Adtalem Global Education Inc. (ATGE) Fiscal Q3 Earnings: Outperforms Analyst Projections with ...

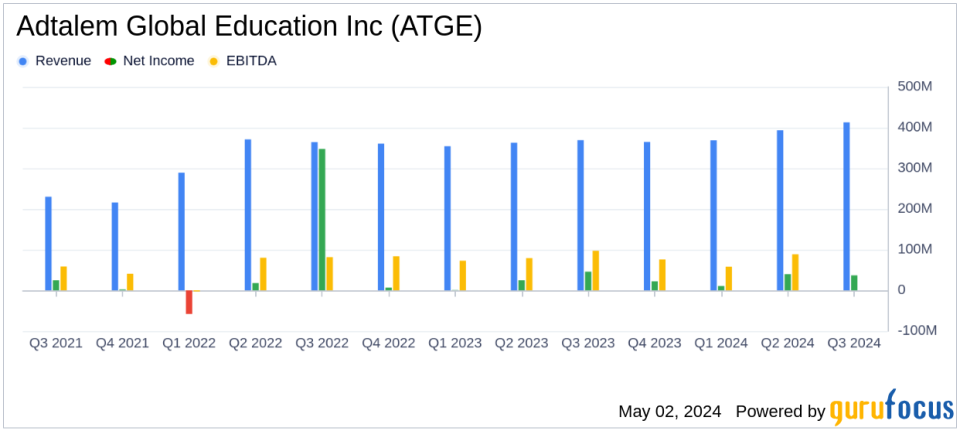

Revenue: Reported at $412.66 million, up 11.8% year-over-year, surpassing the estimated $391.70 million.

Diluted EPS: Recorded at $0.93, falling below the estimated $1.16.

Adjusted EPS: Achieved $1.50, reflecting a 32.7% increase year-over-year, exceeding the estimated $1.16.

Total Enrollment: Increased by 7.8% year-over-year, supporting growth momentum.

Fiscal Year 2024 Guidance: Revenue guidance raised to $1,560 million to $1,580 million, and adjusted EPS guidance increased to $4.80 to $5.00.

Segment Performance: Chamberlain revenue grew by 13.8% and Walden's operating income surged by 128.0%, indicating strong segment-specific growth.

Capital Allocation: Focused on enhancing shareholder value and supporting strategic growth areas.

On May 2, 2024, Adtalem Global Education Inc. (NYSE:ATGE) unveiled its fiscal third-quarter results for the period ending March 31, 2024, demonstrating significant growth and operational efficiency. The company reported an 11.8% year-over-year increase in revenue and a notable rise in total enrollment by 7.8%. Adtalem's diluted earnings per share (EPS) stood at $0.93, with an adjusted EPS of $1.50, reflecting a 32.7% growth from the previous year. These results have led to an upward revision in the full-year 2024 guidance, underscoring the company's strong performance and optimistic outlook. For more details, view the full 8-K filing.

About Adtalem Global Education Inc.

Adtalem Global Education Inc. is a leading American for-profit educational company, primarily focused on healthcare education. The company operates several institutions, including eight colleges and universities offering degrees in business, medicine, education, and nursing. With over 90 campuses and extensive online programs, Adtalem plays a crucial role in filling the workforce gap in the U.S. healthcare system, supporting approximately 80,000 students and over 300,000 alumni.

Quarterly Financial and Operational Highlights

The third quarter saw Adtalem continue its trajectory of growth, driven by increased enrollments and improved academic outcomes. The College of Nursing and the College of Social and Behavioral Health, which together account for over 60% of the degrees awarded, were significant contributors to this quarter's success. Segment-wise, the Chamberlain University reported a 13.8% increase in revenue to $170.3 million and a 9.5% rise in operating income. Walden University also showed strong performance with a 13.3% revenue increase and a dramatic 128% boost in operating income, reflecting efficient operational management and strategic focus.

Enhanced Fiscal Year 2024 Outlook

Encouraged by the strong performance in the third quarter, Adtalem has raised its revenue guidance for fiscal year 2024 to a range of $1,560 million to $1,580 million, up from the previous forecast of $1,520 million to $1,560 million. The adjusted EPS is also expected to be between $4.80 and $5.00, revised from the earlier range of $4.55 to $4.75. This optimistic outlook is supported by Adtalem's effective capital allocation and strategic initiatives aimed at expanding its educational offerings and operational excellence.

Analysis of Financial Statements

The consolidated statements of income reveal a total revenue of $412.7 million for the quarter, surpassing the estimated $391.7 million and marking an 11.8% increase from the previous year. The operating income also improved, registering at $61.7 million. These figures highlight Adtalem's ability to not only generate increased revenue but also effectively manage its operating expenses to boost profitability.

Market and Future Outlook

Adtalem's strategic focus on healthcare education, coupled with its robust financial performance, positions it well in the educational sector, particularly at a time when the demand for healthcare professionals is on the rise. The company's forward-looking strategies and operational adjustments are expected to continue driving growth, making it a noteworthy entity for investors and stakeholders in the education industry.

Adtalem's commitment to enhancing educational pathways into healthcare and addressing the evolving needs of the patient population remains a cornerstone of its mission, promising sustained growth and community impact in the forthcoming periods.

Conclusion

Adtalem Global Education Inc.'s fiscal third-quarter results reflect a strong performance trajectory and an optimistic outlook for the future. With increased guidance for FY 2024 and continuous improvements in enrollment and academic outcomes, ATGE is poised for further success in the dynamic educational landscape.

Explore the complete 8-K earnings release (here) from Adtalem Global Education Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance