Alcon (ALC) Q2 Earnings Surpass Estimates, Guidance Lowered

Alcon Inc. ALC delivered core earnings per share (EPS) of 63 cents in the second quarter of 2022. Earnings rose 12.5% from the year-ago quarter’s figure. The figure also exceeded the Zacks Consensus Estimate by 14.6%. Alcon’s ”core” results are based on non-IFRS (International Financial Reporting Standards) measures.

ALC’s second-quarter reported EPS of 30 cents lagged the year-ago quarter figure by a penny.

Revenues in Detail

Alcon’s net sales to third parties in the second quarter were $2.20 billion, exceeding the Zacks Consensus Estimate by 0.6%. The top line increased 5.1% from the year-ago quarter’s levels (up 10% at constant exchange rate or CER).

In the second quarter, Total Surgical (consisting of implantables, consumables and equipment/other) sales amounted to $1.29 billion, up 17% at CER. Alcon registered implantables growth, driven by the strength in advanced technology lenses for commercial execution and international market recovery.

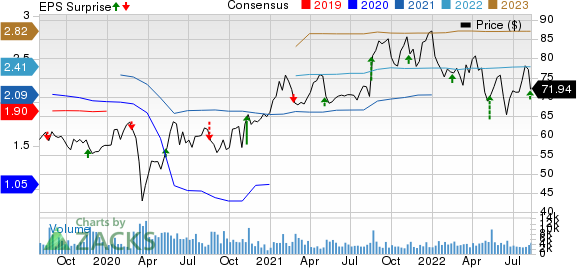

Alcon Price, Consensus and EPS Surprise

Alcon price-consensus-eps-surprise-chart | Alcon Quote

Total Vision Care (comprising contact lenses and ocular health) reported sales of $904 million, up 10% year over year at CER. In the quarter, the United States grew mid-single-digits, in line with historical averages, while Europe and Japan, which were impacted more significantly by COVID-19 in the second quarter of last year, grew in double digits.

Margins

The cost of net sales in the quarter was $999 million, up 14.2% year over year. Adjusted gross profit (net sales to third parties less cost of net sales) fell 1.5% to $1.2 billion in the reported quarter. Adjusted gross margin contracted 362 basis points (bps) to 54.6% in the second quarter of 2022.

The core operating margin, according to Alcon, was 18.4% in the quarter, marking a year-over-year expansion of 170 bps at CER.

Financial Position

Alcon exited second-quarter 2022, with cash and cash equivalents of $1.03 billion compared with $961 million at the end of Q1.

Cumulative net cash flow from operating activities at the end of the quarter was $470 million compared with $542 million a year ago. For the same period, free cash flow totaled $233 million compared with $320 million in the year-ago quarter.

2022 View

Alcon updated its 2022 guidance, assuming global markets grow at slightly above historical rates, inflation remains at current levels throughout the remainder of the year and the supply chain does not materially deteriorate. Also, the exchange rates as of mid-July 2022 are expected to prevail through year-end.

The company projects net sales in the range of $8.6-$8.8 billion (down from the earlier projection of $8.7-$8.9 billion), indicating growth of 9-11% at CER from the 2021 level (unchanged). The Zacks Consensus Estimate for ALC’s revenues is pegged at $8.86 billion.

The company also reduced core earnings per share expectations to the range of $2.20-$2.30 ($2.35-$2.45), suggesting growth of 19-24% from 2021 levels (unchanged). The Zacks Consensus Estimate for ALC’s earnings is currently pegged at $2.41 per share.

Our Take

Alcon exited the second quarter with revenues and earnings beating the Zacks Consensus Estimate. Despite the macroeconomic concerns, the company reported strong underlying second-quarter performance within its business. Its robust innovation pipeline is delivering solid results as evidenced by the successful launch of new ATIOL roles and SiHy contact lenses.

However, given the supply chain challenges, unfavorable foreign exchange impact, the ongoing inflationary pressure and other macroeconomic headwinds, the company had to reduce its core EPS and net sales expectations for 2022.

Zacks Rank & Key Picks

Alcon currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader medical space that have announced quarterly results are Quest Diagnostics Incorporated DGX, AMN Healthcare Services, Inc. AMN and Zimmer Biomet Holdings, Inc. ZBH.

Quest Diagnostics, carrying a Zacks Rank #2, reported second-quarter 2022 adjusted EPS of $2.36, which beat the Zacks Consensus Estimate by 9.8%. Revenues of $2.45 billion outpaced the consensus mark by 7.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Quest Diagnostics has an earnings yield of 6.9% compared with the industry’s 3.9%. DGX’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average being 12.1%.

AMN Healthcare, sporting a Zacks Rank #1, reported second-quarter 2022 adjusted EPS of $3.31, which beat the Zacks Consensus Estimate by 11.8%. Revenues of $1.43 billion outpaced the consensus mark by 4.8%.

AMN Healthcare has an estimated long-term growth rate of 3.2%. AMN’s earnings surpassed estimates in all the trailing four quarters, the average being 15.7%.

Zimmer Biomet reported second-quarter 2022 adjusted EPS of $1.82, which surpassed the Zacks Consensus Estimate by 11.7%. Second-quarter revenues of $1.78 billion outpaced the Zacks Consensus Estimate by 3.5%. It currently has a Zacks Rank #2.

Zimmer Biomet has an estimated long-term growth rate of 5%. ZBH’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average being 7.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

Alcon (ALC) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance