Adient (ADNT) Tops Q1 Earnings & Sales Estimates, Scraps View

Adient PLC ADNT reported adjusted earnings per share of 62 cents in second-quarter fiscal 2020, beating the Zacks Consensus Estimate of 32 cents. The figure was also higher than the year-ago quarter’s 31 cents. Theupside mainly resulted from better-than-expected performance in the company’s EMEA and Asia segments.

During the reported quarter, Adient generated net sales of $3,511 million, down from $4,228 million in second-quarter fiscal 2020. However, the top line surpassed the Zacks Consensus Estimate of $3,497 million.

During the fiscal second quarter, net sales in the Seat Structures & Mechanisms business totaled $1,214 million, down from $1,920 million reported in second-quarter fiscal 2019 mainly due to lower vehicle production in China.

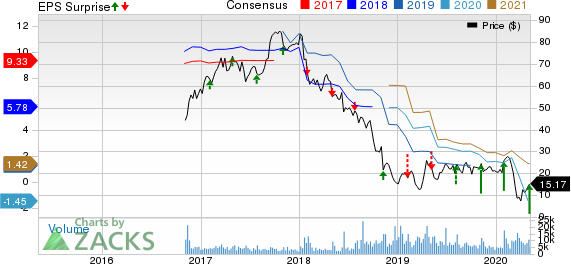

Adient PLC Price, Consensus and EPS Surprise

Adient PLC price-consensus-eps-surprise-chart | Adient PLC Quote

Segment Results

Adient currently operates through three reportable segments — Americas, which includes North America and South America; Europe, Middle East, and Africa (EMEA); and Asia Pacific/China (Asia).

In the Americas, the company recorded revenues of $1,641 million, down 14.3% year over year. The metric also missed the Zacks Consensus Estimate of $1,779 million. Adient generated adjusted EBITDA of $106 million in the fiscal second quarter, indicating a rise from $34 million recorded in the prior-year period, primarily owing to lower launch costs combined with decreased SG&A costs and low commodity costs.

In EMEA, the company registered revenues of $1,488 million, down 16.3% year over year. However, it beat the Zacks Consensus Estimate of $1,385 million. Its quarterly adjusted EBITDA was $62 million compared with the prior-year quarter’s $59 million. Theupside resulted from lower launch costs along with decreased SG&A costs.

Revenues in the Asia segment were $444 million in the reported quarter compared with the year-earlier quarter’s $599 million. The metric, however, beat the Zacks Consensus Estimate of $413 million. The company’s adjusted EBITDA was $63 million compared with $123 million reported in second-quarter fiscal 2020 due to a significant reduction in China production volume amid the coronavirus crisis.

Financials

Adient had cash and cash equivalents of $1,640 million as of Mar 31, 2020,compared with $924 million as of Sep 30,2019. As of the same date, long-term debt amounted to $3,717 million, up from $3,708 billion as of Sep 30, 2019. Long-term debt-to-capital ratio stands at 70.7%. Capital expenditure declined to $94 million in the fiscal second quarter from $108 million recorded in the prior-year quarter.

Outlook

Adient scrapped the 2020 guidance as it expects the coronavirus pandemic’s impactstostrain its operations in the days to come.

Zacks Rank & Stocks to Consider

Adient currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector are Veoneer, Inc. VNE, Unique Fabricating, Inc. UFAB and Modine Manufacturing Company MOD, each carrying a Zacks Rank of 2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Modine Manufacturing Company (MOD) : Free Stock Analysis Report

Unique Fabricating Inc (UFAB) : Free Stock Analysis Report

Adient PLC (ADNT) : Free Stock Analysis Report

Veoneer Inc (VNE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance