Asian currencies decouple from yuan in two-speed recovery

By Livia Yap

(Bloomberg) -- Counting on China as an anchor of strength has been a good tactic for traders of Asia’s emerging currencies. That link is losing traction as recovery paths from the coronavirus pandemic diverge.

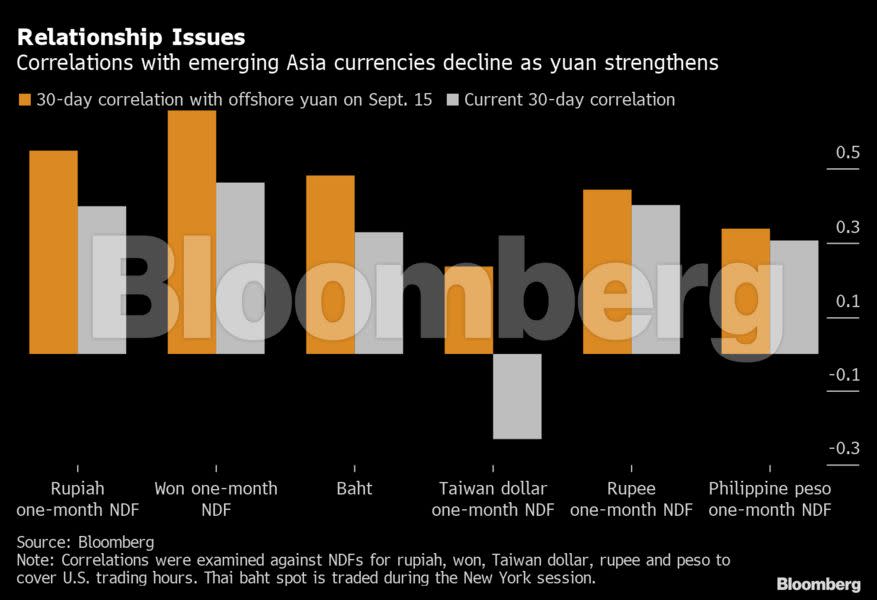

While China’s economy has bounced back from the Covid-19 crisis, as shown by data such as retail sales and industrial production, countries including Indonesia and the Philippines are still grappling with rising outbreaks. The 30-day correlation between the offshore yuan and six regional counterparts has declined in the past week as the Chinese currency climbed to the strongest level in more than a year.

Asia’s two-speed recovery is making it difficult to predict the fortunes of the region’s exchange rates amid mounting headwinds ranging from U.S.-China tensions to the American presidential election. The Asian Development Bank expects China to avoid an economic contraction this year, while developing nations in the region as a whole will see their economies shrink for the first time since the early 1960s.

“Given that much of the strength in the yuan is related to China’s economic resilience, which has not been replicated in much of the rest of the Asia, this suggests that yuan appreciation is going to continue to have a less pronounced impact on Asian currencies,” said Mitul Kotecha, a senior emerging-markets strategist at TD Securities in Singapore. “Idiosyncratic factors have become more important for regional currencies.”

China’s gathering economic recovery has seen the offshore yuan strengthen 3.7% this quarter, beating all of its developing Asian peers. The South Korean won is in second place, having gained 3%, while the currencies of Thailand and Indonesia, facing some of the largest economic challenges from the pandemic, have weakened.

The uneven nature of Asia’s recovery will generally be reflected in currency performance, according to Khoon Goh, head of Asia research at Australia & New Zealand Banking Group Ltd. in Singapore, who recently raised his year-end forecast for the onshore yuan to 6.7 per dollar from 6.85.

“I see the trend continuing, probably into the second half of next year, and it will hinge on the success of any vaccine deployment or countries managing to bring the domestic outbreak down,” Goh said. “These will be key for getting the laggards to catch up.”

The yuan opened at 6.81 per dollar Thursday after the People’s Bank of China set its daily fixing at a stronger level than anakysts forecast. While the currency has trimmed this quarter’s gains following weaker-than-expected fixings in the past few days, it’s still on track for the biggest three-month advance since March 2018.

The key exchange-rates to watch for signs of a breakdown in correlation with the yuan are those that have typically followed it the closest. These include the Malaysian ringgit, the won, and the Taiwan and Singapore dollars, according to a Bloomberg analysis. A 1% move in the Chinese currency has previously led to an average 0.6% shift in these peers.

While the yuan’s correlation with other emerging-Asian currencies seems to be breaking down, its relationship with those in the Group-of-10 countries appears to be rising. The Chinese currency is increasingly influencing weekly price changes in the pound and commodity-linked currencies such as the Australian, New Zealand and Canadian dollars, according to HSBC Holdings Plc.

Domestic risks are likely to hinder emerging Asian currencies from keeping pace with the yuan, even as the Chinese currency’s strength and the weakening dollar create a favourable environment, said Terence Wu, a currency strategist at Oversea-Chinese Banking Corp. in Singapore.

Weak exports will probably damp sentiment toward the won, while debt monetisation concerns weigh on the Indonesian rupiah, and the rupee will be hurt by India’s worsening virus outbreak, he said.

“The macro recovery in the rest of Asia has been choppy and uncertain at best, and there is also no strong portfolio inflow momentum,” Wu said. “These factors will cause the rest of the Asian currencies to lag behind.”

© 2020 Bloomberg L.P.

Yahoo Finance

Yahoo Finance