Arcadia's poor sales blamed for squeeze on suppliers

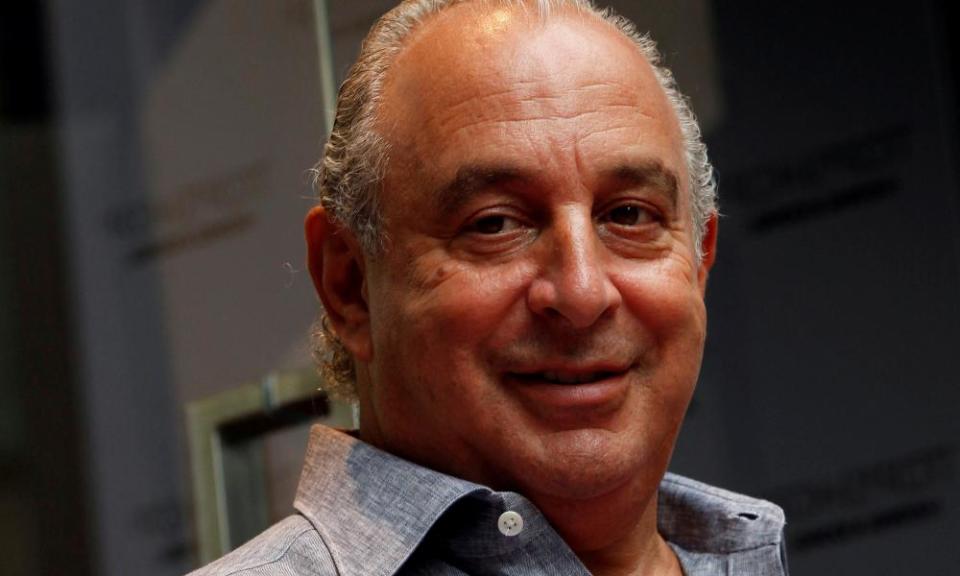

Sir Philip Green’s retail business has told suppliers that Arcadia Group is imposing a discount on all current and existing orders from next month.

The group’s CEO Ian Grabiner, blaming changes in the retail market, told suppliers that it would pay 2% less on both existing and future orders from 1 February, saving the company millions.

Arcadia, which includes high street brands like Burton, Miss Selfridge, Topshop and Dorothy Perkins, told suppliers in a letter: “I know this is not news that you would wish to hear, but we have absorbed significant costs in technology, distribution and people as I have earlier in order to remain competitive in the global market and we trust you will continue to support us.”

The cost-cutting move follows poor sales across Green’s retail empire, which saw profits slump 79% in 2016 in the wake of the BHS collapse and subsequent pension scandal. Pre-tax profits fell to £36.8m, compared with £172.2m in the previous year.

The fashion mogul is said to have appointed management consultants McKinsey to help turn Arcadia’s fortunes round, with a particular focus on internet sales.

“We recently asked our suppliers for a small increase in our discount terms. The cost of servicing and delivering to our customers through new channels is considerably higher than through the traditional retail market place,” Arcadia said in a statement.

“This has resulted in major investment in our infrastructure in terms of systems and distribution as well as a large headcount increase. These substantial developments to our business will mutually benefit our suppliers.”

A source close to the company told the Guardian it had asked suppliers for discounts as it faced heavy competition from online players as well as the rising cost of distributing its clothes, running stores and selling online.

“It’s a tough, competitive market and the costs of doing business have escalated dramatically,” the source said, adding that Arcadia was known for having reasonable terms compared with some rivals. “We don’t think this is draconian.”

Citing rising pressure from online rivals like boohoo, Missguided and Asos, the company source suggested that Arcadia brands have been trading poorly due to online competition.

The fashion industry has had a tough season after a warm autumn enabled shoppers to put off buying coats and knitwear, while business rates, the minimum wage and other costs have risen.

Fashion has also slipped down shoppers’ lists as they spend more on eating out, going on holiday, using their phones and other experiences. Shoppers also have less money to spend because inflation is outstripping wage rises.

New Look, Debenhams and Marks & Spencer are all expected to close stores, and John Lewis has been cutting staff as they try to adapt to changing shopping habits.

Yahoo Finance

Yahoo Finance