Amyris (AMRS) Earnings and Revenues Lag Estimates in Q1

Amyris, Inc. AMRS recorded a loss of 37 cents per share for first-quarter 2022, compared with a loss of $1.08 in the year-ago quarter. Loss per share for the reported quarter was wider than the Zacks Consensus Estimate of a loss of 24 cents.

The company registered revenues of $57.7 million for the quarter, down around 67% year over year, missing the Zacks Consensus Estimate of $65.5 million. The top line in the year-ago quarter included one-off $148.3 million revenues associated with the strategic DSM flavor and fragrance (F&F) transaction. The company witnessed solid demand for its consumer and ingredients products in the quarter.

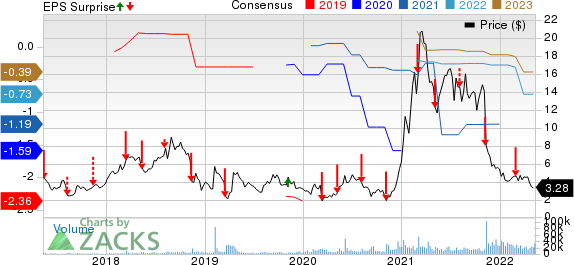

Amyris, Inc. Price, Consensus and EPS Surprise

Amyris, Inc. price-consensus-eps-surprise-chart | Amyris, Inc. Quote

Segment Highlights

Revenues from the Consumer segment went up 121% year over year to $34.6 million in the reported quarter. The upside was driven by the growth of the company’s legacy brands, as well as strong contribution from new brands.

The Technology Access segment raked in revenues of $23.2 million, up around 33% year over year. The upside was mainly driven by higher demand for F&F and Sweetener ingredients, and the earnout related to the DSM F&F transaction.

Financials

The company ended the quarter with cash, cash equivalents and restricted cash of roughly $287.9 million, up from $144 million a year ago. Long-term debt was $672 million, up from $13.8 million a year ago.

Outlook

The company reaffirmed its full-year outlook and expects to be on the top end of its earlier communicated guidance ranges. It sees consumer revenues to rise more than 150% year-over-year this year. Revenues from Technology Access are forecast to increase around 40% year-over-year in 2022.

Amyris also started commissioning its fermentation plant in Barra Bonita, Brazil, in the second quarter of 2022. The company reiterated its guidance for the full year factoring in the current consumer revenue performance and the launch of new brands and new in-house ingredients capacity from Barra Bonita taking full effect in second-half 2022.

Price Performance

Amyris’ shares are down 70.4% over a year compared with a 22.4% decline recorded by the industry.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Amyris carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth considering in the basic materials space include Steel Dynamics, Inc. STLD, Commercial Metals Company CMC and Nutrien Ltd. NTR.

Steel Dynamics, sporting a Zacks Rank #1 (Strong Buy), has an expected earnings growth rate of 18.5% for the current year. The Zacks Consensus Estimate for STLD's current-year earnings has been revised 32.5% upward over the last 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Steel Dynamics beat the Zacks Consensus Estimate for earnings in each of the last four quarters, the average being roughly 2.5%. STLD has gained around 18% in a year.

Commercial Metals, carrying a Zacks Rank #1, has a projected earnings growth rate of 78.2% for the current fiscal year. The Zacks Consensus Estimate for CMC's current fiscal year earnings has been revised 31.9% upward over the past 60 days.

Commercial Metals beat the Zacks Consensus Estimate for earnings in three of the last four quarters while missed once. It has a trailing four-quarter earnings surprise of roughly 16%, on average. CMC has gained around 14% in a year.

Nutrien, sporting a Zacks Rank #1, has an expected earnings growth rate of 161.9% for the current year. The Zacks Consensus Estimate for NTR's current-year earnings has been revised 38.8% upward over the last 60 days.

Nutrien beat the Zacks Consensus Estimate for earnings in three of the last four quarters while missed once. It has a trailing four-quarter earnings surprise of roughly 5.8%, on average. NTR has rallied around 64% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Amyris, Inc. (AMRS) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance