50 Tips From Mark Cuban, Dave Ramsey and Other Experts on How To Get Debt-Free

Are you looking to get out of debt? Whether it’s credit cards or student loans, you’ll likely benefit from advice given by some of the world’s most popular financial experts.

Find Out: How To Eliminate $100,000 of Debt

Read More: 7 Common Debt Scenarios That Could Impact Your Retirement — and How To Handle Them

Below is a list of 50 tips for becoming and staying debt-free from top financial professionals including Dave Ramsey, Mark Cuban and Suze Orman.

Dave Ramsey

Check out advice from financial guru Dave Ramsey.

Learn More: This Is the One Type of Debt That ‘Terrifies’ Dave Ramsey

Be Aware: You Can Get These 3 Debts Canceled Forever

Wealthy people know the best money secrets. Learn how to copy them.

Use the Debt Snowball Method

Start by paying off your smallest debt first while maintaining minimum payments on others. As each debt is paid off, roll the amount you were paying into the next smallest debt. This method builds momentum and gives you psychological wins. This makes the debt repayment process feel more manageable and encouraging as you see debts disappearing one by one.

For You: 8 Myths About Debt That Boomers Must Stop Believing Before They Retire

Create a Zero-Based Budget

Every dollar of your income should be allocated to a specific expense, debt payment or investment before the month begins, ensuring no money is wasted. This proactive approach to budgeting helps prevent any discretionary spending and ensures that every dollar is working toward your financial goals.

Cut Up Your Credit Cards

To avoid accumulating new debt, Ramsey advises physically cutting up credit cards and using cash or debit instead. Eliminating the means of getting into new debt helps you focus solely on paying down existing balances and prevents the temptation of impulse buys on credit.

Sell Unnecessary Items

Generate extra cash by selling items you don’t need and apply this money toward your debt. This declutters your space and converts unused assets into cash you can use to pay down your debt.

Cut Grocery Costs

Ramsey suggests meal planning and using coupons to reduce grocery bills as much as possible. Stick to store brands and buy only what’s on your shopping list. If you have trouble with impulse buys at the grocery store, try curbside pickup instead.

Discover More: I’m an Economist: Here Are My Predictions for Inflation If Biden Wins Again

Temporarily Stop All Extra Investments

Ramsey suggests pausing investments in retirement accounts while you focus on debt repayment, then restarting once you are debt-free. Although it may feel counterintuitive, the rationale is that the guaranteed return on investment from paying off high-interest debt often outweighs the potential gains from your current investments. For example, if you have credit card debt with 12% APR, then avoiding that cost will be worth more than the potential 10% or so you can get yearly from an S&P 500 index fund.

Create an Emergency Savings Fund

Ramsey recommends setting aside an emergency fund of at least $1,000, so you can afford unexpected costs. This makes sure you’re prepared for irregular expenses without having to revert to credit.

Use a Cash Envelope System

It’s harder to spend money when you pay in cash rather than with your card, so Ramsey recommends using multiple envelopes for each part of your budget and filling them with cash.

Seek Out Extra Work

He encourages finding additional part-time work or freelancing to increase your income. The more money you have coming in, the more money you can put toward paying off your debt.

Find Out: 6 Reasons the Poor Stay Poor and Middle Class Doesn’t Become Wealthy

Know Your Why

Understanding and reminding yourself why you want to be debt-free can keep you motivated throughout the process. Connecting your efforts to clear motivations — like financial independence, reduced stress or leaving a legacy — can fuel persistence and dedication, especially when you need to make sacrifices.

Mark Cuban

See what billionaire Mark Cuban has to say about handling your debts.

Live Like a Student

Mark Cuban encourages maintaining a minimalist lifestyle, even after you’re making some money. Living below your means helps you avoid unnecessary debt and accumulate savings.

Negotiate With Cash

When making purchases, Cuban suggests that negotiating with cash can lead to better deals. Sellers are sometimes willing to offer discounts for cash payments because it eliminates transaction fees and reduces the risk of chargebacks or disputes. This tactic can be particularly effective for larger purchases such as furniture or electronics, or in settings like markets and small businesses where pricing may be more flexible.

For You: 5 Frugal Habits of Mark Cuban

Use Cash Instead of Credit

To avoid spending money you don’t have, Cuban recommends using cash as much as possible. Using cash imposes a natural limit on your spending and eliminates the risk of accruing interest charges from credit card use, making it a tangible way to stick to a budget. If you need to use a card, he recommends using a debit card.

Buy Consumables in Bulk

Purchasing items in bulk can lead to significant savings for consumable products that you use regularly. Cuban’s advice here focuses on reducing the cost per unit of items like toiletries, cleaning supplies and nonperishable foods.

Suze Orman

Keep reading for Suze Orman’s best debt advice.

Always Pay More Than the Minimum

Paying only the minimum on credit cards can extend debt for years. Orman recommends paying extra whenever possible. This reduces the principal faster, which decreases interest costs and shortens the repayment period.

Explore More: Net Worth for Baby Boomers: How To Tell Whether You’re Poor, Middle Class, Upper Middle Class or Rich

Check Your Credit Report Regularly

Regular checks can help you identify any errors or fraudulent activities that might affect your debt reduction efforts. A clean and accurate credit report can also improve your credit score, which may qualify you for lower interest rates on debt consolidation or refinancing.

Choose the Right Debt To Pay Off First

Orman sometimes suggests the “debt avalanche” or “debt rolldown” method — paying off debts with the highest interest rates first, which differs from Ramsey’s snowball method. This method reduces the amount of interest you pay more quickly than targeting smaller debts.

Use Balance Transfers Wisely

Orman recommends using balance transfers to a zero-interest credit card as a tool, but make sure to read the fine print and understand any fees involved. Properly managed, this can provide a breather from interest, allowing more of your payments to go toward reducing the principal balance.

Don’t Co-Sign Loans

She warns against co-signing loans, even for friends and family. It can lead to unforeseen debt obligations if the other party fails to pay, adversely affecting your credit score and financial stability.

Read Next: I’m a Financial Advisor: Here’s Why My Rich Clients Identify With the Middle Class

Don’t Overspend During the Holidays

Orman recommends setting a realistic budget for gifts, decorations and celebrations, and sticking to it no matter what. Instead of focusing on pricey gifts, she suggests giving meaningful experiences or homemade presents.

Use Windfalls Wisely

Orman suggests putting any unexpected windfalls, like tax refunds or bonuses, directly toward paying down debts and increasing savings. You can spend a bit of the money, up to around 10%, on something you want, but the rest should go toward your financial goals.

Educate Yourself on Financial Laws

Knowing your rights regarding debt collection can protect you from unfair practices and provide peace of mind. Understanding what collectors can and cannot do can help you navigate interactions with them and potentially negotiate better repayment terms.

Ramit Sethi

Here’s the guidance Ramit Sethi has if you’re dealing with debt.

Check Out: How Much Does the Average Baby Boomer Have in Savings?

Automate Your Finances

Ramit Sethi recommends setting up automatic transfers for savings and automatic payments toward debt to ensure you never miss a payment. This automation simplifies your financial management and prioritizes debt repayment and savings as nonnegotiable aspects of your budget.

Spend Consciously

Sethi encourages spending on what truly makes you happy but advises being ruthless in cutting unnecessary expenses. This philosophy ensures that your spending aligns with your values, thereby maximizing personal satisfaction while minimizing wasteful expenditure.

Use a 50/20/30 or 70/20/10 Budget

Ramit Sethi recommends employing a structured budgeting framework to manage your finances effectively. For the 50/20/30 rule, you’d allocate 50% of your income to essentials like rent and groceries, 20% to savings and debt repayment and 30% to personal spending on things like dining out and entertainment. Alternatively, the 70/20/10 rule puts 70% toward living expenses, 20% toward savings and 10% toward giving. This approach to budgeting helps you prioritize your financial goals.

Negotiate With Creditors

Sethi suggests that you can often negotiate down your interest rates or get better payment terms by simply calling and asking. Negotiating can lead to a reduced financial burden, as lower interest rates or extended payment terms can make your repayment trajectory much faster.

Explore More: I’m a Self-Made Millionaire: Here’s My Monthly Budget

Invest In Yourself

While paying off debt, Sethi encourages continued investment in personal development and skills that can increase income. Investing in your professional growth can lead to higher earnings potential, which in turn can be used to accelerate debt repayment.

Robert Kiyosaki

Check out what Robert Kiyosaki says about managing your debts.

Use Good Debt to Your Advantage

Unlike other financial experts, Kiyosaki differentiates between good debt (that creates value) and bad debt (that costs money). He advises leveraging good debt to create assets. Good debt, such as loans for real estate or business investments, can generate returns greater than the cost of the debt itself, effectively increasing wealth.

Focus On Asset Building

Even while in debt, focus on building assets that generate income, which can then be used to pay off bad debt. Kiyosaki advocates for income-generating assets as a strategy to outpace the burden of debt and build long-term financial security.

Check Out: Here’s How Much the Definition of Rich Has Changed in Every State

Financial Education

Kiyosaki stresses the importance of understanding how money works. He says that knowing which things in your life are assets and which are liabilities is one of the first steps of financial literacy.

Invest for Cash Flow, Not Capital Gains

Robert Kiyosaki advocates for putting your money into assets that produce monthly income, such as rental properties or dividend-paying stocks. Kiyosaki explains that while capital gains can be unpredictable and subject to market fluctuations, cash flow is more stable and controllable, offering financial freedom and security. He encourages investors to think like business owners, prioritizing investments that keep money flowing in consistently, regardless of the economic climate.

Clark Howard

Here’s a look at what personal finance pro Clark Howard has to say about dealing with debt.

Find Cheaper Insurance Alternatives

Howard often advises shopping around for insurance to lower monthly expenses and apply the savings toward debt. Regularly comparing insurance providers for better rates or reduced coverage that still meets needs can significantly decrease monthly outflows, freeing up resources for debt payments.

Read More: I’m a Self-Made Millionaire, but I Still Opt for the Budget Versions of These 6 Items

Try To Get a Better Rate

If possible, try to get your high-interest loans and credit cards to lower interest rates, either by negotiating with your bank or getting a different lower-interest loan to pay off the high-interest one. This can dramatically reduce the amount of interest paid on existing debts, particularly credit card balances and personal loans, speeding up the debt repayment process.

Freeze Your Credit

To prevent new debts, Howard suggests freezing your credit, which also protects against identity theft. A credit freeze restricts access to your credit report, which makes it harder for identity thieves to open accounts in your name and prevents you from impulsively opening new credit accounts.

Use Loyalty Programs Wisely

Howard recommends using cash back and rewards to your advantage, making sure they are saving you money, not encouraging more spending. Effectively utilizing rewards and cash back from credit cards and loyalty programs can provide genuine savings on purchases you were already planning to make.

Utility Savings

Howard advises regularly auditing your utility usage and reducing costs with more efficient practices and appliances. Investing in energy-efficient appliances and adopting smarter energy-use habits can lower utility bills substantially.

Be Aware: 5 Unnecessary Bills You Should Stop Paying in 2024

Drive Older Vehicles

Howard recommends driving reliable older vehicles to avoid the steep depreciation and financing costs of new cars. Older vehicles typically have lower insurance costs and are cheaper to register, not to mention they help buyers avoid the large initial depreciation hit they’d take on a new vehicle.

Avoid Expensive Cellphone Plans

He suggests using low-cost cellphone carriers or plans to reduce monthly expenses. Switching to budget carriers or plans that only charge for the services you use can cut your cellphone bill in half.

Travel Frugally

Howard is a proponent of budget travel and recommends looking for deals and discounts to save on vacations. Planning travel during off-peak times, using price comparison tools and taking advantage of last-minute deals can make even exotic vacations affordable and help you avoid allowing these trip costs to become debt.

Regular Price Comparisons

Regularly compare prices for services like internet and utilities to ensure you’re getting the best deal. Consistent vigilance in comparing service providers and negotiating rates can lead to substantial savings over time, which can be applied directly to debt.

For You: Mark Cuban Reveals Why He Keeps a Strict Budget Everyday

Take Advantage of Free Resources

Clark often highlights free educational and entertainment resources, which can help maintain quality of life on a tighter budget. Utilizing free resources like free streaming services, public libraries, community events and online courses can enrich your life and skills without impacting your wallet.

Brian Preston

Keep reading to see what Brian Preston, founder and host of “The Money Guy Show,” has to say about paying off your debts.

Detailed Financial Planning

Preston emphasizes the need for detailed budgeting and financial planning. This approach involves setting up specific, measurable financial goals and regularly reviewing budgets to align with these goals.

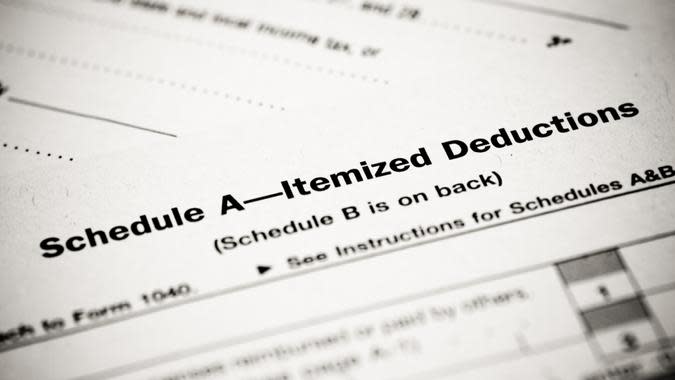

Maximize Tax Deductions

Effective tax planning can significantly reduce your tax burden, freeing up additional funds that can be directed toward faster debt reduction.

Check Out: Net Worth for Gen X: How To Tell If You’re Poor, Middle-Class, Upper Middle-Class or Rich

Maximize Employer Matching

Preston strongly advocates taking full advantage of employer-matching contributions in retirement plans, emphasizing that it’s essentially free money. He advises everyone to contribute at least enough to their retirement accounts to receive the full match offered by their employer, as this is an immediate return on your investment. Not maximizing this benefit is like leaving money on the table — money that could significantly impact your future financial stability and potentially keep you out of debt.

Don’t Pay Off Your Mortgage Too Early

Preston cautions against rushing to pay off a mortgage prematurely. He points out that mortgage interest rates are typically lower than the returns you could potentially earn from investing in the stock market or other investments. By prioritizing mortgage payoff over contributions to investment accounts, especially tax-advantaged retirement accounts, you might be missing out on higher returns.

Don’t Spend More Than 8% of Your Income on Car Payments

Brian Preston advises keeping car payments within 8% of your monthly income to maintain a balanced budget. He says that it is best to buy cars with cash, but if you have to take out a loan, you should aim to put down 20% and pay off the car in three years or less.

Set Aside Money for Your Deductibles

Brian Preston emphasizes the importance of having a dedicated savings account for insurance deductibles, whether it’s for health, auto or homeowners insurance. This approach ensures that you’re financially prepared for unexpected events or emergencies that require an insurance claim. Setting aside funds specifically for deductibles prevents the need to divert money from other areas like monthly expenses or long-term savings.

Find Out: Here’s What the US Minimum Wage Was the Year You Were Born

Use Technology To Track Spending

Preston advocates using financial apps to track spending and stay on budget. Utilizing technology for financial management can provide real-time insights into spending habits, helping to identify areas where adjustments are needed and ensuring financial goals are met.

Treat Low-Interest and High-Interest Debt Differently

Preston advises prioritizing high-interest debts, such as credit card balances and personal loans, because they cost you more over time. Low-interest debts, like most student loans and mortgages, may not need to be rushed for repayment. Preston suggests that with low-interest debts, it might be more beneficial to make regular payments while directing extra financial resources toward investments that could yield a higher return than the interest rate on the debt.

Focus on Net Worth, Not Just Debt

He encourages a holistic view of finances that focuses on building net worth, not just eliminating debt. By focusing on overall net worth, you consider assets and investments alongside debt, which provides a more comprehensive picture of your financial progress.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 50 Tips From Mark Cuban, Dave Ramsey and Other Experts on How To Get Debt-Free

Yahoo Finance

Yahoo Finance