5 Top-Ranked Media Stocks to Enrich Your Portfolio in 2H19

Media companies enjoyed a smooth ride in first-half 2019. This is reflected in the solid performance of the Invesco Dynamic Media ETF (PBS), which has returned 19.3% on a year-to-date basis compared with the S&P 500’s growth of 16.9%.

Expanding original and fresh content, rapid adoption of alternative distribution channels for broadcast and cable programming, strong demand for high-quality video, and the binge-viewing trend are driving growth.

Media companies are offering skinny bundles, which are helping them keep pace with new consumption patterns and attract customers. Moreover, the momentum in advertising revenues is expected to continue, owing to major sporting events like European Games and Women’s World Soccer despite stiff competition from Google and Facebook.

Further, political ad spending is expected to increase in the second half of 2019 — due to the 2020 U.S. Presidential election — which bodes well for media companies.

Our Picks

Here, we pick five media stocks that offer good investment opportunities in the second half of 2019. These stocks either sport a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Los Gatos, CA-based Roku ROKU benefits from rapid adoption of its players and expanding footprint in the fast-growing Smart TV space. The company’s advertising sales is also growing.

Further, the company is expanding internationally, which provides significant growth opportunities. Moreover, impressive Roku channel content — including HBO, SHOWTIME, EPIX and STARZ — is a key catalyst.

This Zacks Rank #1 stock has returned a whopping 203.7% on a year-to-date basis. Moreover, the company delivered average positive earnings surprise of 85.82% in the trailing four quarters. The Zacks Consensus Estimate of a loss has narrowed from 73 cents to 58 cents per share for 2019 over the past 60 days.

Roku, Inc. Price and Consensus

Roku, Inc. price-consensus-chart | Roku, Inc. Quote

Beijing-based iQIYI IQ has returned 42.5% year to date. The Chinese online media company now has more than 100 million subscribers.

iQiYI’s content portfolio strength is expected to expand subscriber base. Reportedly, the company is planning to spread its international presence for further growth opportunities.

This Zacks Rank #1 stock delivered average positive earnings surprise of 19.82% in the trailing four quarters. The Zacks Consensus Estimate of a loss has narrowed from $1.64 to $1.38 per share for 2019 over the past 60 days.

iQIYI, Inc. Sponsored ADR Price and Consensus

iQIYI, Inc. Sponsored ADR price-consensus-chart | iQIYI, Inc. Sponsored ADR Quote

Camarillo, CA-based Salem Media Group SALM has returned 14.4% on a year-to-date basis.

Salem Media is a radio broadcaster, Internet content provider, and magazine and book publisher specializing in Christian and Conservative content. The company is also foraying into television through a deal with Trinity Broadcasting Network, announced in May.

The company is investing in its agency digital initiative, Salem Surround, which is expected to drive local digital revenues.

This Zacks Rank #1 stock delivered average positive earnings surprise of 40.18% in the trailing four quarters. The Zacks Consensus Estimate for 2019 earnings has surged 55.6% to 14 cents over the past 60 days.

Salem Media Group, Inc. Price and Consensus

Salem Media Group, Inc. price-consensus-chart | Salem Media Group, Inc. Quote

Santa Monica, CA-based Entravision Communications EVC has a Zacks Rank #2. The company is a popular name among Hispanics, and provides Latino data and digital services to advertisers. Notably, expansion into Mexico, Argentina and Colombia are expected to further boost advertiser base.

Entravision’s increasing digital advertising solutions portfolio is a major growth driver. The company is also expected to benefit from continued higher spending by advertisers on digital audio.

The company delivered average positive earnings surprise of 138.89% in the trailing four quarters. The Zacks Consensus Estimate for 2019 earnings has rallied 25% to 25 cents over the past 60 days.

Entravision Communications Corporation Price and Consensus

Entravision Communications Corporation price-consensus-chart | Entravision Communications Corporation Quote

Shaw Communications’ SJR wireless business, which covers almost half of the Canadian population, is benefiting from an increasing subscriber base and improving average revenue per unit (ARPU). Moreover, the company’s initiative to deploy 700 MHz and 2500 MHz spectrums further improves the network quality.

Shaw Communications recently acquired 11 paired blocks of 20-year 600 MHz spectrum across its wireless operating footprint. The acquisition is expected to not only improve the company’s current LTE service, but also help it affordably offer 5G service in the long haul.

This Zacks Rank #2 stock delivered average positive earnings surprise of 19.92% in the trailing four quarters. The Zacks Consensus Estimate for fiscal 2019 earnings has increased 12.2% to $1.10 over the past 30 days. The stock has returned 13.3% year to date.

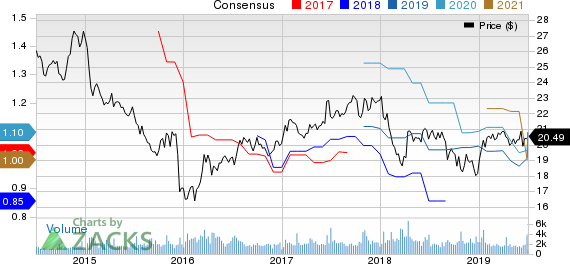

Shaw Communications Inc. Price and Consensus

Shaw Communications Inc. price-consensus-chart | Shaw Communications Inc. Quote

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Entravision Communications Corporation (EVC) : Free Stock Analysis Report

Salem Media Group, Inc. (SALM) : Free Stock Analysis Report

Shaw Communications Inc. (SJR) : Free Stock Analysis Report

Roku, Inc. (ROKU) : Free Stock Analysis Report

iQIYI, Inc. Sponsored ADR (IQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance