Here's Why Shares of Warrior Met Coal Got Pummeled in November

What happened

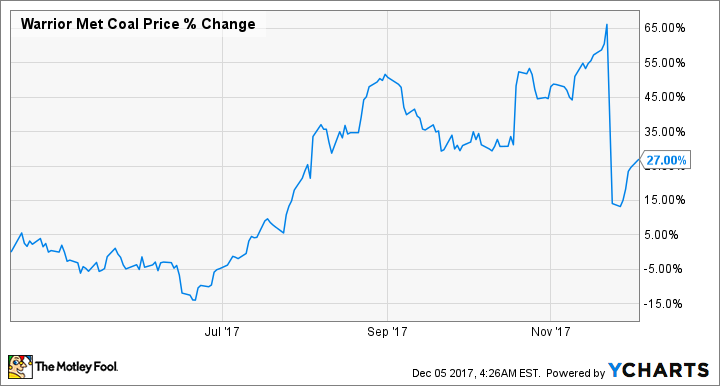

Shares of metallurgical coal producer Warrior Met Coal (NYSE: HCC) declined 16.6% in November. Much of that sell-off occurred on Nov. 22 when shares dropped 31% after the company paid a special dividend.

So what

Warrior Met Coal is the company that emerged from the Walter Energy bankruptcy back in 2015. The new company purchased a couple of Walter's select metallurgical coal mines and Walter's former noteholders took an equity stake in the new business. So far, the company has done reasonably well. Its third-quarter results show that production is up 180% compared to this time last year, and the company has been able to turn a decent profit thanks to rising metallurgical coal prices and the absence of an onerous debt load.

Image source: Getty Images.

Back in October, the company announced it would pay a hefty special dividend to its investors in the range of $600 million, and it issued $350 million in senior notes to help fund that special dividend. Shares popped 11% on the announcement. That total dividend ended up being an $11.21 per share distribution that, at the time of the ex-dividend date, was a 40% (!!!) yield.

Now what

It's hard to find management's reasoning for this from an individual investor's point of view. Offering a lump sum investment like that is going to get a lot of short-term investors to come in, take a massive lump sum payment, and then cash out. This isn't the kind of move that is going to foster a relationship with long-term investors.

What's even more peculiar is that the company elected to take on debt for the sole purpose of paying a special dividend, so there is no way to make a return on the raised capital. Sure, the company was essentially debt free and had the ability to add debt to its balance sheet, but doesn't really feel worth it. That was financial firepower it could have saved to grow the business or to act as a cushion in the event of a crash in met coal prices. Now, the company has to pay 8% on an unnecessary loan when it could have made a sizable special dividend with just the cash on hand.

Warrior Met Coal looks like it has a low-cost production source for metallurgical coal and an ability to generate free cash flow, which are traits one would want in a commodity business. Management moves like this, though, really have to make you wonder if it has the best interests of long-term shareholders in mind. That is enough of a reason that investors may want to take a pass on this stock.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Tyler Crowe has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance