Aridis (ARDS) Up on Receiving FDA's QIDP Designation for AR-301

Aridis Pharmaceuticals ARDS announced that the FDA has granted the Qualified Infectious Disease Product (QIDP) designation to its novel drug candidate, AR-301. Shares of the company were up almost 26% on Jul 13, following the news.

AR-301 is a fully human IgG1 monoclonal antibody, currently being evaluated in the phase III study. The candidate is being developed as an adjunctive therapy for the treatment of pneumonia caused by gram-positive bacteria, Staphylococcus aureus (S. aureus), in mechanically ventilated hospitalized patients.

Per the company, this designation made AR-301 the first antibacterial biologics to receive the QIDP label, paving the way for expedited drug development and regulatory review processes. It further strengthens ARDS’ position as it progresses through the confirmatory phase III study and prepares for the submission of a biologics license application (BLA) for AR-301.

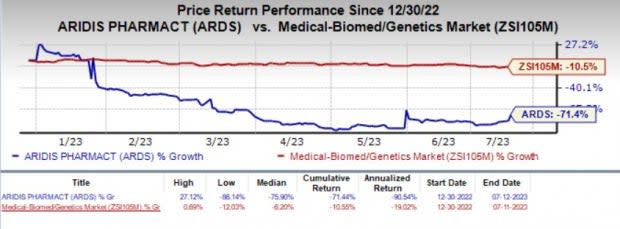

Aridis’ shares have nosedived 71.4% year to date compared with the industry’s 10.5% decline.

Image Source: Zacks Investment Research

In May 2023, ARDS announced that the FDA has accepted the company’s proposal of a single confirmatory phase III AR-301-003 study of AR-301 for treating pneumonia. The agreement with FDA includes certain key details regarding the confirmatory phase III study that is required to support the submission of a BLA.

Aridis has also reached an agreement with the FDA regarding the expansion plan of the study. The target patient group affected by S. aureus ventilator-associated pneumonia (VAP) shall include ventilated hospital-acquired pneumonia and ventilated community-acquired pneumonia patients.

ARDS’ lead candidate, AR-320, is being developed as the preventive treatment of S. aureus pneumonia. AR-320 and AR-301 are two complementary products being developed by the company.

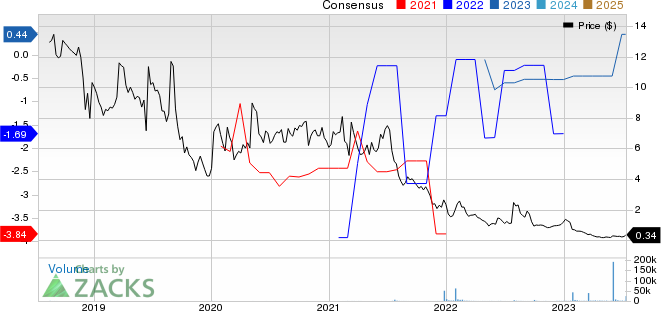

Aridis Pharmaceuticals Price and Consensus

Aridis Pharmaceuticals price-consensus-chart | Aridis Pharmaceuticals Quote

Zacks Rank & Stocks to Consider

Aridis currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the overall healthcare sector are Omega Therapeutics OMGA, Akero Therapeutics AKRO and ImmunoGen IMGN. While Omega Therapeutics sports a Zacks Rank #1(Strong Buy), both Akero Therapeutics and ImmunoGen carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Omega Therapeutics has narrowed from a loss of $2.49 per share to a loss of $2.05 for 2023 in the past 90 days. Shares of the company have nosedived 20% year to date.

OMGA’s earnings beat estimates in two of the trailing four quarters, met the mark in one and missed in another, delivering an average surprise of 8.24%.

The consensus estimate for Akero Therapeutics has narrowed from a loss of $2.97 per share to a loss of $2.80 for 2023 in the past 90 days. The company's shares have nosedived 18.2% year to date.

AKRO’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 7.96%.

The consensus mark for ImmunoGen has narrowed from a loss of 81 cents per share to a loss of 53 cents for 2023 in the past 90 days. Shares of the company have rallied 276.8% year to date.

IMGN’s earnings beat estimates in two of the trailing four quarter and missed the mark in other two, delivering an average surprise of 7.09%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ImmunoGen, Inc. (IMGN) : Free Stock Analysis Report

Aridis Pharmaceuticals (ARDS) : Free Stock Analysis Report

Akero Therapeutics, Inc. (AKRO) : Free Stock Analysis Report

Omega Therapeutics, Inc. (OMGA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance