Atlassian Corp (TEAM) Surpasses Revenue Estimates in Q3 FY 2024 Amidst CEO Transition

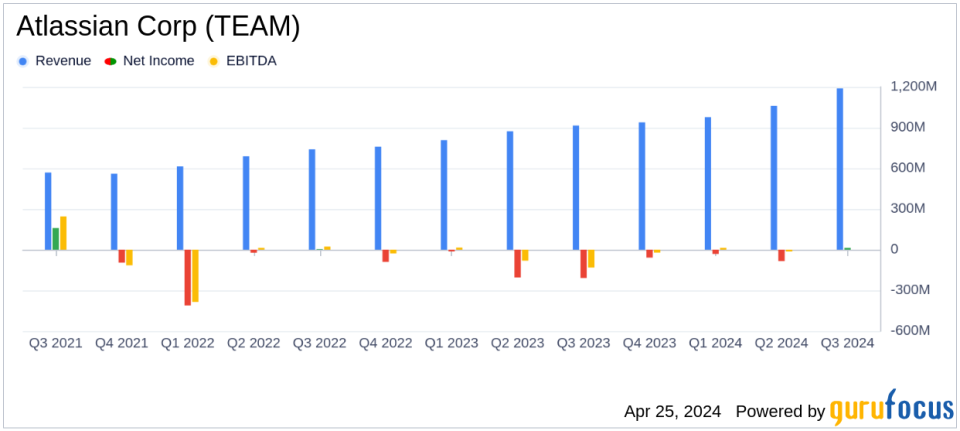

Revenue: Reached $1,189 million in Q3, up 30% year-over-year, surpassing the estimate of $1,097.45 million.

Subscription Revenue: Grew to $1,071 million, a 41% increase from the previous year, highlighting strong demand for cloud products.

Net Income: Reported at $12.8 million, a significant recovery from a net loss of $209 million in the same quarter last year, but fell short of the estimated $163.32 million.

Earnings Per Share (EPS): Posted at $0.05, recovering from a loss of $0.81 per share year-over-year, yet below the expected $0.62.

Free Cash Flow: Achieved a record $555 million, demonstrating a robust 59% increase year-over-year.

Operating Margin: Improved to 1% on a GAAP basis and 27% on a non-GAAP basis, up from -18% and 22% respectively in the prior year.

CEO Transition: Announced co-founder Scott Farquhar will step down as co-CEO, with Mike Cannon-Brookes continuing as the sole CEO.

On April 25, 2024, Atlassian Corp (NASDAQ:TEAM) released its 8-K filing, announcing a significant revenue increase and detailing a CEO transition. The company reported a quarterly revenue of $1,189 million, a 30% increase year-over-year, surpassing the analyst's estimate of $1,097.45 million. This growth was primarily driven by a substantial 41% increase in subscription revenue, which reached $1,071 million.

Atlassian, founded in 2002 and headquartered in Sydney, specializes in software that enhances team collaboration and productivity. The company operates across four segments: subscriptions, maintenance, perpetual licenses, and other services, including its thriving Atlassian Marketplace app store.

Financial Performance and CEO Transition

The third quarter of fiscal year 2024 marked a milestone for Atlassian with not just financial growth but also significant leadership changes. Co-founder Scott Farquhar announced his decision to step down as co-CEO, effective August 31, 2024. Mike Cannon-Brookes will continue as the sole CEO, steering Atlassian towards new opportunities in cloud and AI technologies.

Atlassian's GAAP operating income for the quarter stood at $17.8 million, a stark improvement from a loss of $161.6 million in the same quarter the previous year. The non-GAAP operating income was even more impressive at $316.5 million, reflecting an operating margin of 27%. This financial strength translated into a net income of $232.5 million on a non-GAAP basis, with earnings per share of $0.89, significantly higher than the estimated $0.62.

Strategic Highlights and Future Outlook

The quarter also saw strategic expansions and product innovations. Atlassian's marketplace surpassed $4 billion in lifetime sales, and the company made key acquisitions like Optic to enhance API documentation and management. The launch of Confluence whiteboards and new data residency regions underscores Atlassian's commitment to broadening its service capabilities and geographical reach.

Looking ahead to Q4 FY 2024, Atlassian anticipates revenue between $1,120 million and $1,135 million. The expected cloud revenue growth of approximately 32% and data center revenue growth between 40% to 42% reflect the company's strong positioning in the market.

Analysis of Financial Health

Atlassian's balance sheet remains robust with cash and cash equivalents plus marketable securities totaling $2.1 billion. The company's strategy of focusing on high-margin cloud services and expanding its customer base in cloud solutions with more than $10,000 in Cloud ARR has proven effective, as evidenced by a 19% year-over-year increase in such customers.

The company's ability to generate a record $555 million in free cash flow this quarter, up 59% year-over-year, not only demonstrates operational efficiency but also provides ample resources for future investments and shareholder returns.

Conclusion

Atlassian's impressive third-quarter performance, highlighted by revenue growth and strategic advancements, positions it well for sustained long-term growth. The upcoming CEO transition marks the end of an era and the beginning of a new chapter under Mike Cannon-Brookes leadership, focusing on cloud innovation and AI integration. Investors and stakeholders may look forward to continued growth and innovation from Atlassian in the evolving landscape of enterprise software solutions.

Explore the complete 8-K earnings release (here) from Atlassian Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance