Arkema And Two More High-Yield Dividend Stocks To Consider

As the French market navigates a period of recovery, with the CAC 40 Index recently experiencing a decline amidst mixed corporate earnings and interest rate uncertainties, investors are keenly observing potential opportunities. In this context, high-yield dividend stocks like Arkema present an attractive consideration for those looking to potentially enhance portfolio stability and income in fluctuating markets.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 6.10% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 8.89% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.50% | ★★★★★★ |

Métropole Télévision (ENXTPA:MMT) | 9.53% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 3.87% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.09% | ★★★★★☆ |

Carrefour (ENXTPA:CA) | 5.49% | ★★★★★☆ |

Jacquet Metals (ENXTPA:JCQ) | 5.34% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 3.44% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.43% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

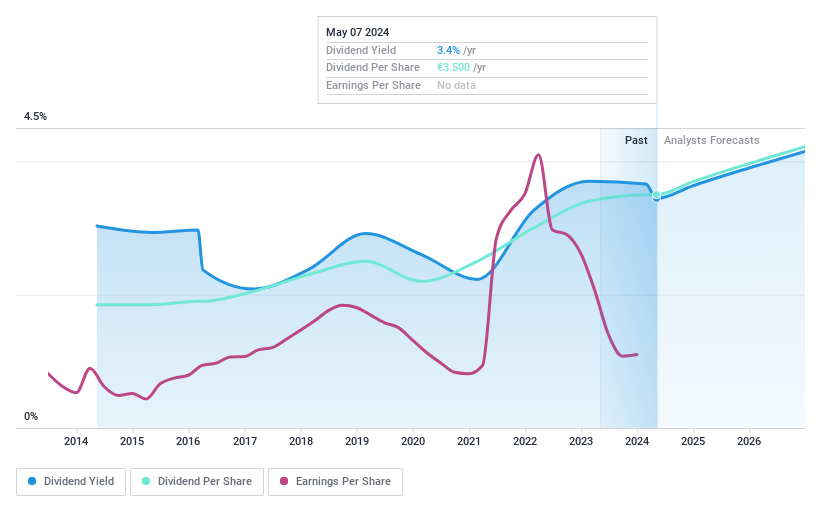

Arkema

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Arkema S.A. is a global manufacturer and seller of specialty chemicals and advanced materials, with a market capitalization of approximately €7.61 billion.

Operations: Arkema S.A.'s revenue is primarily generated from four segments: Adhesive Solutions (€2.71 billion), Advanced Materials (€3.56 billion), Coating Solutions (€2.40 billion), and Intermediates (€0.80 billion).

Dividend Yield: 3.4%

Arkema S.A. reported a decline in Q1 2024 sales to €2.34 billion and net income to €79 million, reflecting a decrease from the previous year's figures. Despite this downturn, Arkema maintains a stable dividend yield at 3.44%, supported by a reasonable payout ratio of 65% and cash payout ratio of 41%. The company recently completed a €400 million fixed-income offering, strengthening its financial flexibility. However, its current dividend yield is lower than the top quartile of French dividend payers at 5.25%.

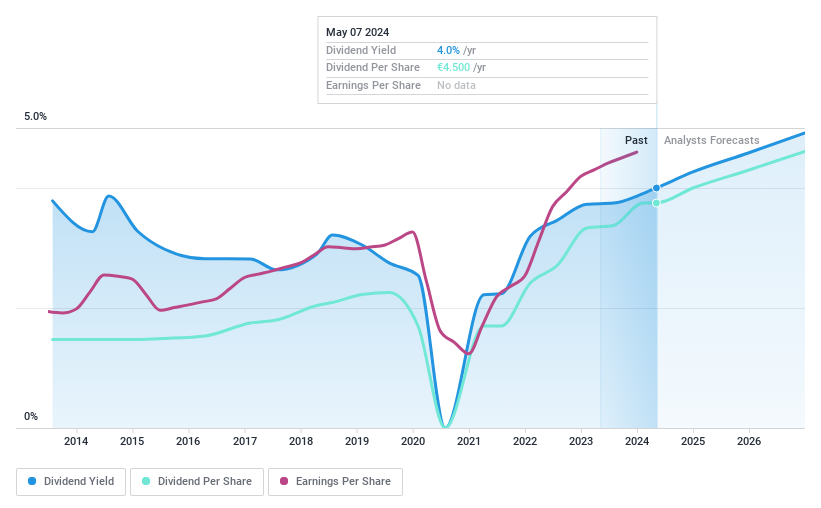

Vinci

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vinci SA operates in concessions, energy, and construction sectors both in France and globally, with a market capitalization of approximately €64.18 billion.

Operations: Vinci SA generates revenue through several key segments: VINCI Construction, including Eurovia, contributes €31.46 billion; VINCI Energies adds €19.33 billion; Concessions - VINCI Autoroutes brings in €6.88 billion; Concessions - VINCI Airports accounts for €4.23 billion; Cobra IS provides €6.50 billion; and Other Concessions and VINCI Immobilier and Holding Companies contribute €0.73 billion and €1.23 billion respectively.

Dividend Yield: 4%

Vinci's recent €53 million contracts in the U.S. for toll services and its strategic moves, like the acquisition of Northwest Parkway, highlight its expanding operational footprint. Despite a challenging tax environment with an impending €280 million levy impacting long-distance transport operators, Vinci anticipates maintaining net income levels close to 2023. However, its dividend yield at 4% trails behind France’s top quartile. The dividend's sustainability is supported by a reasonable payout ratio of 54.4% and cash payout ratio of 35.6%, but its historical volatility could concern conservative investors seeking stable returns.

Click here to discover the nuances of Vinci with our detailed analytical dividend report.

Upon reviewing our latest valuation report, Vinci's share price might be too pessimistic.

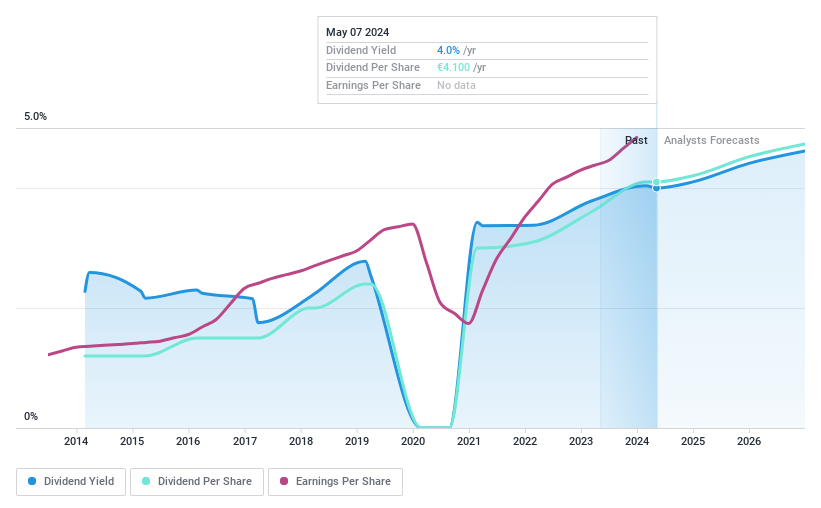

Eiffage

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eiffage SA operates in various sectors including construction, property and urban development, civil engineering, metallic construction, roads, energy systems, and concessions both in France and globally, with a market capitalization of approximately €9.64 billion.

Operations: Eiffage SA's revenue is primarily derived from its Infrastructures segment at €8.43 billion, followed by Energy Systems with €5.99 billion, Construction at €4.29 billion, and Concessions generating €3.90 billion.

Dividend Yield: 4%

Eiffage S.A. reported a notable increase in sales to €22.37 billion and net income to €1.01 billion for 2023, reflecting earnings growth of 11.8% annually over the past five years. Despite a low dividend yield of 4%, which is below the top quartile in France, dividends are well-supported by a payout ratio of 38.5% and cash flows with a cash payout ratio at 15.6%. However, its dividend track record has been inconsistent, showing volatility over the past decade.

Dive into the specifics of Eiffage here with our thorough dividend report.

The valuation report we've compiled suggests that Eiffage's current price could be quite moderate.

Seize The Opportunity

Gain an insight into the universe of 28 Top Dividend Stocks by clicking here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:AKEENXTPA:DG and ENXTPA:FGR

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance