Apogee (APOG) Earnings Surpass Estimates in Q4, Rise Y/Y

Apogee Enterprises, Inc. APOG reported fourth-quarter fiscal 2024 (ended Mar 2, 2024) adjusted earnings per share (EPS) of $1.14, surpassing the Zacks Consensus Estimate of 97 cents. The bottom line increased 32.6% year over year.

Including one-time items, the company reported earnings per share of 71 cents compared with the year-ago quarter's 91 cents.

Apogee generated revenues of $362 million in the quarter under review, up 5.2% year over year on solid growth in Architectural Services and Architectural Glass. The top line surpassed the Zacks Consensus Estimate of $343 million.

Apogee Enterprises, Inc. Price, Consensus and EPS Surprise

Apogee Enterprises, Inc. price-consensus-eps-surprise-chart | Apogee Enterprises, Inc. Quote

Operational Update

Cost of sales in the fiscal fourth quarter rose 2.8% year over year to $273 million. The gross profit grew 13.3% year over year to $88.5 million. The gross margin increased to 24.4% in the quarter from the prior-year quarter's 22.7%.

The selling, general and administrative (SG&A) expenses rose 27.2% year over year to $67 million. The operating income was $34.3 million in the quarter under review compared with prior-year quarter’s $25.7 million.

Segmental Performance

In the fiscal fourth quarter, revenues in the Architectural Framing Systems segment were down 6.3% year over year to $139 million due to lower volume. The segment's operating income was $12.8 million compared with the year-ago quarter's $15.6 million.

Revenues in the Architectural Glass segment rose 18.2% year over year to $96 million, attributed to improved pricing and mix. The segment's operating profit was $18.9 million compared with $9.5 million in 2022.

Revenues in the Architectural Services segment improved 7.9% year over year to $106 million on a favorable mix of projects. The segment reported an operating income of $6.2 million compared with $3.7 million a year ago.

Revenues in the Large-Scale Optical Technologies segment fell 0.4% year over year to $27 million, driven by lower volumes. The segment reported an operating profit of $6.9 million in the fiscal fourth quarter compared with the prior-year quarter's $5.8 million.

Backlog

The Architectural Services segment's backlog was $808 million at the end of the fiscal fourth quarter compared with $777 million in the prior quarter’s end. The backlog in the Architectural Framing segment amounted to $201 million, up from $184 million at the end of third-quarter fiscal 2024.

Financial Position

Apogee had cash and cash equivalents of $37.2 million at the end of fiscal 2024 compared with $19.9 million at the end of fiscal 2023. Cash generated from operating activities was $204 million in fiscal 2024 compared with the prior year’s $103 million.

Long-term debt was $62 million at the end of fiscal 2024 compared with $170 million at the end of fiscal 2023. Apogee returned $33 million of cash to shareholders through share repurchases and dividend payments in fiscal 2024.

FY24 Performance

Apogee reported adjusted EPS of $4.77 in fiscal 2024 compared with $3.98 in the prior year. Earnings beat the Zacks Consensus Estimate of $4.61. Including one-time items, the bottom line was $4.51, down from $4.64 in fiscal 2023. Sales were down 1.6% year over year to $1.41 billion, which beat the Zacks Consensus Estimate of $1.40 billion.

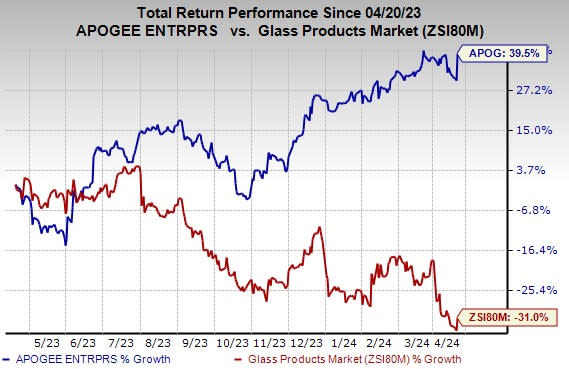

Price Performance

Shares of Apogee have gained 39.5% in the past year against the industry's decline of 31%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Apogee currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the Industrial Products sector are Applied Industrial Technologies AIT, Chart Industries, Inc. GTLS and Cadre Holdings, Inc. CDRE. AIT currently sports a Zacks Rank #1 (Strong Buy), and GTLS and CDRE carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Applied Industrial has an average trailing four-quarter earnings surprise of 13.9%. The Zacks Consensus Estimate for AIT’s 2024 earnings is pinned at $9.43 per share, which indicates year-over-year growth of 7.8%. Estimates have been unchanged in the past 60 days. The company’s shares have gained 43.3% in the past year.

The Zacks Consensus Estimate for Chart Industries’ 2024 earnings is pegged at $11.79 per share. The consensus estimate for 2024 earnings has moved 5% north in the past 60 days and suggests year-over-year growth of 93.6%. The company has a trailing four-quarter average earnings surprise of 75.9%. GTLS shares have gained 15.3% in the past year.

The Zacks Consensus Estimate for Cadre Holdings’ 2024 earnings is pegged at $1.15 per share. The consensus estimate for 2024 earnings has moved 6% north in the past 60 days and suggests year-over-year growth of 16.7%. The company has a trailing four-quarter average earnings surprise of 33%. CDRE shares have gained 72% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Apogee Enterprises, Inc. (APOG) : Free Stock Analysis Report

Chart Industries, Inc. (GTLS) : Free Stock Analysis Report

Cadre Holdings, Inc. (CDRE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance