Airline Stock Roundup: JBLU's Bullish Q2 Revenue Update, AZUL's Traffic & More

With air-travel demand for leisure witnessing an upturn in the United States, management at JetBlue Airways JBLU gave an improved outlook for the June-quarter revenues. Also, riding on this bullish sentiment surrounding air-travel demand, Spirit Airlines SAVE expects second-quarter 2021 load factor (% of seats filled by passengers) to be identical to the second-quarter 2019 actuals. Notably, Delta AirLines DAL had issued upbeat updates for the June quarter owing to enhanced air-travel demand as discussed in detail in the previous week’s writeup.

In another encouraging development, Brazilian carrier Azul’s AZUL May traffic improved 12.4% from its April reading as the increased rate of vaccination prompts people to opt for more air travel.

Recap of the Past Week’s Most Important Stories

1. With air-travel demand continually improving, especially on the leisure front, JetBlue has been witnessing improved bookings in recent weeks. Notably, the carrier, currently carrying a Zacks Rank #3 (Hold), now anticipates revenues to decline 30-33% in the June quarter of 2021 from the same-period actual in 2019. This is narrower than the previous guided range of a 30-35% decrease. The airline continues to expect flown capacity to decline approximately 15% in the second quarter from second-quarter 2019 actuals.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

2. Driven by this better scenario of leisure air travel in both its international and domestic markets, Spirit Airlines expects load factor for the second quarter to be 84%, matching the second-quarter 2019 actuals. Moreover, the second-quarter expectation is much higher than 72.1% reported sequentially.

Owing to brighter revenue scenario, the carrier has witnessed higher operating yields over the past three months. Evidently, Spirit Airlines now expects adjusted EBITDA margin for the June quarter to be positive, albeit moderately (earlier expectation was between -5% and 0% range). The scenario with respect to capacity (measured in available seat miles) is also rosier. The metric is now anticipated to dip 5.2% in second-quarter 2021 from the second-quarter 2019 actuals. Earlier, the company had expected the same to decline 5.5% from the second-quarter 2019 finals. Capacity for the full year is anticipated to inch up 2% from the reported figure of 2019.

3. At Azul, consolidated traffic surged 361.9% year over year in May. In the same time frame, capacity expanded 337.8%. As a result, with traffic surge outweighing capacity expansion, load factor increased 3.9 percentage points. On the domestic front, both traffic and capacity increased 435.5% and 406.7%, respectively, from the year-ago period’s levels. Load factor also inched up 4.2 percentage points to 78.1% in the month. Internationally too, traffic as well as capacity rose 14% and 56.9%, respectively, in the same time frame.

4. Reflecting the uptick in passenger demand in Latin America, Copa Holdings’ CPA May 2021 traffic decline of 58% from the May 2019 reading represents an improvement from the April traffic decline of 67% (from the comparable period in 2019). This highlights the gradual recovery in air-travel demand. May load factor of 77.6% is also better than April’s figure of 72.8%.

5. In a bid to meet its investment objective in the emerging clean-energy technologies, United Airlines UAL announced the formation of a corporate venture fund called United Airlines Ventures. The fund will focus on sustainability concepts that are in line with this Chicago-based airline’s goal of achieving net-zero emissions by 2050 without relying on traditional carbon offsets. The new fund will also concentrate on revolutionary developments in the aerospace field.

Performance

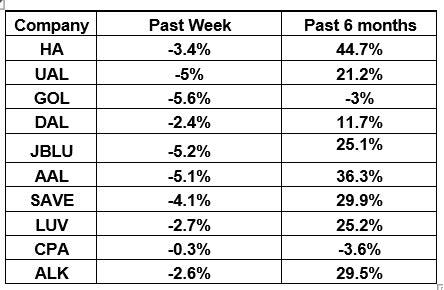

The following table shows the price movement of major airline players over the past week and during the last six months.

Image Source: Zacks Investment Research

The table above shows that all airline stocks have traded in the red in the past week, inducing the NYSE ARCA Airline Index to slip 2.6% over the past week to $105.49. Over the course of the past six months, the NYSE ARCA Airline Index has rallied 25.9%.

What's Next in the Airline Space?

Stay tuned for May traffic reports from the likes of Allegiant Travel Company ALGT.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

Spirit Airlines, Inc. (SAVE) : Free Stock Analysis Report

Allegiant Travel Company (ALGT) : Free Stock Analysis Report

AZUL SA (AZUL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance