Alphabet (GOOGL) Vs. Microsoft (MSFT): Which Tech Giant is More Attractive Ahead of Earnings

Outside of Tesla TSLA and Meta Platforms META, investors are largely antcipating quarterly results from magnificent seven players Alphabet GOOGL and Microsoft MSFT this week as well.

With Alphabet and Microsoft’s quarterly reports set for Thursday, April 25, let's see which big tech stock is more attractive at the moment.

Quarterly Expectations

Alphabet’s Q1 earnings are expected to increase 27% to $1.49 per share versus $1.17 a share in the comparative quarter. On the top line, the search engine leaders' Q1 sales are projected to be up 14% to $66.02 billion. Notably, Alphabet has surpassed earnings expectations for four straight quarters posting an average earnings surprise of 7.22%.

Image Source: Zacks Investment Research

As for Microsoft, the software titan has surpassed EPS estimates for six consecutive quarters and posted an average earnings surprise of 8.82% in its last four quarterly reports. Microsoft is expected to post earnings of $2.81 per share for its current fiscal third quarter which would reflect a 14% increase from a year ago. Plus, Microsoft’s Q3 sales are projected to rise 15% to $60.63 billion.

Image Source: Zacks Investment Research

Performance & Valuation Comparison

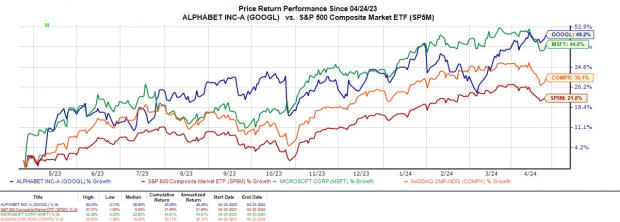

Correlating with their expansive growth trajectories, Alphabet’s stock has risen +13% year to date with Microsoft shares up +8% to both outperform the S&P 500’s +5% and the Nasdaq’s +4%. Even better, GOOGL and MSFT have now soared over +40% in the last year which has also topped the strong performances of the broader indexes.

Image Source: Zacks Investment Research

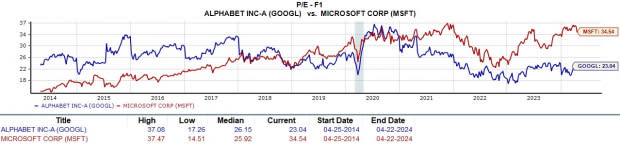

At their current levels, Alphabet is more appealing in terms of P/E valuation and trades at a 23X forward earnings multiple which is near the S&P 500’s 20.9X with Microsoft at 34.5X. It’s also noteworthy that GOOGL still trades at a discount to its decade-long median of 26.1X whereas MSFT trades above its median and closer to its high of 37.4X during this period.

Image Source: Zacks Investment Research

Earnings Estimate Revisions

Over the last 60 days, earnings estimate revisions for Q1 (Current Qtr) and Alphabet’s FY24 have remained unchanged with FY25 EPS estimates slightly higher.

Image Source: Zacks Investment Research

In contrast, earnings estimates for Microsoft’s current quarer and FY24 have slightly decreased in the last two months while FY25 EPS estimates have remained unchanged.

Image Source: Zacks Investment Research

Takeaway

While both of these tech giants are expecting double-digit EPS growth in FY24 and FY25, Alphabet currently lands a Zacks Rank #3 (Hold) with Microsoft landing a Zacks Rank #4 (Sell).

This is largely attributed to the trend of earnings estimate revisions which has remained favorable for Alphabet along with the company’s P/E valuation whereas Microsoft trades at a bit of a premium to its big tech peer and FY24 EPS estimates have dipped.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance