5 ETF Strategies To Consider In The Current Bull Market

Investors are experiencing the best bull market historically. But many investors are asking, “How much further can the world’s stock markets rise?”.

Where should we place our bets on and how much returns should we expect? What are some of the risks that investors should be wary of?

ETF investing an attractive option for investors

October has historically been the most pessimistic months during pivotal world events.

As we head into the 30th year anniversary of Black Monday crash of October 1987, DBS Research remains confident that markets are heading upwards.

DBS Research believes that global stock markets will be driven by fundamentals and valuations supported by the former in the near future.

DBS Research views dividend yields, earnings and portfolio diversification by region and sector worldwide to be important factors that will determine whether global stock markets continue to hit new highs.

As the global growth broadens and the reflation theme gains traction, the outlook for exchange-traded funds (ETFs) investing has turned attractive in the eyes of DBS Research.

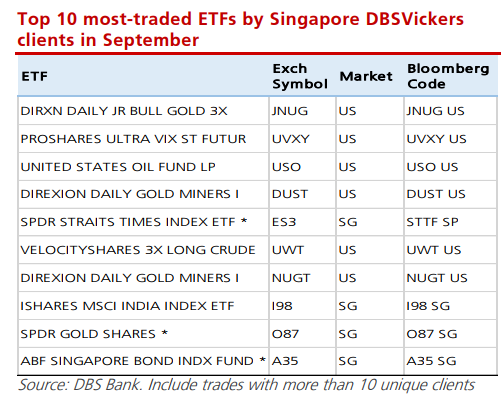

Singapore STI, Singapore Bond, Oil and Gold ETFs are among the top 10 traded ETFs as portfolio diversification tools for Singapore retail investors.

DBS Research opines that retail investors should instead move to diversify their portfolios as we head into historically pessimistic and uncertain months of the year.

Here are five ETF investing strategies DBS Research suggested recently:

1. International diversification

There are a few compelling reasons why investors should maintain a diversified international portfolio through ETFs.

Firstly, expectations of a weak dollar continue despite the likelihood of rate hikes at the end of the year. Bond yields will continue to stay low as well.

Another compelling reason is the cheap valuations of markets outside of the US, especially in the emerging markets (EMs), especially in Asia.

Much of the fanfare for EMs in Asia is the stronger growth from China. Stronger commodity prices are also underlying the performance of EMs Asia.

Recommended ETF: Vanguard FTSE Europe (NYSE ARCA: VGK), iShares Emerging Markets (NYSE ARCA: EEM)

2. EM exposure: Thailand

Within EM Asia, one of the markets DBS Research is positive on is Thailand.

DBS Research is seeing positive developments in Thailand and as such, getting more optimistic on the outlook for the Thai market.

The macro trend has also been improving. The Thai market is also showing signs that the recovery could be sustainable.

Recommended ETF: iShares MSCI Thailand (NYSE ARCA: THD)

3. Energy sector

From an overall portfolio perspective, DBS Research remains convinced that investors should stay slightly exposed to the energy sector, in the event that the energy sector bounces back.

DBS Research recommends investing in energy sector ETFs to remove company-specific risks of energy companies.

Recommended ETF: Power Shares Cleantech (NYSE ARCA: PZD), United States Oil (NYSE ARCA: USO)

4. Technology sector

Another sector that DBS Research recommends exposure to is the technology sector.

After all, the technology sector has been the top performer in the past year because of next-generation technology, cybersecurity and artificial intelligence themes.

Moving forward, these themes will continue to garner strong interests from both retail and institutional investors.

Recommended ETF: Technology Select Sector SPDR Fund (NYSE ARCA: XLK), Vanguard Information Technology ETF (NYSE ARCA: VGT)

5. USD strengthening

While DBS Research foresees an extended period of a weak USD and low bond yields, DBS Research recommends investors to stay exposed to the potential event of the USD strengthening.

DBS Research notes that small and mid-cap stocks generally have less international focus and will be key beneficiaries of the USD strengthening.

Recommended ETF: iShares Russell 2000 (NYSE ARCA: IWM), PowerShares QQQ Trust Series 1 (NASDAQ: QQQ)

Yahoo Finance

Yahoo Finance