat for Atlassian this season.The combination of a positive Earnings ESP, and Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), increases the chances of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell, before they’re reported, with our Earnings ESP Filter.

Atlassian currently carries a Zacks Rank of 3 and has an Earnings ESP of -1.61%.

Stocks With Favorable Combinations

Here are some companies, which, per our model, have the right combination of elements to post an earnings beat this quarter:

Inphi Corporation IPHI has an Earnings ESP of +24.11% and holds a Zacks Rank of 2 currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shopify Inc. SHOP has an Earnings ESP of +5.85% and currently carries a Zacks Rank of 2.

Okta, Inc. OKTA has an Earnings ESP of +5.17% and carries a Zacks Rank of 2, at present.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.1% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Atlassian Corporation PLC (TEAM) : Free Stock Analysis Report

Inphi Corporation (IPHI) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

Okta, Inc. (OKTA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance