Amalgamated Financial Corp. Exceeds Analyst EPS Estimates in Q1 2024

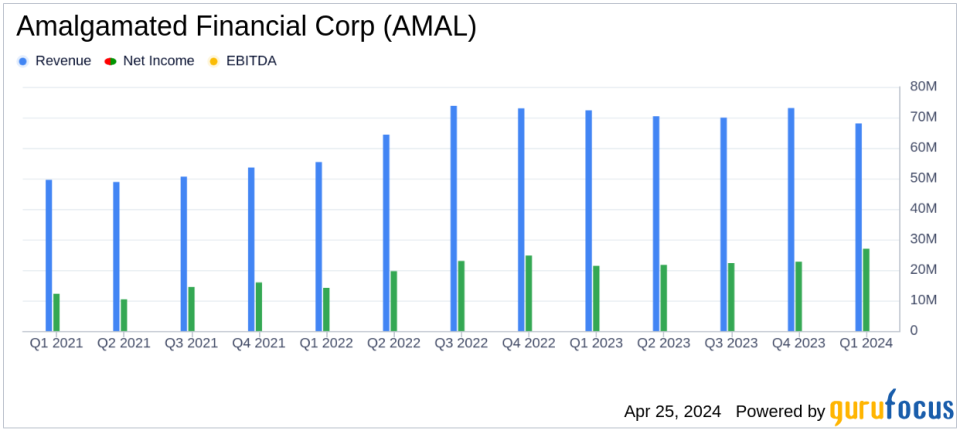

Net Income: $27.2 million, up from $22.7 million in the previous quarter, exceeding estimates of $22.56 million.

Earnings Per Share (EPS): Reported at $0.89 per diluted share, surpassing the estimated $0.74.

Revenue: Net interest income slightly increased to $68.0 million from $67.3 million last quarter, indicating a stable revenue flow.

Deposits: Total deposits rose by $293.8 million to $7.3 billion, with a significant increase in political deposits.

Asset Quality: Nonperforming assets slightly decreased to 0.42% of total assets, improving from 0.43% in the previous quarter.

Capital Ratios: Common Equity Tier 1 ratio improved to 13.68%, reflecting stronger capital adequacy.

Share Repurchase: Repurchased approximately 10,000 shares, utilizing $0.2 million of the allocated $40 million share repurchase program.

Amalgamated Financial Corp. (NASDAQ:AMAL) announced its financial results for the first quarter ended March 31, 2024, revealing a performance that surpassed analyst expectations for earnings per share (EPS). The company reported a net income of $27.2 million, or $0.89 per diluted share, outperforming the estimated EPS of $0.74. This represents a significant increase from the previous quarter's net income of $22.7 million, or $0.74 per diluted share.

Amalgamated Financial Corp., a bank holding company for Amalgamated Bank, serves both commercial and retail customers with a comprehensive suite of banking and trust services. The company's latest financial achievements underscore its robust business model and operational efficiency, particularly in a challenging economic environment.

The first quarter of 2024 saw notable improvements in several key areas:

Deposits and Liquidity: Total deposits grew by $293.8 million, or 4.2%, reaching $7.3 billion. This growth includes a significant increase in political deposits, which rose by $250.4 million, or 21%, to $1.4 billion.

Net Interest Income and Margin: Net interest income slightly increased by $0.7 million to $68.0 million. More impressively, the net interest margin expanded by 5 basis points to 3.49%.

Capital and Returns: The Common Equity Tier 1 Capital ratio improved to 13.68%, and the tangible book value per share increased by 5.3% to $19.73.

President and CEO Priscilla Sims Brown highlighted the quarter's success, stating,

Our first quarter results show Amalgamated as a banking industry leader and we proved once again that our unique and valuable business model is well positioned to thrive in varying economic conditions."

The balance sheet remained stable with total assets slightly increasing to $8.1 billion. The loan portfolio saw a modest increase, with net loans receivable rising by $13.8 million to $4.4 billion. The asset quality remained solid with nonperforming assets slightly decreasing.

Looking ahead, Amalgamated Financial Corp. is well-positioned to continue its growth trajectory, supported by strong capital ratios, a robust deposit base, and effective cost management strategies. The company's performance is a testament to its resilient business model and strategic execution.

For a detailed analysis of AMAL's financial results and future outlook, investors and interested parties can access the full 8-K filing.

Amalgamated Financial Corp. will host a conference call to discuss these results further on April 25, 2024, at 11:00 AM Eastern Time.

Explore the complete 8-K earnings release (here) from Amalgamated Financial Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance