5 Giants Likely to Win Big on Earnings Results This Week

We are in the initial stages of the first-quarter 2024 earnings season. The earnings results and management guidance will be crucial for market participants to gauge the health of the U.S. economy.

As of Apr 12, 30 companies on the S&P 500 Index have reported their financial numbers. Total earnings for these 30 index members are up 21% from the same period last year on 5.8% higher revenues, with 80% beating EPS estimates and 56.7% beating revenue estimates.

At present, total earnings of the S&P 500 Index in first-quarter 2024 are expected to be up 2.9% on 3.8% higher revenues. This follows the 6.8% earnings growth on 4% higher revenues in fourth-quarter 2023 and 3.8% earnings growth on 2.2% higher revenues in third-quarter 2023.

Meanwhile, a few U.S. corporate behemoths are set to beat on earnings this week. A handful of them currently carry a favorable Zacks Rank. The combination of a favorable Zacks Rank and an earnings beat should drive their stock prices in the near-term.

Our Top Picks

We have narrowed our search to five large-cap stocks that are poised to beat on earnings results this week. Each of these stocks carries a Zacks Rank #3 (Hold) and has a positive Earnings ESP. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our research shows that for stocks with the combination of a Zacks Rank #3 or better and a positive Earnings ESP, the chance of an earnings beat is as high as 70%. These stocks are anticipated to appreciate after their earnings release. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

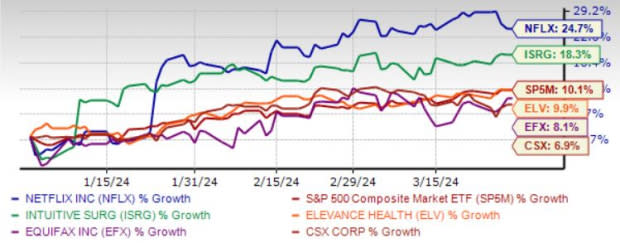

The chart below shows the price performance of our five picks in the last quarter.

Image Source: Zacks Investment Research

CSX Corp. CSX expects volumes in 2024 to grow in the low to mid-single digits, driven by strong anticipated performances in the merchandise, intermodal and coal units. To counter inflationary pressure, the railroad operator aims to improve efficiencies. We are also impressed by CSX's efforts to reward its shareholders through dividends and buybacks. In February 2024, CSX raised its dividend by 9.1% to $0.12 per share.

CSX has an Earnings ESP of +0.72%. It has an expected earnings growth rate of 6.5% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.5% over the last seven days.

CSX recorded earnings surprises in two out of the last four reported quarters, with an average beat of 4.1%. The company is set to release earnings results on Apr 17, after the closing bell.

Equifax Inc. EFX plays a crucial role for its customers who rely on its credit information, analytical services and data for processing various financial applications such as credit cards, auto loans, and home and equity loans.

EFX’s strategic acquisitions over time have allowed it to offer comprehensive insights into consumer behavior and financial status as well as market opportunities. The diverse client base of EFX is advantageous, helping to offset weaknesses in one sector with strengths in others.

Equifax has an Earnings ESP of +1.91%. It has an expected earnings growth rate of 22.2% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.5% over the last 30 days.

Equifax recorded earnings surprises in three out of the last four reported quarters, with an average beat of 2.4%. The company is set to release earnings results on Apr 17, after the closing bell.

Netflix Inc. NFLX is benefiting from its growing subscriber base, thanks to a robust portfolio. Crackdown on password-sharing and the introduction of paid sharing in more than 100 countries, which represents over 80% of NFLX’s revenue base, is also expected to aid growth.

NFLX’s diversified content portfolio, which is attributable to heavy investments in the production and distribution of localized and foreign-language content, has been driving its growth prospects.

Netflix has an Earnings ESP of +0.71%. It has an expected earnings growth rate of 41.5% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last seven days.

Netflix recorded earnings surprises in three out of the last four reported quarters, with an average beat of 5.4%. The company is set to release earnings results on Apr 18, after the closing bell.

Intuitive Surgical Inc. ISRG has been benefiting from The da Vinci procedure volume in the last couple of years. This trend is likely to continue in 2024. Improving procedure volume along with better system placements and services across all markets will drive ISRG’s top-line growth this year. Intuitive Surgical witnessed healthy customer demand for its products in the quarter under review. ISRG’s Ion platform has strong growth potential. A stable liquidity position is an added positive.

Intuitive Surgical has an Earnings ESP of +6.50%. It has an expected earnings growth rate of 8.2% for the current year. ISRG recorded earnings surprises in the last four reported quarters, with an average beat of 5.8%. The company is set to release earnings results on Apr 18, after the closing bell.

Elevance Health Inc. ELV has benefited from premium rate increases and expanding memberships. Strategic acquisitions and partnerships have fortified ELV’s business portfolio. Notably, a robust Medicare Advantage segment, combined with successful contract acquisitions, is poised to drive future membership growth.

The Carelon business is a key contributor to ELV’s success. Elevance Health utilizes excess capital to boost shareholder value. We expect ELV’s product revenues to rise more than 5.4% year over year in 2024.

Elevance Health has an Earnings ESP of +1.19%. It has an expected earnings growth rate of 11.8% for the current year. Elevance Health recorded earnings surprises in the last four reported quarters, with an average beat of 3.1%. The company is set to release earnings results on Apr 18, before the opening bell.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CSX Corporation (CSX) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance