Airlines Are Secretly Making You Poorer

This article was first published by Cheerfulegg.

Last month, my Dad got really annoyed by you tiao(dough fritters). He complained, “You know, you tiao used to cost $0.50. But when I tried adding it to my porridge yesterday, it cost me $0.80!!!! WTF???? I AM NEVER EATING YOU TIAO AGAIN!”

At first, I thought it was pretty funny because $0.30 isn’t thaaaaat much money. But as I thought about it, it actually affects us more than we think.

Let’s take airlines, for example. On 22 March 2016, American Airlines – with the stroke of a pen – did something that instantly made tens of thousands of people poorer. Singapore Airlines also did something similar this week, although they were much nicer about it.

Can you guess what it is?

I’m secretly a huge nerd at heart, so I love applying Economic concepts to real life. When I read about the SIA news this week, I was like “YES! TEACHING MOMENT!!”

You tiao and airlines have one thing in common – and it can secretly make you poorer without you realizing it.

Mileflation Reaches Singapore

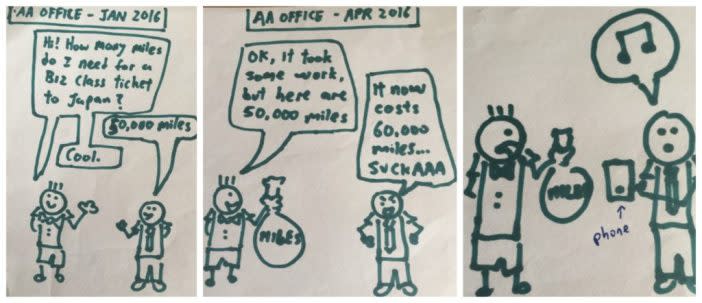

To understand how airlines can secretly make you poorer, let’s take the example of American Airlines (AA). I was feeling bored on a plane this week, so I drew this comic:

Inspiration: Wait But Why

What happened here? Well, AA devalued their miles by making it more expensive (in terms of miles) to redeem a flight. On one day, a US-Japan flight cost 50,000 miles. The next day, it cost 60,000 miles.

This happened without warning, catching tens of thousands of customers off-guard when they found out that their AAdvantage miles were suddenly worth a lot less.

2015-2016 saw a slew of mileage devaluations from American Airlines, Southwest Airlines, and Alaska Airlines. Think this only happens to US-based airlines? Our favourite Singapore Airlines just announced a slight devaluation this week too.

To be fair, SIA’s mile devaluations were relatively minor compared to the other carriers. The only routes affected were Amsterdam, Athens, Copenhagen and Rome – they used to cost 60,000 miles and will now cost 80,000 miles from 24 May. That’s a “mileflation” rate of 30%! (You can download their old and new award charts to compare them).

Some of you might say, “Well, I don’t have any airline miles. This doesn’t affect me.” WRONG.

Smart people take lessons from one domain and apply it to others. It turns out that the airlines’ sneaky tactics apply everywhere else in our lives too.

Everything Inflates

Let’s take grades, for example. When I was in college, getting a “B” was like the end of the world, especially among my hyper-competitive Singaporean friends. If we didn’t get an “A”, we’d lock ourselves at home, binge on ice cream and How I Met Your Mother, and feel sorry for ourselves.

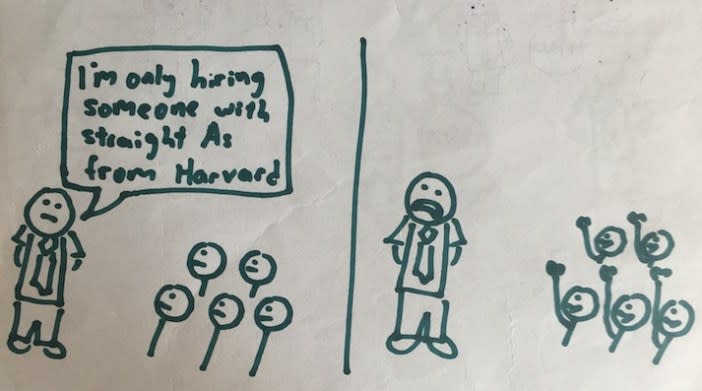

But it wasn’t just us – college professors were handing out even more “A”s than ever too. At Harvard, the most frequently awarded grade is an A. Today, 45 percent of students in American universities get the highest possible grade, compared to 15 percent in 19601. In an age where everyone gets an A, how do employers figure out who’s truly exceptional, and who’s just average?

Inspiration: Wait But Why

We’re also all familiar with the concept of price inflation. When I started work just a few years ago, a Big Mac meal (it was my post-work indulgence okaaay?) cost $6.50. Now, it’s easily close to $8. At least that’s stopping me from getting fat… kinda.

Miles, money, grades, credit card points, loyalty stamps – almost any “currency” you can think of – are depreciating assets. Most of them will be worth a lot less tomorrow than they are today.

The culprit? Inflation. Think about inflation as the opposite of King Midas: Everything it touches becomes less valuable.

How To Be Smart About This Inflation Thing

That’s not to say that miles are “bad” because they depreciate. Cash depreciates, but you wouldn’t say no if someone gave you a free $10, would you?

You can use depreciating assets to your advantage if you’re smart about it.

If you have miles, make sure you spend them. Once you accumulate enough for a free flight or a Business Class ticket, spend them! Miles are meant to be enjoyed, not hoarded for ten years. If not, you run the risk of an airline devaluation.

And what if you have cash? Lucky for us, we’ve got more options here. We could:

Save it

Spend it

Invest it.

Your long-term wealth depends on how you allocate your moolah between these 3 options.

Unfortunately, most people put ALL their money in option 1 (save) which is a baaaaad idea. Bank interests rates are pathetic. Saving all your money may seem “safe” on the surface, but in reality, you’re getting poorer and poorer in the background.

That’s what this blog is for – to help smart young executives (like you!) fight the threat of inflation. So that you can enjoy your you tiao without worrying about the price.

I wanna hear from you: What’s the #1 price increase that you’re the most annoyed about? Let me know in the comments below.

To read more articles from Cheerfulegg, subscribe to their Cheerfulegg‘s VIP List.

1Source: Naked Money by Charles Wheelan

The post Airlines Are Secretly Making You Poorer appeared first on DollarsAndSense.sg.

Yahoo Finance

Yahoo Finance