Applying for a BTO and Then Breaking Up – How Much Will it Cost You

Breakups are one of the most traumatic experiences a person can go through. Your self-esteem gets crushed, you feel unwanted and unloved, and you’ve got to deal with the prospect of being alone forevermore.

Unfortunately, it gets worse. If you and your ex had actually gone so far as to ballot for a BTO flat, you’ll also face the prospect of losing money. And depending on how far you’ve gotten in the purchase process, you could be looking at a loss of tens of thousands of dollars.

Here’s what to expect when you cancel your BTO flat purchase because of a breakup:

You have selected your flat, but haven’t signed the Sale and Purchase Agreement yet

So you’ve balloted for a flat, and been selected to pick a unit. When you chose your unit, you would have paid an Option Fee of $2,000 for a 4/5 room flat, $1,000 for a 3-room flat or $500 for a 2-room flexi flat.

The only cash you lose, other than the $10 application fee, will be the option fee. Financially, you’ll have emerged relatively unscathed, as couples who have signed the Sale and Purchase Agreement stand to lose a lot more.

You’ll not be allowed to apply to buy or ballot for another flat for one year. And the next time you decide to ballot for a flat, either as a single or with a new love, additional chances accumulated from previous unsuccessful applications will be reset to zero so you won’t find it any easier to get a flat.

You have signed the Sale and Purchase Agreement but haven’t collected your keys yet

At this stage in the purchase process, you would have already paid a total of 5% to 20% of the property’s purchase price as downpayment. This sum would include the option fee you paid earlier when booking the flat.

If you are taking an HDB loan you would have paid 10% of the purchase price (or 5% if under the Staggered Downpayment Scheme). Those taking bank loans would have paid 20% of the purchase price (or 10% if under the Staggered Downpayment Scheme).

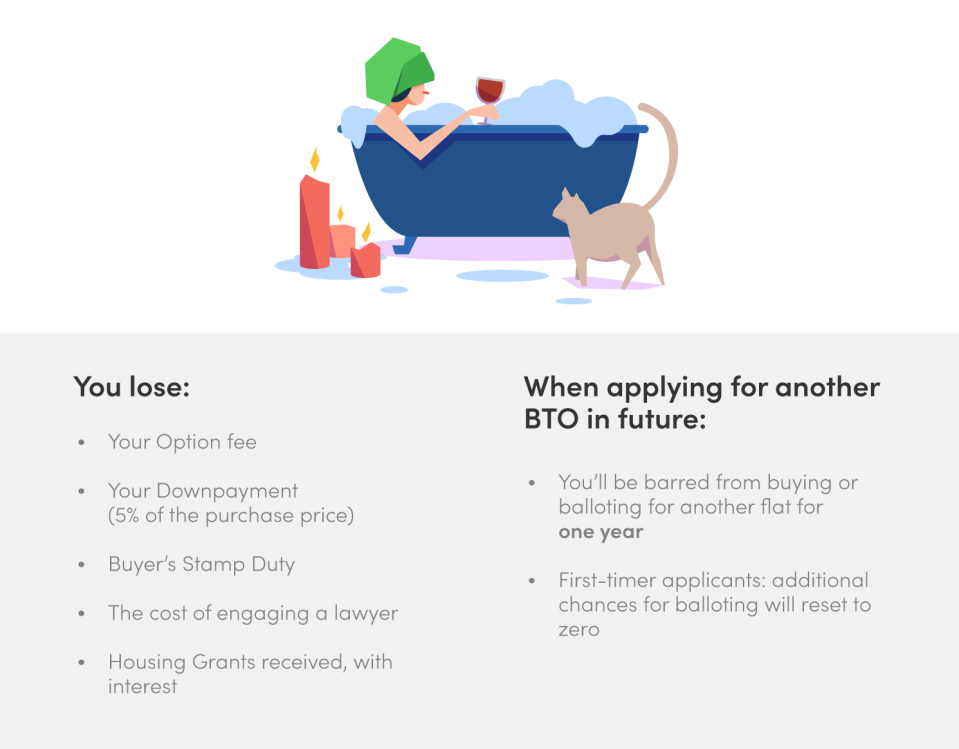

You would also have paid the Buyer’s Stamp Duty, as well as the cost of engaging a lawyer, whether HDB’s or your own.

Assuming you are buying a $400,000 flat and taking out a bank loan, that would mean you’d lose 20% of the purchase price amounting to $80,000, as well as $6,600 being Buyer’s Stamp Duty, and legal fees and disbursements incurred by the lawyer for lodging a caveat, etc.

Do note that it might be possible for your/HDB’s lawyer to apply to IRAS to ask for a refund of your Buyer’s Stamp Duty. HDB will excuse you from paying their conveyancing fee if you’re using their lawyers, but an external lawyer will not.

You will also have to give back to the government the housing grants you’ve received with interest, so hopefully you haven’t spent them on anything yet.

Finally, it goes without saying that you’ll be barred from balloting for or buying a flat for a year, and lose your advantages as a first-timer applicant the next time you do decide to ballot.

You have already collected your keys

So you received notice that your keys were ready for collection, and that you would need to submit your ROM cert by a certain date. But in the end you didn’t go through with the marriage.

In this case, the BTO flat is already in your possession and will have to be surrendered to the HDB.

At this stage, you would have already paid the balance of the purchase price of the flat using cash, CPF funds, and/or disbursements of your bank loan.

There are other miscellaneous fees you will have incurred at this point, such as registration fees for your mortgage in-escrow if you’re taking out a loan, stamp duty on your mortgage, survey fees, as well as fire insurance and fees for the Home Protection Scheme.

The HDB will take back your flat and offer you some compensation in return, the amount of which will be determined at their discretion, but you can still expect to lose quite a bit of money. If your bank has already disbursed your home loan, don’t forget that a large chunk of this money will have to go towards repaying this loan.

You’ll also be barred from applying for another BTO flat for a number of years.

As you can see, breaking up in Singapore is hard when there’s a BTO flat involved. Be that as it may, if you get a sinking feeling when you think of tying the knot, you’re better off going for counselling and if that doesn’t change things, calling off the union altogether. The consequences of a divorce can be far costlier and more emotionally draining.

Do you have any concerns about how the BTO process affects couples who are having problems with their relationship? Share them in the comments.

Buying a home? Here are some related articles to check out:

Home Loans in Singapore – The Complete Guide to Property Loans

Best Home Loans Singapore (2018) – Most Affordable Housing Loans Reviewed

Getting an EC vs. BTO Flat: What are the Differences?

The post Applying for a BTO and Then Breaking Up - How Much Will it Cost You appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

More From MoneySmart

Yahoo Finance

Yahoo Finance