4 Things To Know About URA’s Master Plan 2019

The Urban Redevelopment Authority (URA) recently released its Master Plan 2019 which detailed the blueprint of Singapore’s developments over the next decade. Here are four things you should know about the Master Plan 2019 and how you can invest in the right stocks to ride on the Master Plan.

Turning CBD Into A ‘Work, Live And Play’ Environment

Under the new Master Plan, the Central Business District (CBD) is slated to be repositioned as a 24/7 mixed-use district to be a place to work, live and play. The Singapore government has signalled its intention to convert Downtown Singapore from a commercial centre dominated by offices into one which is more mixed-use and has more vibrancy after office hours. The aim is to facilitate a work, live and play environment.

Incentivising Development Under New Schemes

In order to achieve this, URA will be introducing development incentives, in particular increasing the development density by 25-30 percent to encourage the conversion of existing older office developments into mixed-use projects to include more residences, hotels and creative lifestyles possibilities. This will be targeted at areas like Anson Rd, Robinson Rd, Cecil St, Shenton Way and Tanjong Pagar via the CBD Incentive and Strategic Development Incentive Scheme.

Greater Southern Waterfront And PLAB Redevelopment

Over the longer term, the government plans to redevelop two key areas: Greater Southern Waterfront and Paya Lebar Air Base. ~1,000ha of land stretching across the southern coastline from Pasir Panjang to Marina East will be freed up for development after the City Terminals and Pasir Panjang Terminal are relocated to Tuas. Paya Lebar Air Base which will also relocate and free up 800ha of land, will be transformed into a highly liveable new town. DBS believes that these developments will open up ample opportunities for developers.

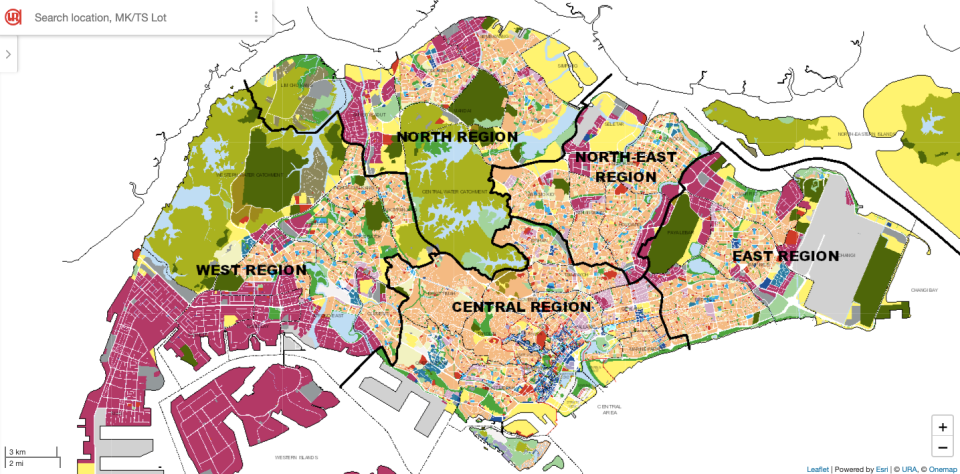

Regional Hubs To Reduce Reliance On CBD

The Master Plan also hints at the upcoming trend of decentralisation where regional hubs are being built to reduce reliance on the CBD. UOBKH notes that the economic gateways in the East, West And North regions bring together key employment areas and transport infrastructure.

Region | Key Infrastructure | |

East | Changi Aviation Park | Changi Business Park |

Changi City | Singapore University of Technology & Design | |

North | Northern Agri-Tech | Woodlands Regional Centre |

AgriFood Innovation Park |

| |

West | Jurong Lake District | Nanyang Technological University |

Jurong Innovation District | Tuas Terminal | |

Investors Takeaway: How To Invest In Light Of URA Master Plan By UOBKH

Investment Theme 1: Invest In Developers With Low Gearing Ratio

One of the key investment themes will be developers with low gearing ratio. According to UOBKH, the Master Plan 2019 benefits developers with low gearing as these are the players who could actively participate in upcoming auction for land parcels in the central area.

CapitaLand is one of the recommended BUYs under this investment theme. The other recommended developer play is City Developments, which could benefit from redevelopment of Republic Plaza and The Arcade to maximise the new permissible plot ratio.

Investment Theme 2: Ride On URA Master Plan With Office REITs

Another interesting investment theme will be office REITs with properties in the CBD area. UOBKH notes that the redevelopment of older office buildings will reduce the supply of office space and benefit existing office REITs.

Furthermore, office REITs who owns older buildings with redevelopment potential could also benefit. For example, CapitaLand Commercial Trust could redevelop HSBC Building while Keppel REIT could redevelop Bugis Junction Tower.

Investment Theme 3: Hospitality REITs

Under the URA Master Plan, office space could also be converted into hotel rooms or serviced apartments. The conversion of office space into hotel rooms or serviced apartments could alleviate the shortage in the hospitality sector. Given the strong growth in tourist arrivals and the transformation of Singapore’s tourism landscape, this will help to alleviate shortage of hotel rooms in Singapore. UOBKH recommends CDL Hospitality Trusts and Frasers Hospitality Trust.

Related Article:

Yahoo Finance

Yahoo Finance