What's in the Offing for Archer Daniels' (ADM) Q1 Earnings?

Archer Daniels Midland Company ADM is slated to report first-quarter 2018 results on May 1. The company has a mixed record of earnings surprise in the trailing four quarters, with an average beat of 1.7%.

The Zacks Consensus Estimate of 56 cents for the quarter under review moved south by 3 cents in the last seven days and reflects a decline of 6.7% year over year.

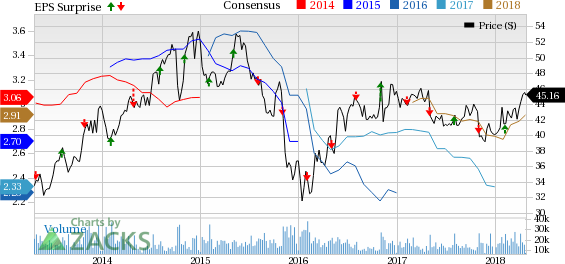

Archer Daniels Midland Company Price, Consensus and EPS Surprise

Archer Daniels Midland Company Price, Consensus and EPS Surprise | Archer Daniels Midland Company Quote

Let’s see how things are shaping up prior to the first-quarter earnings announcement.

Factors at Play

Archer Daniels has been struggling with a dismal surprise history for quite a long time. In fact, the company has lagged sales estimates for more than three years now. Notably, analysts polled by Zacks expect first-quarter revenues to be $14,965 million, down 0.2% from the year-ago quarter. Though the company delivered earnings beat in fourth-quarter 2017, it recorded negative surprises in eight of the preceding 10 quarters. This drab performance can be attributed to fluctuating commodity prices, oversupply in the industry and unfavorable margins.

In the previous quarter, the company’s margins remained under pressure due to soft operating performance at the Oilseeds Processing segment. Despite robust crush volumes and persistent growth in demand, results were hurt by soft crush margins and lower South American origination margins. These factors also hampered Crushing and Origination results. Additionally, soft biodiesel results affected Refining, Packaging, Biodiesel and Other operations.

However, Archer Daniels’ solid focus on cost savings to strengthen business is commendable. It remains focused on cost synergy activities by addressing redundancies and removing overlapping corporate SG&A. Furthermore, the company’s Project Readiness program that aims at enhancing operational efficiency at production and supply chain networks to curtail costs bodes well. Management has also been on track with business transformation, under its 1ADM program.

In March, management realigned its business into four segments namely Carbohydrate Solutions, Nutrition, Oilseeds and Origination, to accelerate growth and resonate well with changing customers’ needs. These changes will be reflected in first-quarter 2018 results. The new business segments are expected to clearly differentiate the company’s product and service offerings, while justifying its operating structure. Additionally, the segments should help Archer Daniels provide value-added and exclusive product assortments, hence boost growth across its business portfolio. These efforts, in turn, are likely to add stimulus to the company’s performance and profitability.

Given the major strengths and weaknesses, let’s wait and see what lies ahead for Archer Daniels when it reports quarterly results.

What Does the Zacks Model Say?

Our proven model does not show that Archer Daniels is likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Archer Daniels sports a Zacks Rank #1, which increases the predictive power of earnings beat. However, the company’s Earnings ESP of -7.47% makes surprise prediction difficult.

Stocks With Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Colgate-Palmolive Company CL has an Earnings ESP of +0.69% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Church & Dwight Co., Inc. CHD has an Earnings ESP of +0.52% and a Zacks Rank of 3.

Sysco Corporation SYY has an Earnings ESP of +0.77% and a Zacks Rank #3.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sysco Corporation (SYY) : Free Stock Analysis Report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance