5 Singapore Dividend Stocks That Reported Higher Profits

Dividend-paying stocks are highly sought after as they provide a steady stream of passive income.

These companies become even more attractive when they report better profits too.

As the business grows, the share price should naturally follow as well.

Investors who own such companies in their investment portfolios get to enjoy the best of both worlds — steady capital appreciation and a stream of dividends to boot.

Here are five Singapore stocks that both pay out a dividend and reported higher year on year net profits.

Micro-Mechanics (Holdings) Ltd (SGX: 5DD)

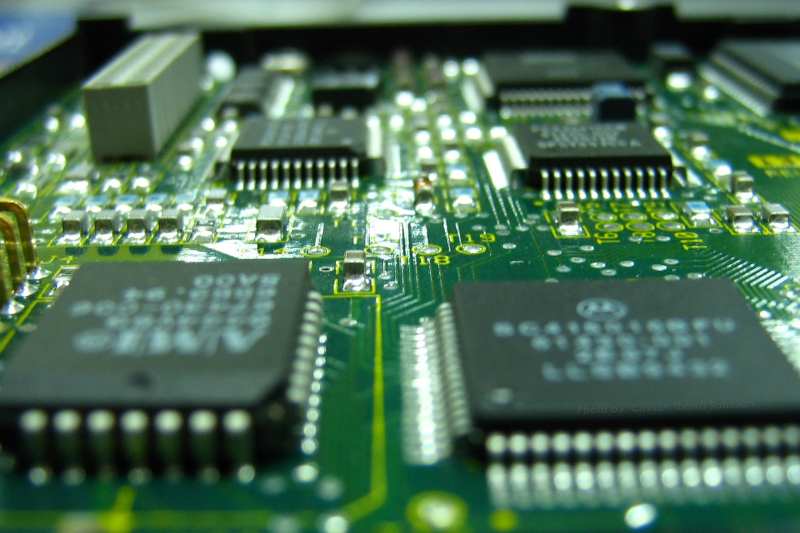

Micro-Mechanics (Holdings) Ltd, or MMH, designs, manufactures and markets high-precision tools and parts used in the manufacturing processes for the semiconductor industry.

For the first nine months of its fiscal 2022 (9M2022) ended 31 March 2022, MMH saw revenue increase by 10.8% year on year to S$60.5 million.

Operating profit rose 10% year on year to S$18.7 million while net profit inched up 5% year on year to S$13.9 million.

The group also generated a healthy free cash flow of S$14.8 million for 9M2022.

MMH had just paid out an interim dividend of S$0.06 when it released its fiscal 2022’s first-half results, and its trailing 12-month dividend stood at S$0.14.

Its shares provide a trailing dividend yield of 4.6%.

The group remains optimistic about its future with the worldwide semiconductor market projected to increase by 10.4% to US$613.5 billion in 2022.

Grand Venture Technology (SGX: JLB)

Grand Venture Technology, or GVT, is a solutions and services provider for the manufacture of complex precision machining, sheet metal components, and mechatronic modules.

For its fiscal 2022 first quarter (1Q2022) business update, GVT saw revenue jump 41% year on year to S$32.5 million.

All three of its divisions — semiconductor, life sciences, and electronics, aerospace and medical, saw revenues rise year on year.

Net profit increased by 8.9% year on year for 1Q2022 to S$3.6 million.

The group had paid out a total dividend of S$0.01 in fiscal 2021 (FY2021), translating to a historical dividend yield of 1.1%.

Venture Corporation Limited (SGX: V03)

Venture Corporation is a blue-chip electronic services provider that manages a portfolio of more than 5,000 products and solutions and employs more than 12,000 globally.

In its 1Q2022 business update, the group reported a healthy 29.5% year on year jump in revenue to S$889.3 million.

Net profit climbed 28.6% year on year to S$84 million.

Venture Corporation attributed the good showing to broad-based growth across the majority of its domains, underpinned by robust demand from its multiple clients.

The group paid out a total dividend of S$0.75 for FY2021, translating to a historical dividend yield of 4.3%.

Venture Corporation remains optimistic as it has gained good traction in various sectors and is now the technology partner of choice for many global companies.

AEM Holdings Limited (SGX: AWX)

AEM provides comprehensive test solutions for the semiconductor and electronics sectors and has manufacturing plants located in Singapore, Malaysia, Indonesia, Vietnam, China, and Finland.

The group reported a stellar set of earnings for its 1Q2022 business update.

Revenue soared 226.4% year on year to S$261.9 million while net profit more than tripled year on year to S$40.8 million.

The increase was due to the strong uptake of AEM’s new-generation tools and equipment, as well as the consolidation of CEI Pte Ltd which was acquired by AEM last year.

A total of S$0.076 per share was paid out in dividends for FY2021, giving AEM’s shares a trailing dividend yield of 1.7%.

Sheng Siong Group Ltd (SGX: OV8)

Sheng Siong operates one of the largest supermarket chains in Singapore with 65 outlets across the island.

The group sells a wide variety of products including live and chilled produce as well as general merchandise and essential household items.

Revenue for 1Q2022 rose 6% year on year to S$358 million, driven by higher comparable store sales and the opening of a new store.

Net profit increased by 13.9% year on year to S$35.2 million.

For FY2021, Sheng Siong paid out a total of S$0.062 per share in dividends, giving its shares a trailing dividend yield of 4%.

Sheng Siong will focus on opening three to five new stores per year over the next three to five years and focus on heartland areas where it is currently not present.

Already, two new stores will open in the first half of 2022 and the group intends to build its e-commerce capabilities to serve customers in areas where it has currently no presence.

In our special FREE report, Top 9 Dividend Stocks for 2022 – and 3 Tactical Shifts to Maximise Your Profits, we’re revealing 3 special categories of stocks that are poised to deliver maximum growth in 2022 and beyond.

Our safe-harbour stocks are a set of blue-chip companies that have been able to hold their own and deliver steady dividends. Growth accelerators stocks are enterprising businesses poised to continue their growth. And finally, the pandemic surprises are the unexpected winners of the pandemic.

Download for free to find out which are our safe-harbour stocks, growth accelerators, and pandemic winners! CLICK HERE to find out now!

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclaimer: Royston Yang owns shares of Micro-Mechanics (Holdings) Ltd.

The post 5 Singapore Dividend Stocks That Reported Higher Profits appeared first on The Smart Investor.

Yahoo Finance

Yahoo Finance