Allison Transmission Q1 Earnings: Slight Beat on EPS, Meets Revenue Expectations

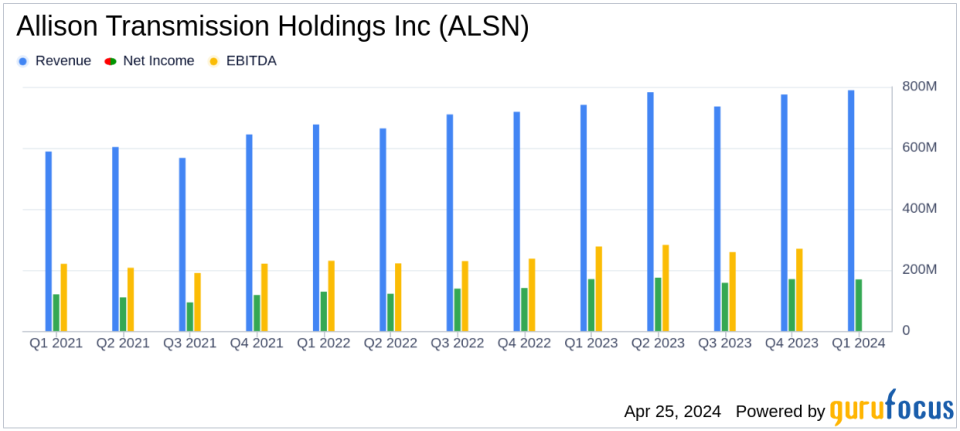

Revenue: Reported $789 million, up from $741 million year-over-year, surpassing estimates of $772.30 million.

Earnings Per Share (EPS): Achieved $1.90, slightly above the estimate of $1.89.

Net Income: Totaled $169 million, slightly above the estimate of $164.54 million.

Adjusted EBITDA: Increased to $289 million from $276 million in the previous year.

Gross Profit: Rose to $366 million, driven by higher sales and price increases, despite higher manufacturing expenses.

Adjusted Free Cash Flow: Recorded at $162 million, a decrease from $169 million year-over-year.

Dividend: Increased quarterly dividend by 9% to $0.25 per share, marking the fifth consecutive annual increase.

On April 25, 2024, Allison Transmission Holdings Inc (NYSE:ALSN) announced its first-quarter results, revealing a slight beat on earnings per share (EPS) and alignment with revenue forecasts. The company reported a quarterly net sales of $789 million against an estimated $772.30 million and an EPS of $1.90, which is slightly above the estimated $1.89. The details were disclosed in their recent 8-K filing.

Allison Transmission, the largest global manufacturer of fully automatic transmissions for commercial vehicles, continues to dominate the market with a broad portfolio that includes applications in on-highway trucks, buses, motorhomes, and defense vehicles. The company's success in the quarter was notably driven by increased demand in the Global On-Highway and Defense sectors, particularly with record revenues in North America and Asia for on-highway markets.

Financial Highlights and Market Performance

The first quarter saw Allison Transmission achieving a net income of $169 million, with a slight decrease from the previous year's $170 million, primarily due to higher manufacturing expenses and non-recurring costs related to UAW contract signing incentives. Despite these challenges, the company managed to increase its gross profit driven by higher net sales and strategic price increases on certain products. The adjusted EBITDA stood at $289 million, up from $276 million in Q1 2023, reflecting effective management of operational efficiencies and cost controls.

Operationally, the company showed a robust cash flow performance, with net cash provided by operating activities at $173 million. The adjusted free cash flow was reported at $162 million, slightly down from $169 million in the previous year, impacted by higher cash incentive compensation payments and non-recurring UAW contract signing incentive payments.

Strategic Financial Management

David S. Graziosi, CEO of Allison Transmission, highlighted the company's strategic financial decisions, including an increase in commitments under its revolving credit facility to $750 million and a proactive approach to debt management with the refinancing of $518 million of term loan debt. The company also continued its shareholder return strategy, repurchasing nearly 1% of outstanding shares and increasing its quarterly dividend by 9% to $0.25 per share.

Looking Forward

For the full year 2024, Allison Transmission reaffirmed its guidance, expecting net sales between $3,050 million and $3,150 million, and net income in the range of $635 million to $685 million. The company's projections reflect confidence in its operational strategy and market position despite ongoing challenges in global supply chains and economic conditions.

The company's detailed financial maneuvers and strategic market positioning underscore its resilience and proactive management, setting a stable course for continued growth in 2024. Allison Transmission remains committed to delivering innovative propulsion solutions that enhance vehicle performance and efficiency across various applications, reinforcing its leadership in the transmission industry.

Conference Call and Investor Communication

Allison Transmission will host a conference call to discuss the detailed quarterly results and provide further insights into its strategic initiatives and outlook. The call is scheduled for 5:00 p.m. ET on April 25, 2024, with a replay available until May 9, 2024. Investors and interested parties can access the call and replay details through the company's investor relations website.

For ongoing updates and detailed financial information, stakeholders are encouraged to consult the investor relations section of Allison Transmission's website and reach out to the company's investor relations team for any inquiries.

Explore the complete 8-K earnings release (here) from Allison Transmission Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance