Amazon is opening its first air cargo hub

(BII)

This story was delivered to BI Intelligence "E-Commerce Briefing" subscribers. To learn more and subscribe, please click here.

In yet another move to build out its logistics operations, the online retail giant has announced plans to open its first air cargo hub, The Wall Street Journal reports.

The hub will be located at the Cincinnati/Northern Kentucky Airport in Hebron, Kentucky, and will serve as a central base for Amazon’s growing fleet of cargo planes, though it is unclear when it will open.

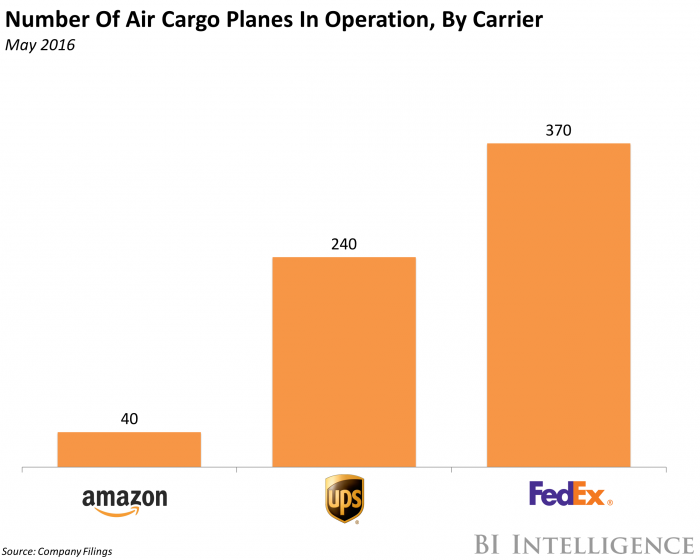

Amazon began leasing planes from air freight companies last year to reduce its reliance on traditional logistics companies like UPS and FedEx. The company plans to lease 40 cargo planes for its own shipping needs, and 16 of those are already operating in its fleet. Items will be sorted and packaged at the new 2-million-square-foot facility, which Amazon plans to pour $1.5 billion into, and later transported via the planes. Meanwhile, the facility will be in the same airport as a major air cargo facility operated by DHL, the world’s largest logistics company, and not far from the largest US air cargo hubs owned by UPS and FedEx. Amazon also has 11 fulfillment centers close by in Kentucky.

In addition to its growing air freight transportation capabilities, Amazon has expanded its ground and sea transportation operations. The company now has its own fleet of 4,000 semi-trucks for long-haul ground transportation, and operates its own network of couriers making deliveries in major urban areas.

Additionally, an Amazon subsidiary based in Beijing is now operating as a freight forwarding provider, arranging cargo shipments to the US for Amazon merchants based in China. These moves indicate that Amazon hopes to eventually build out a supply chain that can handle every step of the package delivery process.

The new facility will be a major step forward for Amazon’s logistics efforts, but its operations are still dwarfed by UPS and FedEx, which have hundreds of cargo planes at their disposal. It’s widely speculated that Amazon plans to eventually compete with UPS and FedEx in the freight and logistics space, providing delivery services for other merchants and consumers.

However, the company would need to invest far more in building out its air, ground, and sea transportation fleets and infrastructure to compete with the legacy logistics companies. For now, Amazon’s logistics ambitions will remain limited to handling its own packages, particularly at peak delivery times like the holiday shopping season. This will help Amazon improve the speed of its customer deliveries, ensuring higher customer satisfaction and loyalty.

The parcel delivery industry — a segment of the shipping sector that deals with the transportation of packages to consumers — is booming thanks to e-commerce growth, and players outside the industry want a piece of the pie.

BI Intelligence, Business Insider's premium research service, has compiled a detailed report on the future of shipping that looks at efforts by Amazon, Alibaba, and Walmart to handle more of their own shipping and concludes that big retailers are well positioned to disrupt the parcel industry.

Here are some of the key points from the report:

Transportation and logistics could be the next billion dollar opportunity for e-commerce companies. The global shipping market, including ocean, air, and truck freight, is a $2.1 trillion market, according to World Bank, Boeing, and Golden Valley Co.

There is much at stake for legacy shipping companies, which have seen a boom in parcel delivery as e-commerce spending has risen. Twenty different partners currently share the duties of shipping Amazon's 600 million packages a year, with FedEx, USPS, and UPS moving the most.

Amazon, Alibaba, and Walmart have so far focused on building out their last-mile delivery and logistics services but are increasingly going after the middle- and first-mile of the shipping chain.

Amazon has already made major moves across each stage of the shipping journey. It launched same-day delivery service, which it handles through its own fleet of carriers, cutting out any third-party shippers. The company also recently began establishing shipping routes between China and North America.

Walmart's interest in expanding its transportation and logistics operations is almost purely related to cost-savings. It's begun leasing shipping containers to transport manufactured goods from China and is making greater use of lockers and in-store pickup options to cut down on delivery costs.

Alibaba has begun leasing containers on ships, similar to Amazon's Dragon Boat initiative. This means that Alibaba Logistics can now facilitate first-mile shipping for third-party merchants on its marketplace.

In full, the report:

Sizes the market for the shipping industry.

Explains how the industry operates in broad terms.

Suggests why major e-commerce retailers should disrupt the space.

Outlines the shipping initiatives of Amazon, Walmart, and Alibaba.

Concludes how these moves might impact traditional carriers.

Interested in getting the full report? Here are two ways to access it:

Subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you'll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. » START A MEMBERSHIP

Purchase & download the full report from our research store. » BUY THE REPORT

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of the future of shipping.

More From Business Insider

Yahoo Finance

Yahoo Finance