Analog Devices (ADI) Q2 Earnings & Revenues Beat, Fall Y/Y

Analog Devices Inc. ADI has reported second-quarter fiscal 2024 adjusted earnings of $1.40 per share, which surpassed the Zacks Consensus Estimate by 11.1%. The bottom line declined 51% from the year-ago quarter.

Revenues of $2.16 billion beat the Zacks Consensus Estimate of $2.10 billion. The top line fell 34% from the year-ago quarter.

Softness in the communications, consumer, automotive and industrial end-markets was a major negative.

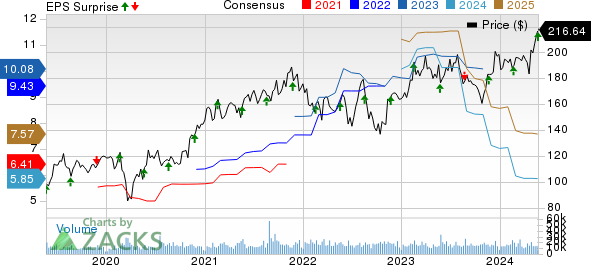

Analog Devices, Inc. Price, Consensus and EPS Surprise

Analog Devices, Inc. price-consensus-eps-surprise-chart | Analog Devices, Inc. Quote

Revenues by End Markets

Industrial: The market generated revenues of $1.01 billion (accounting for 47% of the total revenues), which fell 44% year over year. The figure beat the Zacks Consensus Estimate of $965.7 million.

Communications: Revenues from the market were $240.78 million (11% of revenues), decreasing 45% from the year-ago quarter. The figure lagged the Zacks Consensus Estimate of $253.6 million.

Automotive: Revenues from the market summed up to $658.24 million (30% of revenues), down 10% from the year-ago quarter. The figure surpassed the Zacks Consensus Estimate of $652.8 million.

Consumer: The market generated revenues of $245.18 million (11% of revenues), reflecting a 9% decline from the year-ago quarter. The figure beat the Zacks Consensus Estimate of $232.3 million.

Operating Details

The adjusted gross margin contracted 700 basis points (bps) from the year-ago quarter to 66.7%.

Adjusted operating expenses were $597.74 million, down 18.5% from the year-ago quarter. As a percentage of revenues, adjusted operating expenses were 27.7%, expanding 520 bps year over year.

The adjusted operating margin was 39% in the reported quarter, significantly lower than 51.2% reported in the year-ago quarter.

Balance Sheet & Cash Flow

As of May 4, 2024, cash and cash equivalents were $1.94 billion, up from $1.3 billion as of Feb 3, 2024.

The long-term debt was $6.61 billion at the end of second-quarter fiscal 2024 compared with $5.95 billion at the end of first-quarter fiscal 2024.

Net cash provided by operations was $808 million in the reported quarter, down from $1.14 billion in the prior fiscal quarter.

ADI generated $620 million of free cash flow in the fiscal second quarter.

Analog Devices returned $678 million to its shareholders in the fiscal second quarter, of which dividend payments accounted for $456 million and repurchased shares amounted to $222 million.

Guidance

For third-quarter fiscal 2024, ADI expects revenues of $2.27 billion (+/- $100 million). The Zacks Consensus Estimate for the same is pegged at $2.16 billion.

Non-GAAP earnings are expected to be $1.50 (+/- $0.10) per share. The consensus mark for the same is pinned at $1.35 per share.

Analog Devices anticipates a non-GAAP operating margin of 40% (+/- 100 bps).

Zacks Rank & Stocks to Consider

Currently, Analog Devices carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader technology sector are Dell Technologies DELL, CrowdStrike CRWD and Intuit INTU, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Dell Technologies have gained 93.9% in the year-to-date period. The long-term earnings growth rate for DELL is 12%.

Shares of CrowdStrike have gained 36.8% in the year-to-date period. The long-term earnings growth rate for CRWD is currently projected at 22.31%.

Shares of Intuit have gained 7.2% in the year-to-date period. The long-term earnings growth rate for INTU is 14.57%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance