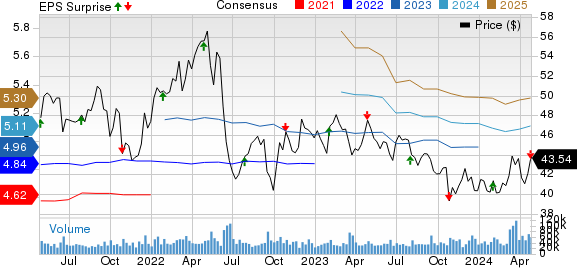

Altria's (MO) Q1 Earnings Miss Estimates, Revenues Decline Y/Y

Altria Group Inc. MO delivered first-quarter 2024 results, with the bottom line missing the Zacks Consensus Estimate and declining year over year. The top line also declined from the year-ago quarter’s reported figure. Though MO benefited from pricing power, soft cigarette shipment volumes continued to hurt. The company saw early momentum from NJOY.

Quarter in Detail

Adjusted earnings came in at $1.15 per share, which declined 2.5% year over year and came a penny below of the Zacks Consensus Estimate of $1.16. The downside can be attributed to reduced adjusted operating companies income (OCI), somewhat countered by less number of shares outstanding.

The company posted net revenues of $5,576 million, declining 2.5% year over year. The downside can mainly be attributed to reduced net revenues in the smokeable products unit. Increased net revenues across the oral tobacco products segment and other categories somewhat offset these. Revenues net of excise taxes inched down 1% to $4,717 million. The metric came in line with the consensus mark.

Altria Group, Inc. Price, Consensus and EPS Surprise

Altria Group, Inc. price-consensus-eps-surprise-chart | Altria Group, Inc. Quote

Segment Details

Smokeable Products: Net revenues in the category decreased 3.6% year over year to $4,906 million, mainly due to reduced shipment volume and increased promotional investments. These were somewhat offset by higher pricing. Revenues net of excise taxes fell 2.2% to $4,072 million in the segment.

Domestic cigarette shipment volumes tumbled 10%, mainly due to the industry’s decline rate and retail share losses. The industry’s decline was a result of macroeconomic pressure on Adult Tobacco Consumers’ (“ATC”) disposable income and increases in illegitimate e-vapor products. Altria’s reported cigar shipment volumes decreased 6.1%.

Adjusted OCI in the segment declined 2.5%, with lower shipment volume, thanks to promotional investments, increased per unit settlement charges and manufacturing costs. These were somewhat countered by improved pricing and reduced selling, general and administrative (SG&A) costs. The adjusted OCI margins contracted 0.2 percentage points to 60.2%.

Oral Tobacco Products: Net revenues in the segment rose 3.7% from the year-ago quarter’s level to $651 million. The upside can be attributed to improved pricing and reduced promotional investments, partly negated by the increased percentage of on! shipment volumes relative to MST and reduced MST shipment volumes. Revenues, net of excise taxes, grew 4.3%.

Domestic shipment volumes fell 3.1%, mainly due to retail share losses and trade inventory movements. This was somewhat offset by the industry’s growth rate and other aspects. Adjusted OCI increased 4.6% to $435 million, mainly due to increased pricing and a decline in promotional investments, somewhat negated by reduced MST shipment volume and mix change. Adjusted OCI margins expanded by 0.2 percentage points to 69.5%.

Other Updates

Altria ended the quarter with cash and cash equivalents of $3,608 million, long-term debt of $25,042 million and a total stockholders’ deficit of $5,114 million.

The company authorized a $2.4-billion increase to its existing $1-billion share repurchase program. During the first quarter, the company paid out dividends of $1.7 billion.

During March, management sold 35 million ordinary shares of ABI via a global secondary offering while ABI repurchased nearly 3.3 million of its ordinary shares (offering) from the company.

Image Source: Zacks Investment Research

Guidance

For 2024, the company still envisions the adjusted earnings per share (EPS) in the range of $5.00-$5.15. The guidance indicates growth of 2-4.5% from the $4.95 recorded in 2023. Management expects the bottom-line growth to be skewed toward the second half of 2024. The guidance includes the impact of two extra shipping days in 2024.

As the external landscape remains dynamic, MO continues assessing economic factors like inflation, ATC dynamics (such as purchasing patterns and the adoption of smoke-free products), illegal e-vapor enforcement and regulatory developments.

The bottom-line view also considers planned investments associated with enhanced smoke-free product research, development and marketplace activities to support MO’s smoke-free products.

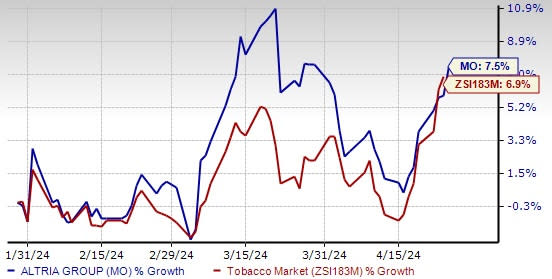

Shares of this Zacks Rank #2 (Buy) company have increased 7.5% in the past three months compared with the industry’s 6.9% growth.

Appetizing Food Picks

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently carries a Zacks Rank #2. VITL has a trailing four-quarter average earnings surprise of 155.4%. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 18.7% and 30.5%, respectively, from the year-ago reported numbers.

Utz Brands Inc. UTZ manufactures a diverse portfolio of salty snacks, currently carrying a Zacks Rank #2. UTZ has a trailing four-quarter earnings surprise of 2.6% on average.

The Zacks Consensus Estimate for Utz Brands’ current financial-year earnings suggests growth of 19.3% from the year-ago reported numbers.

Celsius Holdings CELH, which offers functional drinks and liquid supplements, currently carries a Zacks Rank #2. CELH has a trailing four-quarter earnings surprise of 67.4%, on average.

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and earnings suggests growth of 41.6% each from the year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Altria Group, Inc. (MO) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance