4 Tips for Using Credit Cards to Make Large Purchases You Can't Afford

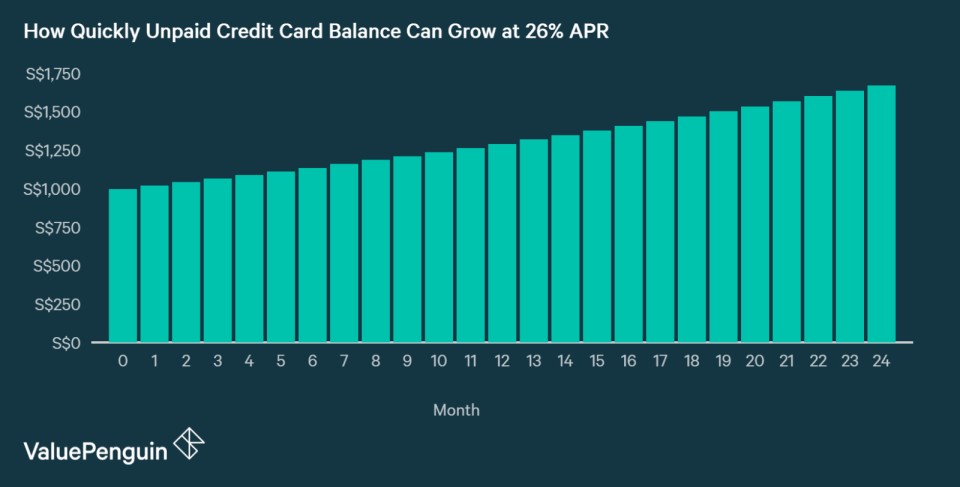

A lot of people like to use their credit cards to make large purchases that they can't immediately afford. However, this can be a quite dangerous financial strategy given that the average credit card APR around 26%. With such a high interest rate, an unpaid balance of S$1,000 can easily grow by S$300 in a year if you don't pay it off.

However, credit cards are still one of the best ways to make those large expenditures, especially in situations like medical emergency, weddings or other important events when big spendings are unavoidable or even necessary. For instance, credit cards provide up to 30 days of interest-free grace period so you can manage down your balance over time. They can also provide rewards like cash back to help you save money. Below, we've prepared some tips to help you utilise these financial instruments even better to get what you need and avoid bad consequences of spending more than you can afford.

1. Utilise 0% Interest Instalment Payment Plans to Spread Out Your Payment

Most credit card issuers offer a 0% interest instalment payment plans. These plans allow you to make a huge purchase upfront with you credit card, where you can repay your card balance in smaller segments over 3 to 36 months without incurring any interest charges. But, you must exercise caution when using this service. First, most banks will charge you a rather high "processing fee" instead of interest to make a profit on your large transaction. Secondly, most banks will also not provide any rewards on the expenditure, robbing you of an opportunity to rack up points or miles on your big purchase.

However, there are some 0% instalment credit cards that charge neither interest nor processing fee and still provide rewards on every dollar you spend through the instalment plan. Some great credit cards for large expenditures like wedding include Standard Chartered Visa Infinite Card, Standard Chartered Unlimited Cashback Card and OCBC Cashflo Card.

2. Leave Credit Limit of 110-120% of Your Monthly Budget

Just because you can now use one of these cards to earn rewards and buy expensive things, it doesn't mean you should go overboard. In fact, you should be very careful to leave a healthy buffer between how much you are spending through the 0% instalment plan and the credit limit you have. Because the amount you put on the payment plan counts towards your credit limit, maxing out on your credit card will mean that you won't be able to spend a dollar with that card until you pay down your balance. This is one of the easiest ways of getting stuck with a credit card debt that just keeps on spiraling out of control.

Not only that, once you set decide how long you will take to payback your 0% instalment plan, you won't be able to change your instalment period later without incurring a hefty penalty fee. If you don't exercise moderation and make an enormous purchase, these two factors combined can create a situation where you are stuck using most of your money to repay your credit card balance over a long period of time. Therefore, an easy rule of thumb to follow would be to leave enough credit limit to cover 10-20% more than what you generally spend on your living expenditures every month.

3. Always Pay Your Amount Due On Time

Perhaps, this is the simplest and the most important advice we can provide to any credit card users. When it comes to credit cards, it's imperative that you pay all of your amount due on time. Because banks charge very high interest and fees on late payments, you can incur very big losses over time by missing your payment deadlines, no matter how much rewards you may be earning. Hopefully, you follow our rule of thumb of leaving 110-120% of monthly spending in available credit limit so that you have enough extra cash to put towards your instalment payment every month.

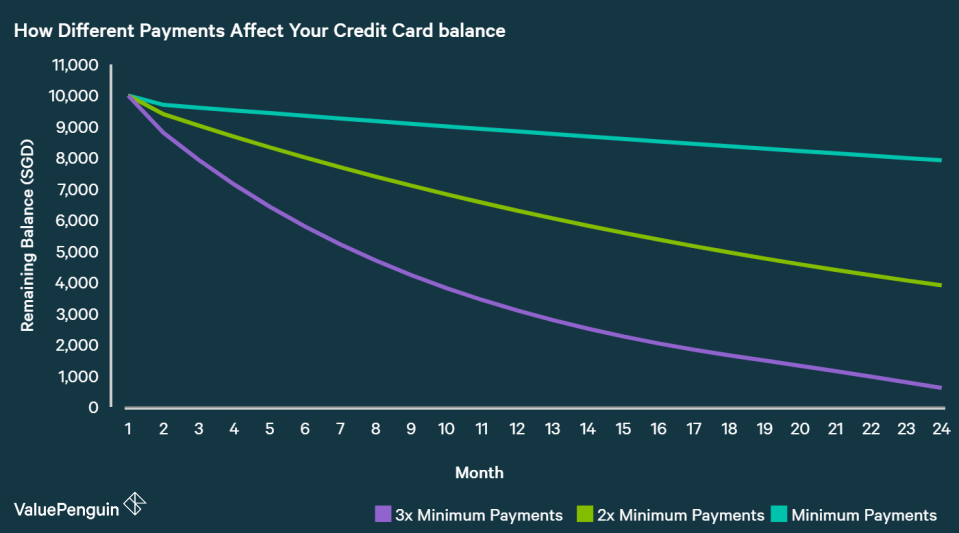

Also, your payments need to be not only "timely", but also be in full. For example, credit card statements will often show something called the "minimum payment requirement." However, you should always pay the full balance that is due instead of just making the minimum payment. The minimum payment, contrary to some myths, is not designed to pay off your balance in 10 months. Instead, making only the minimum payments can actually result in you having to pay down your balance for upwards of several years or more. For example, the graph below shows how "slowly" balances go down based over a 24-month period depending on how much you are paying down every month.

4. If You Can't Pay Off Your Card Balance, Consider Alternatives

If you find yourself with a card balance that is already too large for you to pay off and not much time left on your 0% interest instalment period, there are still alternatives for you. First, banks offer balance transfer loans that work similarly to 0% instalment plans. If you have a card balance that is coming due soon, you can avoid incurring huge interest charges on that amount by "transferring" it to a different account for a small processing fee. These loans typically have 3 to 18 months of 0% interest grace period, so you can buy yourself more time to pay off your credit card debt.

If your card balance is so huge that you couldn't possibly pay it off within 12 to 18 months, then you should consider applying for a debt consolidation plan. These loans consolidate your various personal loans (including card debt) and spread out your payment over up to 10 years. Not only that, though they charge an interest, their rates are less than half of what credit cards or balance transfer loans charge after their 0% interest grace period.

The article 4 Tips for Using Credit Cards to Make Large Purchases You Can't Afford originally appeared on ValuePenguin.

ValuePenguin helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValuePenguin:

Yahoo Finance

Yahoo Finance