Analog Devices (ADI) Q4 Earnings Beat, Revenues Rise Y/Y

Analog Devices Inc. ADI reported fourth-quarter fiscal 2021 adjusted earnings of $1.73 per share, beating the Zacks Consensus Estimate by 2.4%. The bottom line increased 20% year over year and 0.6%, sequentially.

Revenues of $2.34 billion surpassed the Zacks Consensus Estimate of $2.30 billion. Also, the top line improved 53% year over year and 33% from the third-quarter fiscal 2021 level.

The strong performance delivered by Analog Devices across the consumer, communications, industrial and automotive markets drove the top line.

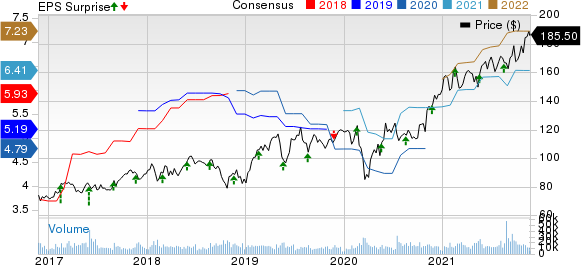

Analog Devices, Inc. Price, Consensus and EPS Surprise

Analog Devices, Inc. price-consensus-eps-surprise-chart | Analog Devices, Inc. Quote

Revenues by End Markets

Industrial: Analog Devices generated revenues of $1.2 billion (accounting for 50% of total revenues), which grew 45% year over year.

Communications: Revenues from the market were $351.6 million (15% of revenues), increasing 13% year over year.

Automotive: Revenues from the market summed $452.6 million (19% of revenues), up 97% from the year-ago quarter’s level.

Consumer: The market generated revenues of $356.9 million (15% of revenues), reflecting 107% growth on a year-over-year basis.

Operating Details

Adjusted gross margin expanded 90 basis points (bps) on a year-over-year basis to 70.9%.

Adjusted operating expenses were $650.7 million, up 50.8% from the year-ago quarter’s level. As a percentage of revenues, adjusted operating expenses were 27.8%, contracting 50 bps year over year.

Adjusted operating margin expanded 140 bps on a year-over-year basis to 43.1% in the reported quarter.

Balance Sheet & Cash Flow

As of Oct 30, 2021, cash and cash equivalents were $1.98 billion, up from $1.5 billion as of Jul 31, 2021.

Long-term debt was $6.25 billion at the end of the fiscal fourth quarter compared with $3.82 billion at the end of the fiscal third quarter.

Net cash provided by operations was $940.7million in the reported quarter, up from $630.04 million in the prior quarter.

ADI generated $810 million of free cash flow in the fiscal fourth quarter.

Additionally, Analog Devices returned $2.5 billion to its shareholders, of which it made dividend payments of $371 million and repurchased shares worth $2.1 billion in the fiscal fourth quarter.

Guidance

For first-quarter fiscal 2022, ADI expects revenues of $2.60 billion (+/- $100 million). The Zacks Consensus Estimate for the same is pegged at $2.48 billion.

Non-GAAP earnings are expected to be $1.78 (+/- $0.10) per share. The consensus mark for the same is pegged at $1.68 per share.

Analog Devices anticipates non-GAAP operating margins of 43.3% (+/- 70 bps).

Zacks Rank & Stocks to Consider

Currently, Analog Devices carries a Zacks Rank #4 (Sell).

Investors interested in the broader technology sector can consider some better-ranked stocks like Alphabet GOOGL, Advanced Micro Devices AMD and Mimecast MIME. While Alphabet sports a Zacks Rank #1 (Strong Buy), Advanced Micro Devices and Mimecast carry a Zacks Rank #2 (Buy), presently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Alphabet has gained 66.9% on a year-to-date basis. The long-term earnings growth rate for the stock is currently projected at 25.8%.

Advanced Micro Devices has soared 66.3% on a year-to-date basis. The long-term earnings growth rate is currently projected at 46.2%.

Mimecast has surged 37.8% on a year-to-date basis. The long-term earnings growth rate is currently predicted at 35%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Mimecast Limited (MIME) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance