5 Stocks in Focus on Their Recent Dividend Hike

U.S. stock markets had a dream rally in the first half of 2023 after a disappointing 2022. Wall Street achieved several milestones in the first half of this year. The broad-market index — the S&P 500 — formed a new bull market during this period. The S&P 500 and the Nasdaq Composite recorded their best first-half since 2019 and 1983, respectively. The Dow relatively lagged. Yet, the blue-chip index managed to finish the first half in green.

Despite these fabulous performances, we are not out of the woods. On Jun 14, in his post-FOMC meeting statement, Fed Chairman Jerome Powell said that the central bank has decided to keep the Fed fund rate unchanged at the existing rate of 5-5.25%.

However, Powell also mentioned that more rate hikes are likely this year. The Fed’s current “dot-plot” shows that the mean expectation of officials is for another 50-basis point raise in the benchmark interest rate. This implies, two more rate hikes of 25 basis points each within 2023.

The terminal interest rate is at present 5.6%, instead of the 5.125%, anticipated after the May FOMC meeting. No rate cut is expected this year. The first cut in interest rate may be delayed till 2025.

At present, the CME FedWatch assigned an 87.5% probability to a Fed fund rate hike of 25 basis points in the July FOMC meeting. Only, 12.5% of respondents think the lending rate will remain the same.

Stocks in Focus

At this stage, dividend-paying stocks should be in demand as investors try to safeguard their portfolios. We believe that one should consider stocks that have recently raised their dividend payments. Five such companies are - General Mills Inc. GIS, Worthington Industries Inc. WOR, The Greenbrier Companies Inc. GBX, The PNC Financial Services Group Inc. PNC and GasLog Partners LP GLOP.

General Mills has gained from its Accelerate strategy, which is highlighted by its key priorities. These include competing efficiently, investing in Holistic Margin Management and Strategic Revenue Management initiatives and reshaping the portfolio.

GIS’ recent portfolio reshaping actions are likely to drive growth, though the net impact is likely to hurt fiscal 2023 profits. In the fiscal year, management expects a rise in the cost of goods sold. That said, saving and pricing actions should favor the company. General Mills currently carries a Zacks Rank #3 (Hold).

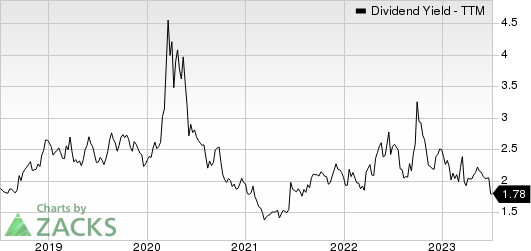

On Jun 28, 2023, General Mills declared that its shareholders would receive a dividend of $0.59 per share on Aug 1, 2023. It has a dividend yield of 2.9%. Over the past five years, GIS has increased its dividend three times, and its payout ratio presently stays at 50% of earnings. Check GIs’ dividend history here.

General Mills, Inc. Dividend Yield (TTM)

General Mills, Inc. dividend-yield-ttm | General Mills, Inc. Quote

Worthington Industries is North American's premier, value-added steel processor, providing customers with wide ranging capabilities, products and services for a variety of markets including automotive, construction and agriculture. WOR is also the leading global supplier of pressure tanks and cylinders.

WOR manufactures a host of pressure cylinders for industrial gas and cryogenic applications, oil and gas equipment, transportation and alternative fuel storage, and consumer brand retail products, including Bernzomatic, Coleman and Balloon Time. Worthington Industries currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

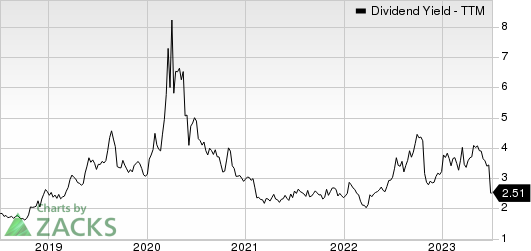

On Jun 28, 2023, Worthington Industries declared that its shareholders would receive a dividend of $0.32 per share on Sep 29, 2023. It has a dividend yield of 1.9%. Over the past five years, WOR has increased its dividend six times, and its payout ratio presently stays at 21% of earnings. Check WOR’s dividend history here.

Worthington Industries, Inc. Dividend Yield (TTM)

Worthington Industries, Inc. dividend-yield-ttm | Worthington Industries, Inc. Quote

The Greenbrier Companies is a leading supplier of transportation equipment and services to the railroad and related industries. GBX’s manufacturing segment produces double-stack intermodal railcars, conventional railcars and marine vessels, and performs repair and refurbishment activities for both intermodal and conventional railcars.

GBX is also engaged in complementary leasing and services activities. Greenbrier Europe is an end-to-end freight railcar manufacturing, engineering and repair business with operations in Poland & Romania that serves customers across Europe and the Middle East. The Greenbrier Companies currently carries a Zacks Rank #2 (Buy).

On Jun 29, 2023, The Greenbrier Companies declared that its shareholders would receive a dividend of $0.30 per share on Aug 8, 2023. It has a dividend yield of 2.8%. Over the past five years, GBX has increased its dividend two times, and its payout ratio presently stays at 42% of earnings. Check GBX’s dividend history here.

Greenbrier Companies, Inc. (The) Dividend Yield (TTM)

Greenbrier Companies, Inc. (The) dividend-yield-ttm | Greenbrier Companies, Inc. (The) Quote

The PNC Financial stands solid from the balance-sheet perspective. Total loans and deposits have witnessed a four-year (2018-2022) CAGR of 9.6% and 13%, respectively. The rising trend continued sequentially in first-quarter 2023 in terms of loans and deposits. With decent pipelines, PNC is well poised for loan balance growth in 2023. PNC expects loans to rise 1-3% in 2023.

PNC remains committed to strengthening its business through strategic acquisitions. Also, sound capital deployment activities, backed by decent liquidity, may boost investors’ confidence in the stock. The PNC Financial currently carries a Zacks Rank #3.

On Jul 3, 2023, The PNC Financial declared that its shareholders would receive a dividend of $1.55 per share on Aug 5, 2023. It has a dividend yield of 4.9%. Over the past five years, PNC has increased its dividend four times, and its payout ratio presently stays at 41% of earnings. Check PNC’s dividend history here.

The PNC Financial Services Group, Inc Dividend Yield (TTM)

The PNC Financial Services Group, Inc dividend-yield-ttm | The PNC Financial Services Group, Inc Quote

GasLog Partners owns, operates and acquires LNG carriers with multi-year charters. GLOP charges customers for the transportation of their LNG using its LNG carriers. GLOP currently carries a Zacks Rank #3.

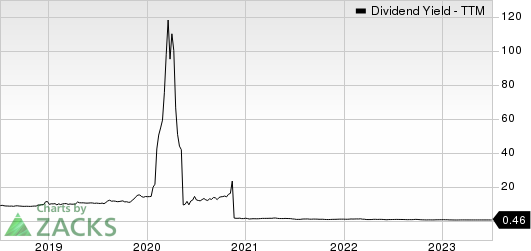

On Jul 3, 2023, GasLog Partners declared that its shareholders would receive a dividend of $3.28 per share on Jul 12, 2023. It has a dividend yield of 0.5%. Over the past five years, GasLog Partners has increased its dividend two times, and its payout ratio presently stays at 2% of earnings. Check GLOP’s dividend history here.

GasLog Partners LP Dividend Yield (TTM)

GasLog Partners LP dividend-yield-ttm | GasLog Partners LP Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

Worthington Industries, Inc. (WOR) : Free Stock Analysis Report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Greenbrier Companies, Inc. (The) (GBX) : Free Stock Analysis Report

GasLog Partners LP (GLOP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance