Amgen (AMGN) Q1 Earnings Beat Estimates, 2023 View Raised

Amgen AMGN reported first-quarter 2023 earnings of $3.98 per share, which beat the Zacks Consensus Estimate of $3.84. Earnings declined 6% year over year due to lower revenues and higher costs.

Total revenues of $6.11 billion missed the Zacks Consensus Estimate of $6.15 billion as well as our estimate of $6.32 billion. Total revenues declined 2% year over year as higher product sales were offset by lower Other revenues.

Total product revenues increased 2% from the year-ago quarter to $5.85 billion (U.S.: $3.98 billion; ex-U.S.: $1.87 billion). Higher volumes were offset by lower selling prices of several drugs and currency headwinds. Volumes rose 14% in the quarter, offset by a 5% lower net selling price. Foreign exchange movement hurt sales by 2% in the quarter.

Other revenues were $259 million in the quarter, down 50% year over year due to lower revenues from its COVID-19 manufacturing collaboration with Eli Lilly.

Performance of Key Drugs

General Medicine

Prolia revenues came in at $927 million, up 9% from the year-ago quarter, driven by volume growth. Prolia sales beat the Zacks Consensus Estimate of $911 million.

Evenity recorded sales of $254 million in the quarter, up 49% year over year, driven by strong volume growth both in and outside the United States.

Repatha generated revenues of $388 million, up 18% year over year, as higher volume was partially offset by lower prices. Repatha sales beat the Zacks Consensus Estimate of $342 million as well as our model estimate as $330.5 million.

Aimovig recorded sales of $69 million in the quarter, down 32% year over year due to lower net selling price and unfavorable changes to estimated sales deductions.

Hematology-Oncology

Xgeva delivered revenues of $536 million, up 7% from the year-ago quarter, driven by volume growth and higher pricing. Xgeva sales beat the Zacks Consensus Estimate of $497 million.

Kyprolis recorded sales of $358 million, up 25% year over year, driven by volume growth and higher price.

Vectibix revenues came in at $233 million, up 16% year over year, driven by volume growth. Nplate sales rose 36% to $362 million, driven by volume growth led by an order from the U.S. government. Blincyto sales increased 41% from the year-ago period to $194 million.

Amgen’s newly approved drug, Lumakras/ Lumykras recorded sales of $74 million in the quarter compared with $71 million in the previous quarter. Lumakras/ Lumykras volumes rose 40% in the quarter. Lumakras/Lumykras sales missed the Zacks Consensus Estimate of $91.0 million.

Sales of Amgen’s oncology biosimilars declined 27% year over year in the first quarter.

In oncology biosimilars, sales of Kanjinti (Amgen’s biosimilar of Roche’s Herceptin) were $47 million, down 51% year over year due to lower pricing and volumes as a result of increased competition.

Sales of Mvasi (biosimilar of Roche’s Avastin) were $202 million in the quarter, down 17% year over year due to declines in net selling price.

Inflammation

Sales of Otezla were $392 million in the quarter, down 13%, due to lower inventory levels and price declines resulting from unfavorable patient and payer mix. Otezla volumes rose 5% in the quarter. Otezla sales in the United States were hurt by free drug programs launched by new competitors, with the impact expected to continue throughout 2023. Otezla sales significantly missed the Zacks Consensus Estimate of $503.0 million.

Enbrel revenues of $579 million declined 33% year over year due to lower prices, softer volumes, lower inventory levels and unfavorable impact of changes to estimated sales deductions. Enbrel sales significantly missed the Zacks Consensus Estimate of $874 million.

Generally, sales of Otezla and Enbrel are lower in the first quarter per historical trends due to the impact of benefit plan changes, insurance re-verification and increased co-pay expenses as U.S. patients work through deductibles.

Newly approved asthma drug, Tezspire (tezepelumab) recorded sales of $96 million in the quarter compared with $79 million in the previous quarter, driven by volume growth. Amgen has a partnership with AstraZeneca AZN for Tezspire. Amgen and AstraZeneca share costs and profits equally after payment by AstraZeneca of a mid-single-digit inventor royalty to Amgen. While AstraZeneca leads development, Amgen leads manufacturing. In the first quarter, the FDA approved a pre-filled, single-use pen formulation of Amgen/AstraZeneca’s Tezspire, which improves patient convenience and accessibility and also provides more flexibility in treatment options.

Amjevita/Amgevita (a biosimilar of AbbVie’s [ABBV] Humira) sales were $164 million in the quarter, up 52% year over year, driven by volume growth and higher inventory levels.

