4 stocks this week [24 Apr 2017]: Aoxin Q&M; Asian Pay TV; Memtech; SembMarine

During the week, companies continued to release their results and many held their Annual General Meetings (AGM). Our 4 Stocks This Week column covers a range of stocks that interested the market and our readers.

If you come across such companies or have interesting ideas, do give us a shout out and let us know why which companies these are via our Facebook page or email.

Market Sentiments

May will see two short weeks for the market with Labour Day (1 May 17) and Vesak Day (10 May 17). This will likely result in subdued market activity, especially during the Labour Day long weekend.

With geopolitical uncertainties persisting, the market experience even more tapering off. In Singapore, Labour Day brought with it messages from Manpower Minister Lim Swee Say and Prime Minister Lee Hsien Loong both reiterating that unemployment could rise further amid Singapore’s restructuring economy.

The Morgan Stanley Capital International (MSCI) All Country World Index (AWCI), an index made up of 23 developed markets and 23 emerging markets worldwide, peaked to new record highs this during the week. Mimicking leading markets in the US and Asia, it surging to a new record high on Wednesday (26 April 2017), before tailing off to end 1.9% higher, at 455.17 on Friday (28 April 2017).

In Singapore, the Straits Times Index (STI) gained 1.1% to end at 3175.44 on Friday (28 April 2017).

Aoxin Q&M

Aoxin Q&M newly listed on Wednesday (26 April 2017). This is a spin-off of local dental company, Q&M Dental Group’s dental services and dental equipment and supplies businesses in Northern China.

Its dental services include 11 centres across four cities in Liaoning while its dental equipment and supplies businesses span Liaoning, Heilongjiang and Jilin Provinces in China.

Also Read: How To Diversify Your Investment Portfolio Outside Of Singapore

It ended 55.0% higher for the week after increasing $0.11 from a listing price of $0.20 to end at $0.31 on Friday (28 April 2017).

Asian Pay Television Trust

Asian Pay Television Trust (APTT), owns Taiwan Broadband Communications (TBC), one of the three leading television operators in Taiwan.

It last announced its results, for full year 2015, on 27 February 2017. It saw a 3.9% decrease in yearly revenue to $319.2 million. Similarly, its profits declined 5.8% to $189.3 million. Despite these decreases to its top and bottom-lines, its expenses for the year rose 0.9% to $129.9 million.

This resulted in it paying out a distribution of 6.5 cents for FY2016, which was 24.2% down compared to a distribution of 8.25 cents in FY2015.

In recent months, there has been some interest surrounding the company. In the past three months, it has saw 25.6% rise in its share price to $0.515 from $0.41.

In the past week, its share price declined close to 1.9% from $0.525 to $0.515. Looking at a longer horizon, it has delivered 37.3% return since the start of the year. In the past 52 weeks, its share price has dropped 2.4%.

It’s upcoming results will be on 12 May 2017, those interested should look toward this set of numbers for guidance.

Asian Pay TV Trust share price chart (1-week)

Source: Yahoo! Finance/ Google Finance

Memtech Ltd

Memtech International, a global components solutions provider, was recently, Tuesday (25 April 2017), rated by UOB Kay Hian as an “under-appreciated gem”. With a price target of $1.05, UOB Kay Hian is expecting a 22.7% upside.

This was mainly due to its share price lagging behind the increase in its peers in the same industry. At the same time, the upswing in operational activity and acquisition interest in the sector supports this potential upside.

In its 1st quarter results of 2017, it reported a 9.8% rise in revenue to $36.4 million and a 180.7% rise in profit attributable to shareholders to $1.6 million. This bodes well for its year ahead as UOB Kay Hian expecting it to distribute at least 3.5 cents in dividends, translating to close to 4.4% yield.

Other reasons for its good performance could also come as there are high entry barriers to the precision engineering market due to the large investments and keen industry knowledge required to stay relevant and customers tend to stick to suppliers that are performing with long term contracts.

In the past week, Memtech’s share price has increased 6.9% to $0.855. Since the start of the year, it has achieved 35.7% increase and in the past 52 weeks, its share price improvement stands at 29.8%.

Memtech share price chart (1-week)

Source: Yahoo! Finance/ Google Finance

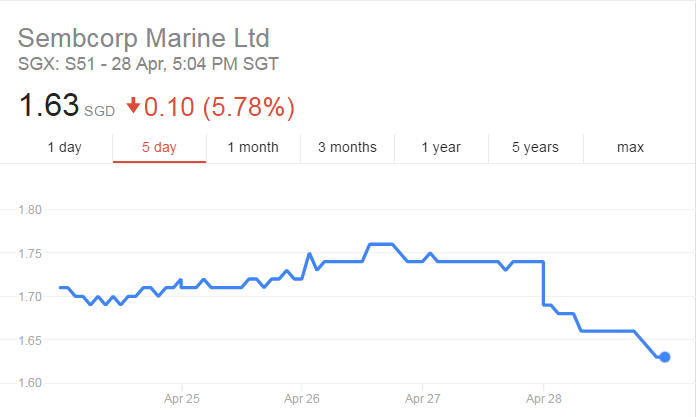

Sembcorp Marine Ltd

Even as oil prices continue to see some stability in the first half of 2017, companies in the marine and offshore sectors continue to experience a tough operating environment.

In Sembcorp Marine’s 1st quarter results, released on Thursday (27 April 2017), it announced a 17.2% decline in revenue to $760.1 million. It earnings experienced a similar decline, decreasing 27.9% to $39.5 million.

Looking forward, the company says it expects global exploration and production projects to increase compared to the last two years.

In the past week, Sembcorp has dropped by 5.2%. The bulk of this decline came on Friday (28 April 2017), the day after it announced its latest set of results. Looking further back, it has gained 18.1% since the start of the year.

Sembcorp Marine share price chart (1-week)

Source: Yahoo! Finance/ Google Finance

Also Read: 4 stocks this week [17 Apr 2017]: Ascott; Keppel; SGX; CapitaLand Mall

4 Stocks This Week is not a recommendation from us to buy or sell any of these stocks. For investors who are keen to find out more, you should continue researching about them before making your investment decisions.

Want to receive first-hand information about new announcements and events from us? Or simply looking for more exclusive content that are not available on our website? Subscribe to our free e-newsletter to get insider access to activities, articles and promotions. We will only send you stuff that we too would be interested to know. Follow us on Instagram @DNSsingapore and Facebook @DollarsAndSenseSG to get your daily dose of finance inspirations through photos and articles.

The post 4 stocks this week [24 Apr 2017]: Aoxin Q&M; Asian Pay TV; Memtech; SembMarine appeared first on DollarsAndSense.sg.

Yahoo Finance

Yahoo Finance