China stocks close up strongly on government moves

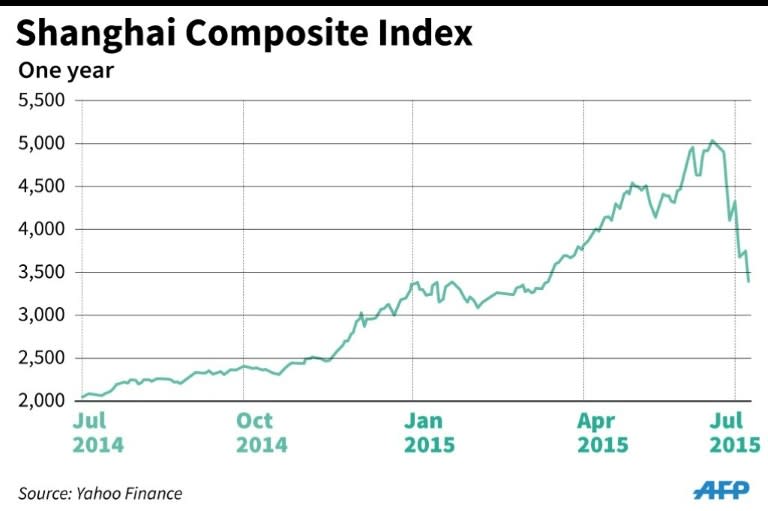

Chinese stocks stormed into positive territory in volatile trade Thursday as Beijing launched new measures to halt a dramatic sell-off, prompting Asian markets to rebound, but dealers questioned whether the gains would last. The main Shanghai index had fallen more than 30 percent since a spectacular bull run peaked on June 12, raising fears for the wider economy, the world's second-largest. But the benchmark surged 5.76 percent, or 202.14 points, to 3,709.33 on turnover of 673.3 billion yuan ($110.1 billion). It fell as much as 3.81 percent and rose up to 6.88 percent during the day, representing a swing of more than 10 percent. The Shenzhen Composite Index, which tracks stocks on China's second exchange, ended up 3.76 percent, or 70.90 points, to 1,955.35 on turnover of 277.6 billion yuan. More than 1,100 stocks on both markets surged by their 10 percent daily limits, data from the exchanges showed. The gains came after China moved to stop "major" shareholders -- those holding at least a five percent stake -- from selling their stocks and launched a probe into short-selling in a bid to calm markets. Short-selling is the selling of stock a trader does not own, in anticipation of a future fall in prices. Police are now planning a nationwide campaign to crack down on illegal operations with regards to securities and futures, to protect capital markets and investors' interests, the official Xinhua news agency reported late Thursday, citing the Ministry of Public Security. "As China beefs up its efforts to rescue the market... market sentiment is recovering slightly," Qian Qimin, an analyst at Shenwan Hongyuan Group, told Bloomberg News. "The rise today may help ease some selling pressure when companies resume their shares from trading, but whether it's sustainable will depend on what policies are coming next." More than 1,400 companies have been suspended from trading on China's share markets as of Thursday, representing around 50 percent of listed stocks, according to Bloomberg. The move temporarily averts further falls in their prices, but seizes up the markets. Heavyweight financial stocks rose. Shanghai-listed banking giant ICBC added 2.01 percent to 5.58 yuan, while Shenzhen-listed Ping An Bank jumped 8.11 percent to 14.26 yuan. Asian markets also rose Thursday, reversing heavy morning losses and tracking the surge in Shanghai. Hong Kong closed up 3.73 percent after the market recorded its biggest single-day loss for more than six years on Wednesday. Tokyo recovered from losses of more than three percent to end 0.60 percent higher. But US shares retreated overnight on worries about how the stock market rout could affect the Chinese economy -- a key driver of global growth -- and worries of a messy Greek exit from the eurozone. The Dow Jones Industrial Average finished down 1.47 percent. - 'Whatever it takes' - The falls of recent week were triggered by restrictions on margin trading, reinforced by concerns about overvaluations, and accelerated by "panic" selling among the retail investors who make up the vast majority of the market. Late Wednesday, China's market regulator barred major shareholders and executives of listed companies from selling their stocks for the next six months in order to "maintain stability", the latest government action to stem the slide. The rout in mainland shares has spread into some commodities, as China is a massive consumer of resources such as iron ore. Prices for iron ore -- the raw ingredient for steel of which China is the largest buyer -- plunged to six-year lows Thursday, with mining companies in resource-driven countries such as Australia and Brazil bearing the brunt. The spot price of the commodity had taken its biggest one-day hit ever overnight, falling 10 percent to $44.59 a tonne. "The risk from Chinese equities markets is clearly impacting commodities markets," IG Markets strategist Evan Lucas said in a research note. Among the latest intervention measures, the central People's Bank of China said on Thursday that it was providing liquidity to the state-backed China Securities Finance Corp. (CSF) to help stabilise the market, reaffirming an earlier pledge. In a separate announcement, the stock regulator said CSF will provide liquidity for investors to buy so-called "public funds" -- similar to mutual funds. Other recent moves include allowing insurance companies to invest more assets in stocks and a programme to buy the shares of smaller companies. On Thursday, six monitored insurance companies saw a net purchase of 15.1 billion yuan ($2.43 billion) in stocks and stock funds in a show of confidence, Xinhua reported, quoting China's insurance regulator. The country's 111 major state-owned enterprises were barred from selling shares in their listed subsidiaries by the state-owned Assets Supervision and Administration Commission, which oversees them. "The Chinese government is having a 'whatever it takes' moment with the stock market," Societe Generale said in a research report. "More resources will probably be ramped up for the battle in the coming days."

Yahoo Finance

Yahoo Finance