In February, Amgen launched Amjevita in the United States at a list price 55% below the current list price set by AbbVie for Humira. Amgen is the first company to have launched a biosimilar of AbbVie’s Humira in the United States. The majority of Amgen’s U.S. Amgevita sales in the first quarter stemmed from inventory build, which means that second-quarter sales will be lower than the first quarter. Also, several more biosimilar versions of Humira are expected to be launched this year as early as July, which can hurt Amjevita sales, going forward.

The 2022 acquisition of ChemoCentryx added a newly launched innovative product, Tavneos to Amgen’s portfolio. Tavneos is approved for the treatment of patients with ANCA-associated vasculitis, a serious systemic autoimmune disease. Tavneos generated $23 million in sales in the first quarter compared with $21 million in the previous quarter. The drug’s sequential growth was driven by higher net selling price and inventory levels, partially offset by lower volumes in outside U.S. markets.

Established Products

Total sales of established products, which include Epogen, Aranesp, Parsabiv and Neulasta decreased 17% year over year in the first quarter.

Operating Margins Decline

Adjusted operating margin declined 6.5 percentage points to 48.3% in the quarter. Adjusted operating expenses increased 6% $3.28 billion due to higher R&D costs.

R&D expenses rose 12% year over year to $1.04 billion due to higher investments behind late-stage pipeline candidates. SG&A spending increased 1% to $1.22 billion.

2023 Guidance Raised

Amgen raised its previously issued revenue and earnings guidance for 2023 that excluded any contribution from the pending acquisition of Horizon Therapeutics HZNP.

In December, Amgen announced a definitive agreement to acquire Horizon Therapeutics for $116.5 per share in cash or $27.8 billion. The acquisition will add several first-in-class early-in-lifecycle biologic drugs like Tepezza, Krystexxa and Uplizna to Amgen’s broad and diversified portfolio. The acquisition is expected to close by the end of June. AMGN will provide updated guidance for 2023 after the transaction closes.

Revenues are expected in the range of $26.2 billion to $27.3 billion, up from the previous expectation of 26.0 billion to $27.2 billion. The Zacks Consensus Estimate is pegged at $27.87 billion.

Adjusted earnings are expected in the range of $17.60 to $18.70, up from the prior expectation of $17.40 to $18.60 per share. The Zacks Consensus Estimate stands at $17.76 per share.

Adjusted R&D costs are expected to increase 3% to 4% year over year from the 2022 level. S&A spending is expected to decrease slightly year over year, driven by productivity improvements. Total operating expenses are expected to increase 1% versus prior expectations of remaining flat versus the 2022 level. Amgen expects the operating margin as a percentage of product sales to be roughly 50% in 2023.

The adjusted tax rate is expected to be in the range of 18.0%-19.0%, while capital expenditures are expected to be approximately $925 million. The company expects to buy back shares worth not more than $500 million in 2023.

Our Take

Amgen’s first-quarter results were mixed as it beat estimates for earnings but missed the same for sales. It raised its earnings and sales guidance for the year as prescription trends and demand for its medicines are expected to improve to pre-pandemic levels despite the current macroeconomic challenges. The stock was down slightly in after-hours trading.

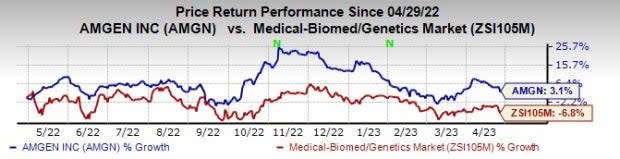

Amgen’s stock has risen 3.1% in the past year against a decline of 6.8% for the industry.

Image Source: Zacks Investment Research

Amgen’s 10 brands delivered a record sales performance in the quarter, including Repatha, Blincyto, Kyprolis and Evenity. Two of its newest medicines, Tezspire and Tavneos, achieved sequential growth in the first quarter. However, pricing pressure and increased competition continued to hurt sales of some drugs as well as biosimilar products. Sales of Otezla and Enbrel as well as new drug Lumakras/ Lumykras significantly missed expectations.

In 2023, Amgen expects strong sales growth of products like Tezspire, Evenity, Repatha, Prolia and Tavneos to be offset by lower revenues from Nplate, oncology biosimilars and legacy established products such as Enbrel and lower COVID-19 antibody revenues. It expects a mid-single-digit price decline in 2023. Amgen also has some key pipeline assets in obesity and inflammation — indications that can have a large market opportunity.

Amgen Inc. Price, Consensus and EPS Surprise

Amgen Inc. price-consensus-eps-surprise-chart | Amgen Inc. Quote

Amgen currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Horizon Therapeutics Public Limited Company (HZNP) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance