ADTRAN (ADTN) Q2 Earnings Beat Estimates, Revenues Up Y/Y

ADTRAN, Inc. ADTN reported impressive second-quarter 2021 results, wherein both the bottom line and the top line surpassed their respective Zacks Consensus Estimate. Solid top-line growth, strong segment performance and increased demand for its fiber access platforms backed by its business resiliency drove the Huntsville, AL-based networking equipment maker’s quarterly performance.

Net Income

On a GAAP basis, net income in the June quarter was $5.1 million or 10 cents per share compared with $0.8 million or 2 cents per share in the prior-year quarter. The year-over-year improvement was mainly driven by top-line expansion.

Non-GAAP net income came in at $8.1 million or 16 cents per share compared with $1.6 million or 4 cents per share in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate by 3 cents.

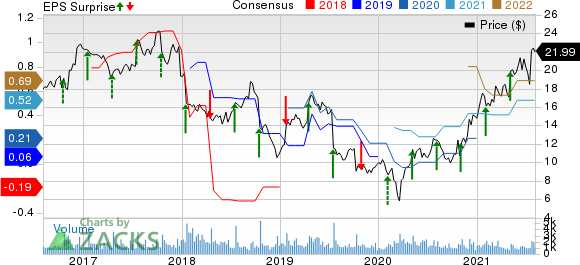

ADTRAN, Inc. Price, Consensus and EPS Surprise

ADTRAN, Inc. price-consensus-eps-surprise-chart | ADTRAN, Inc. Quote

Revenues

Quarterly total revenues grew to $143.2 million from $128.7 million in the prior-year quarter, reflecting the increased demand for ADTRAN’s network solutions. The top line surpassed the consensus estimate of $142 million.

The company’s business continues to be driven by solid demand for its fiber access platforms. This, in turn, boosted ADTRAN’s multiple business segments, including Software-as-a-Service platforms, infrastructure and in-home premises equipment, backed by strength exhibited by Tier 3 regional service providers across the United States and Europe.

Sales of network solutions were $125.4 million compared with $111.3 million in the year-ago quarter. ADTRAN’s end-to-end solutions simplify the deployment of fiber-based broadband services and provide better customer experience. Services and support sales were $17.8 million, up from $17.4 million.

Other Details

The total cost of sales increased from $75.2 million to $80.6 million. Gross profit came in at $62.7 million compared with $53.5 million in the prior-year quarter. Operating income in the quarter was $3.9 million against an operating loss of $6 million in the year-ago quarter.

The company announced that its board of directors approved a cash dividend of 9 cents per share for the second quarter of 2021. The amount is payable on Sep 2 to shareholders on record as of Aug 19.

Cash Flow & Liquidity

During the first six months of 2021, ADTRAN generated $18.2 million of net cash from operating activities compared with $1.7 million in the year-ago quarter. As of Jun 30, 2021, the company had $69.9 million in cash and cash equivalents with $116.1 million of total current liabilities.

Zacks Rank & Stocks to Consider

ADTRAN currently has a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader industry are Materialise NV MTLS, F5 Networks, Inc. FFIV and Duck Creek Technologies, Inc. DCT. While Materialise NV and F5 Networks sport a Zacks Rank #1 (Strong Buy), Duck Creek Technologies carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Materialise NV pulled off a trailing four-quarter earnings surprise of 80%, on average.

F5 Networks pulled off a trailing four-quarter earnings surprise of 5.5%, on average.

Duck Creek Technologies pulled off a trailing four-quarter earnings surprise of 250%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ADTRAN, Inc. (ADTN) : Free Stock Analysis Report

F5 Networks, Inc. (FFIV) : Free Stock Analysis Report

Duck Creek Technologies, Inc. (DCT) : Free Stock Analysis Report

Materialise NV (MTLS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance