AerSale Corp (ASLE) Q1 2024 Earnings: Strong Start with Revenue and Earnings Surpassing Estimates

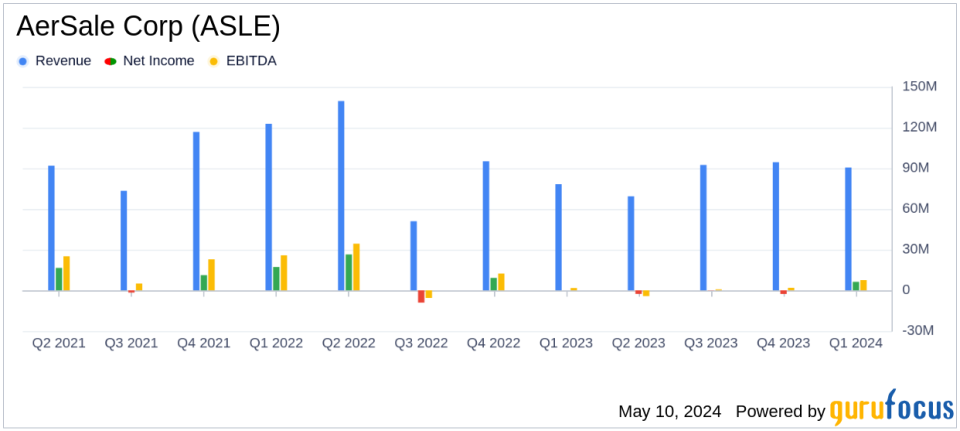

Revenue: $90.5M, up from $78.3M in the same quarter last year, surpassing estimates of $87.57M.

Net Income: Reported GAAP net income of $6.3M, significantly higher than the previous year's $5 thousand, and above estimates of $4.87M.

Earnings Per Share (EPS): Reported GAAP EPS of $0.12, exceeding the estimated EPS of $0.08.

Gross Margin: Improved to 31.8% from 31.2% in the prior-year quarter, reflecting a more profitable sales mix.

Operating Cash Flow: Used $21.5M in operating activities, driven by ongoing investments in inventory.

Liquidity: Ended the quarter with $128.9M in liquidity, providing financial flexibility amid ongoing operations.

Adjusted EBITDA: Increased to $9.0M from $5.0M in the prior-year period, indicating stronger operational efficiency.

AerSale Corp (NASDAQ:ASLE) released its 8-K filing on May 8, 2024, revealing a robust start to the year with first-quarter earnings that exceeded analyst expectations. The company, a leader in the aviation aftermarket services sector, reported a significant increase in revenue and net income compared to the same period last year.

Company Overview

AerSale Corp operates in the aviation industry, focusing on the sale, lease, and exchange of used aircraft, engines, and components. It also provides a range of maintenance, repair, and overhaul (MRO), and engineering services for commercial aircraft and components. The company's primary revenue comes from its Asset Management Solutions segment, which saw a notable increase this quarter.

Financial Highlights

For Q1 2024, AerSale reported revenues of $90.5 million, a substantial rise from $78.3 million in Q1 2023. This increase was driven by higher flight equipment sales, which included one aircraft and four engines. The company's strategic acquisitions of feedstock in 2023 significantly contributed to this year's sales volume. Notably, the revenue figure comfortably surpassed the estimated $87.57 million projected by analysts.

Net income for the quarter stood at $6.3 million, a dramatic improvement from just $5 thousand in the previous year. This performance was bolstered by a favorable sales mix and reduced general and administrative expenses. Earnings per share (EPS) for Q1 2024 were $0.12, exceeding the analysts' expectations of $0.08 EPS.

Operational and Strategic Developments

During the quarter, AerSale continued to capitalize on robust demand for its MRO services, driven by high operational levels in the airline industry. The company's CEO, Nicolas Finazzo, highlighted the ongoing strong commercial demand and the strategic positioning of AerSale to leverage market opportunities, thanks to its comprehensive end-to-end solutions.

AerSale also made significant progress in its Engineered Solutions segment, particularly with the AerAware Enhanced Flight Vision System, which is expected to contribute to long-term growth. The system recently received a Supplemental Type Certificate from the FAA, marking a significant milestone.

Financial Position and Outlook

The company concluded Q1 2024 with $128.9 million in liquidity, which positions it well to manage future growth initiatives and navigate market dynamics. AerSale's management expressed optimism about maintaining strong commercial demand throughout 2024.

Adjusted EBITDA for the quarter was $9.0 million, up from $5.0 million in Q1 2023, reflecting the higher profitability associated with increased flight equipment sales.

Investor and Analyst Perspectives

Investors and analysts might be particularly interested in AerSale's enhanced financial health and strategic market positioning. The company's ability to exceed revenue and earnings estimates provides a positive outlook for its operational efficiency and market adaptability.

AerSale's forward-looking strategies, including its focus on high-margin Engineered Solutions and robust MRO services, suggest a proactive approach to leveraging industry trends and enhancing shareholder value.

For more detailed information, investors and stakeholders are encouraged to review the full earnings report and join the upcoming earnings call scheduled for today at 4:30 pm Eastern Time. The call can be accessed via the Investors section of the AerSale website or by direct dial-in.

AerSale's performance in the first quarter of 2024 underscores its resilience and strategic foresight in a fluctuating market. With a strong start to the year, the company is well-positioned to continue its growth trajectory, supported by solid financial strategies and innovative market solutions.

Explore the complete 8-K earnings release (here) from AerSale Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance