Apple: A Compounding Machine Slowing Down

Apple Inc. (NASDAQ:AAPL) is on the podium for being among the most well-known, highest-market capitalized and profitable companies in the world. It generally needs no introduction, but as it says in its 10-K filing:

"Apple revolutionized personal technology with the introduction of the Macintosh in 1984. Today, Apple leads the world in innovation with iPhone, iPad, Mac, Apple Watch, and Apple TV. Apple's five software platforms iOS, iPadOS, macOS, watchOS, and tvOS provide seamless experiences across all Apple devices and empower people with breakthrough services including the App Store, Apple Music, Apple Pay, and iCloud. Apple's more than 100,000 employees are dedicated to making the best products on earth, and to leaving the world better than we found it."

At its core, the company has this double strategy of manufacturing and selling both the hardware (PCs, tablets, smartphones and accessories) as well as the software.

Segment breakdown

The company is divided in to two main businesses: Products (basically hardware) and Services, which make up the huge $383 billion in revenue. Apple further divides its business into five categories. The iPhone has the lion share of it all with 52.20% of net sales, followed by Services (22.20%) and then the other hardware/products, Wearable, Home and Accessories (10.40%), Mac (7.60%) and iPad (7.40%).

What does Apple mean by services, exactly? Well, the list is long and chances are you know them all, but they encompass advertising (including third-party licensing arrangements and the company's own advertising platforms), AppleCare (a portfolio of fee-based service and support products), Cloud Services (with interactions also with Windows personal computers), Digital Content (App Store, etc.), subscription-based services (including Apple Arcade for games, Apple Fitness+SM for personalized fitness, Apple Music, Apple News+ and Apple TV+ with exclusive original content and live sports ever expanding). Last but not least are Payment Services (including Apple Card, a co-branded credit card not yet available in Italy, and Apple Pay, a cashless payment service based on NFC technology).

The newest of these services is Apple Sports, which was launched in February. The free app provides real-time scores for sporting events, key statistics and betting odds.

Source: Apple's official website.

This vast segment as a whole represents one of the most promising growth factors due to the loyalty of Apple's user base with various estimates ranging around 80% and a high user retention of around 90%.

This is a key factor as the hardware part of the company is approaching its saturation (especially referring to iPhones). As CEO Tim Cook noted in the company's latest earnings release:

"We are pleased to announce that our installed base of active devices has now surpassed 2.2 billion, reaching an all-time high across all products and geographic segments."

Why all the fuss about services?

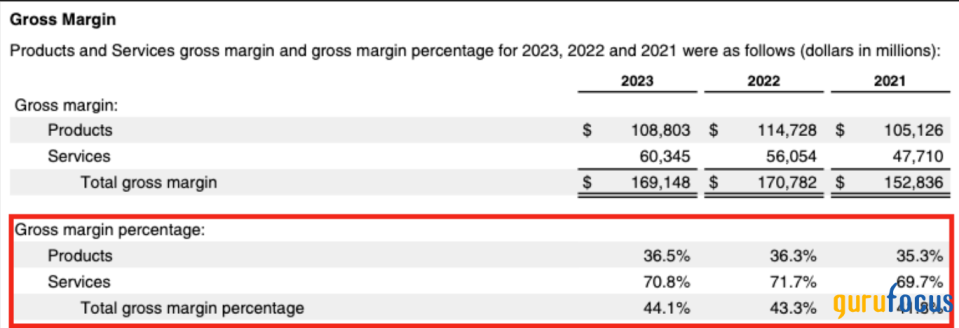

Taking a closer look at Apple's margins for its services, the results are eye-watering. A 70% gross margin is quite impressive for a category still considered to be in its growth phase.

Source: Apple's 10-K.

It is also important to mention the tech giant's global footprint. Over the past three years, it has made around half of its sales from outside the Americas. This means $93 billion from Europe, plus $72 billion from China, $24 billion from Japan and $29 billion from the rest of Asia Pacific in the last fiscal year alone. Attached to the wide diversity in its cash streams is the sensitivity the company has to foreign exchange fluctuations, which can be estimated to be around 3%. Do remember that a stronger U.S. dollar leads to lower sales, all other factors being equal.

This is a strong point against those saying the company is American. Rather, one could argue it is a truly global company.

Future developments

What about AI?

I am not sure what Apple's future holds in respect to artificial intelligence, but some key factors to consider should be the fact the company has a proven track record of innovation, an abundance of cash resources ($61.50 billion as per the most recent fiscal year), a high rate of strategic acquisitions (reported to have acquired more than 30 AI companies in 2023) and the availability of massive data sets to train machine learning algorithms.

VisionPro anyone?

As for the VisionPro headset, I am not pricing this fancy new virtual reality product into the valuation yet. The motivation is twofold: (a) I have not used it yet and (b) I do not fully understand its true potential, nor does the general public. Will it be like the iPhone back in 2007 when it launched and Steve Ballmer famously laughed at its high price tag (around $500) with the then-unthinkable lack of a physical keyboard?

Prepare to discover it!

Risks

As is always the case with tech companies, Apple is facing several risks in both the short term and long term.

Some new risks regard the increasing probability of opening up the App Store (as per legislative initiatives, such as the EU Digital Markets Act, the anticompetitive investigation around Epic Games and Spotify (NYSE:SPOT)), but also the growing and sticky China restrictions (as in the sales of iPhones).

Last but not least, the crowded smartphone industry, especially with Asian companies (notably the fierce competition from Samsung (XKRX: 005930), which recently already added AI capabilities to its new Galaxy S24 device).

Valuation

It is not easy to value the stock. Since one of the company's major characteristics is its record-breaking market capitalization ($2.62 trillion as of the time of writing), valuation by comparison is quite impractical. It would mean making a lot of assumptions (e.g., economy of scale, tangibleness of business model), hence potentially invalidating the results. Apple has definitely maintained a solid balance sheet since its founding, but lately this trend has been inverting.

Since 2019, some common financial strength ratios have decreased, in particular due to declining cash and equivalents and short-term investments, to the tune of $39 billion over a five-year period. Accumulating liquidity forever was obviously a synonym for poor usage of resources and a non-desired goal. The time came to put this huge pile of cash to work during the final years of the Covid-19 pandemic as inflation and increased competition impacted tech stocks.

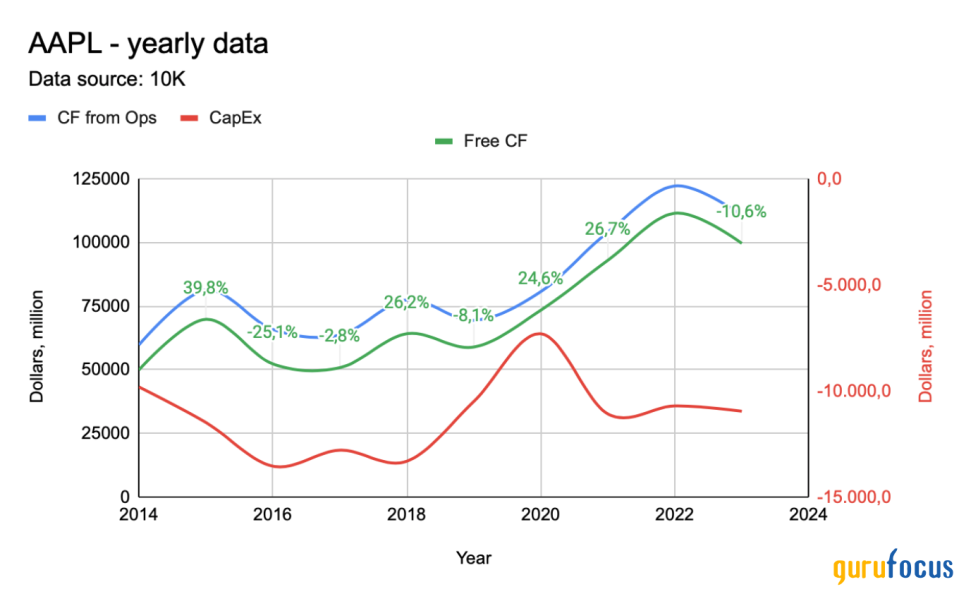

The sterile financial ratios, with a current ratio of 0.98 and a cash-to-debt ratio of 0.68, only tell one side of the story. On the flip side, Apple managed to post sound business performance with a 59% increase in cash from operations and an even more impressive 68% surge in free cash flow over the same period from 2019 to 2023. Also beware that wise usage of funds has been a distinctive feature of Apple that averaged a return on invested capital of 25% in the last decade, never posting a single-digit figure in this metric.

Given all that, I base my valuation on free cash flow and its trend over the past five years, starting from a value of $105 billion.

Source: Author's calculations.

The company uses it cash mostly to repurchase shares. During 2023, $76.60 billion worth of common stock was repurchased and it paid $15 billion in dividends. The current dividend yield is quite low at 0.50%. Not only is this good fiscally, but also for shareholders.

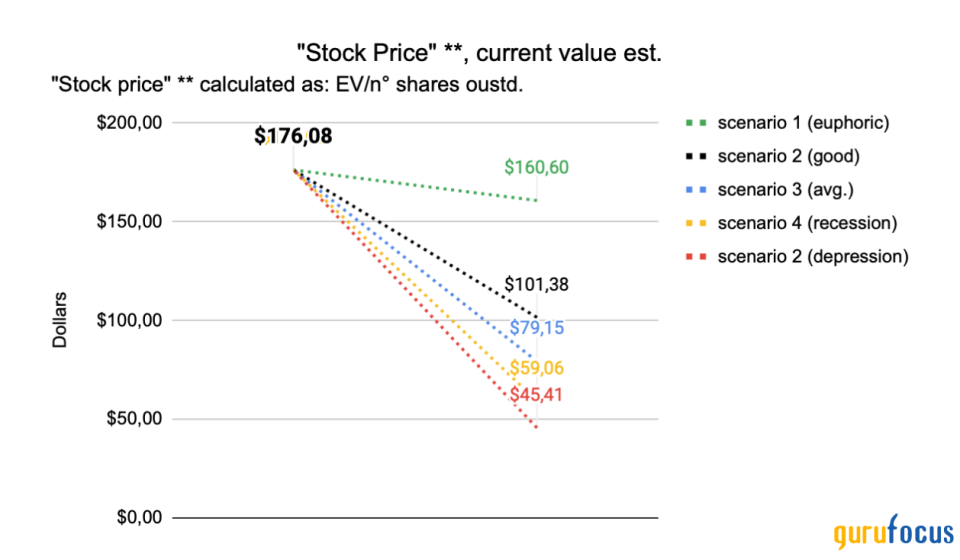

I imputed different growth rates for year one to five and six to 10, as well as different discount rates and terminal value multiples according to five hypothesized Mr. Market manic-depression moods. With respect to the broader enterprise value, the results are surprising.

There is no one scenario in which Apple can comfortably be viewed as on sale or a possible buy.

Assuming the 15.80 billion in fully diluted shares outstanding, the overvaluation ranges between 10% and 74%.

Source: Author's calculations.

The market is currently giving the stock a price-earnings ratio in line with the average for the hardware industry of 26, but much more weight is given to the sales, as shown by the high price-sales ratio of 6.93.

Conclusion

Sometimes it is better to buy great companies at fair prices than the other way around (credits to the late Charlie Munger). This time I do not feel comfortable about the fair price even though I consider Apple to be great. The stock can be considered overvalued currently.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance